Please use a PC Browser to access Register-Tadawul

Omnicell (OMCL) Margin Squeeze To 0.2% Net Profit Tests Bullish Recovery Narratives

Omnicell, Inc. OMCL | 40.26 | +4.22% |

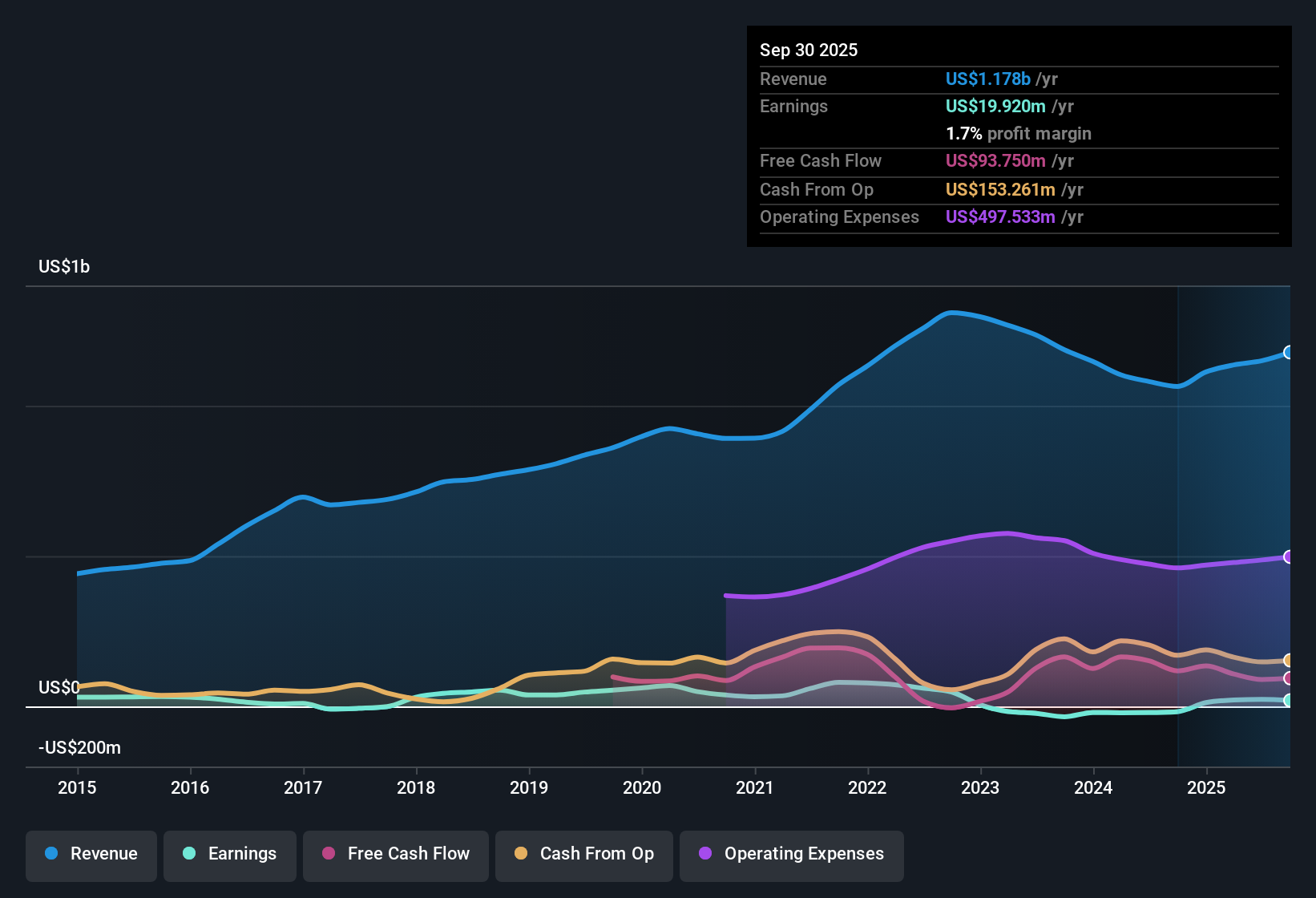

Omnicell (OMCL) has wrapped up FY 2025 with fourth quarter revenue of US$314 million and a basic EPS loss of US$0.05, alongside trailing twelve month EPS of US$0.04 that points to only a slim profit over the year. The company has seen quarterly revenue move from US$283 million in Q3 2024 to US$314 million in Q4 2025, while basic EPS shifted from US$0.19 in Q3 2024 to a loss of US$0.05 in the latest quarter, leaving margins looking tight and keeping the focus firmly on how sustainably profitability can build from here.

See our full analysis for Omnicell.With the headline numbers on the table, the next step is to set these results against the widely held narratives about Omnicell to see which stories the data supports and which ones start to look stretched.

Margins Thin At 0.2% Net Profit

- On a trailing 12 month basis, Omnicell earned US$2.1 million of net income on US$1.2b of revenue, which works out to a 0.2% net profit margin compared with 1.1% a year earlier.

- What stands out for the bullish view that earnings can grow strongly is how little room the current margin leaves, with trailing EPS of US$0.04 and quarterly swings from a US$0.15 loss per share in Q1 2025 to a US$0.12 profit in Q2 and Q3, then back to a small loss in Q4. This means any improvement needs to show up in these thin margins.

One Off US$4.6m Loss Distorts Trailing Profit

- The last 12 months include a non recurring loss of US$4.6 million that feeds into the slim US$2.1 million net profit and 0.2% margin, so the underlying run rate without that item would look different from the headline numbers.

- Critics who worry about weak profitability get some backing from the data, since earnings have declined by about 40% per year over five years. Yet that one off charge complicates the bearish story because it is not part of regular operations, so trailing EPS of US$0.04 and quarterly net income moving between a US$7.0 million loss in Q1 2025 and a US$5.6 million profit in Q2 suggest part of the pressure is temporary rather than purely structural.

- Bears highlight the margin compression from 1.1% to 0.2%, but the one time US$4.6 million loss is flagged separately from ongoing costs, which limits how far that trend can be generalized.

- The earnings decline of about 40% per year over five years fits the cautious narrative, yet the pattern of 2025 quarterly results, with two profitable quarters and two loss making ones, shows a mixed picture rather than a straight line down.

Valuation Discounts Versus Industry Multiples

- Omnicell is trading at a P/S of 1.4x compared with about 3.0x for the US Medical Equipment industry and roughly 3.2x for peers, while a DCF fair value of US$47.76 sits above the current share price of US$37.07.

- Supporters of a more bullish angle point to this gap, arguing the shares price in a lot of the recent weakness even though forecasts in the supplied analysis show expected earnings growth of about 86% per year over the next three years. The mix of a low P/S multiple and a DCF fair value above the market price can be read as the market putting more weight on the current 0.2% margin and five year earnings decline than on those growth expectations.

- The roughly US$10.69 difference between DCF fair value and share price, alongside the 1.4x P/S, is what bullish investors focus on when they talk about potential upside in the data provided.

- At the same time, the modest revenue growth forecast of about 4.3% per year helps explain why some investors are cautious, since the stronger earnings outlook is not matched by a similar revenue growth rate.

If you want to see how different analysts connect these margins, forecasts, and valuation signals into a full story around Omnicell, 📊 Read the full Omnicell Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Omnicell's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With net profit margins at 0.2%, earnings volatility across quarters, and a one off US$4.6 million loss, Omnicell's profitability picture still looks fragile.

If thin margins and choppy earnings are making you cautious, use our 86 resilient stocks with low risk scores to quickly find companies where lower risk scores support more stable financial profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.