Please use a PC Browser to access Register-Tadawul

Optimistic Investors Push Hecla Mining Company (NYSE:HL) Shares Up 57% But Growth Is Lacking

Hecla Mining Company HL | 24.02 | +5.40% |

Hecla Mining Company (NYSE:HL) shares have continued their recent momentum with a 57% gain in the last month alone. The last 30 days were the cherry on top of the stock's 497% gain in the last year, which is nothing short of spectacular.

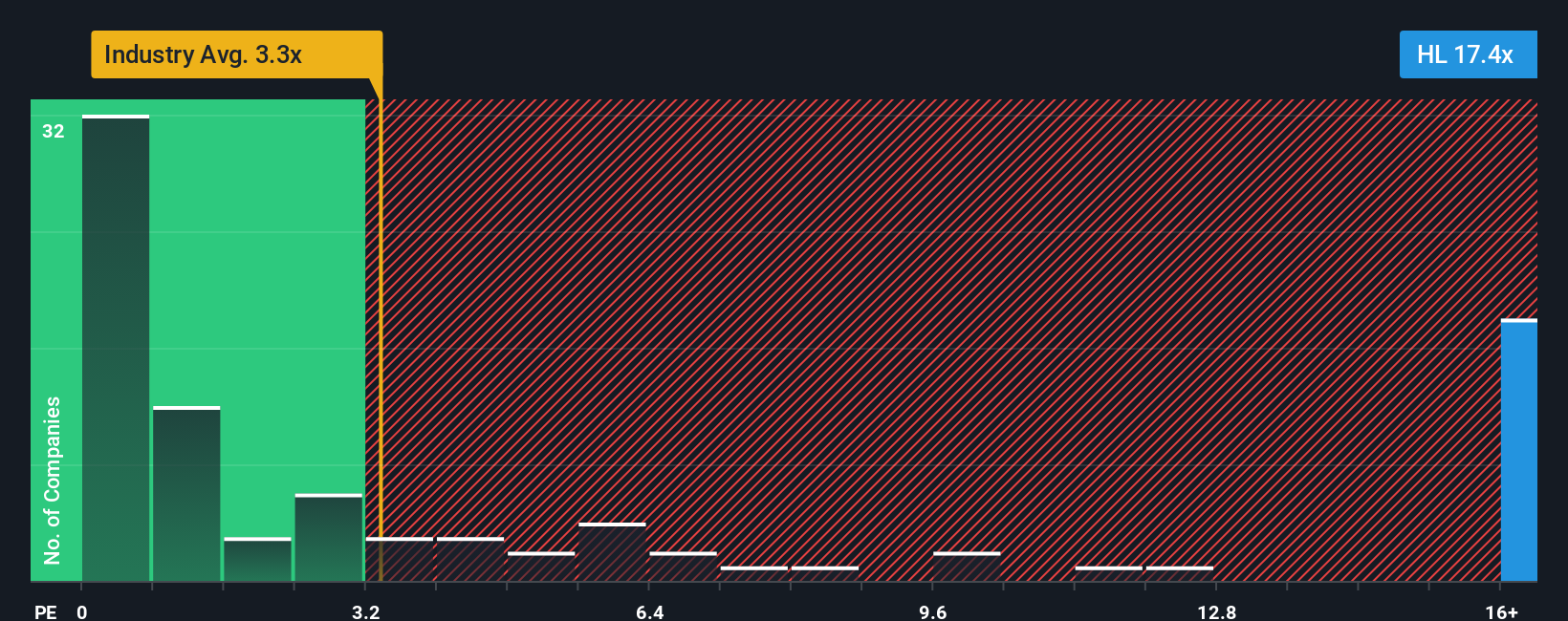

Since its price has surged higher, Hecla Mining's price-to-sales (or "P/S") ratio of 17.4x might make it look like a strong sell right now compared to other companies in the Metals and Mining industry in the United States, where around half of the companies have P/S ratios below 3.3x and even P/S below 0.6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Hecla Mining's P/S Mean For Shareholders?

Hecla Mining certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hecla Mining will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Hecla Mining?

The only time you'd be truly comfortable seeing a P/S as steep as Hecla Mining's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 46% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 11% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 16% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Hecla Mining's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has lead to Hecla Mining's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Hecla Mining currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.