Please use a PC Browser to access Register-Tadawul

Optimistic Investors Push Kopin Corporation (NASDAQ:KOPN) Shares Up 35% But Growth Is Lacking

Kopin Corporation KOPN | 2.48 | +0.61% |

Kopin Corporation (NASDAQ:KOPN) shares have continued their recent momentum with a 35% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

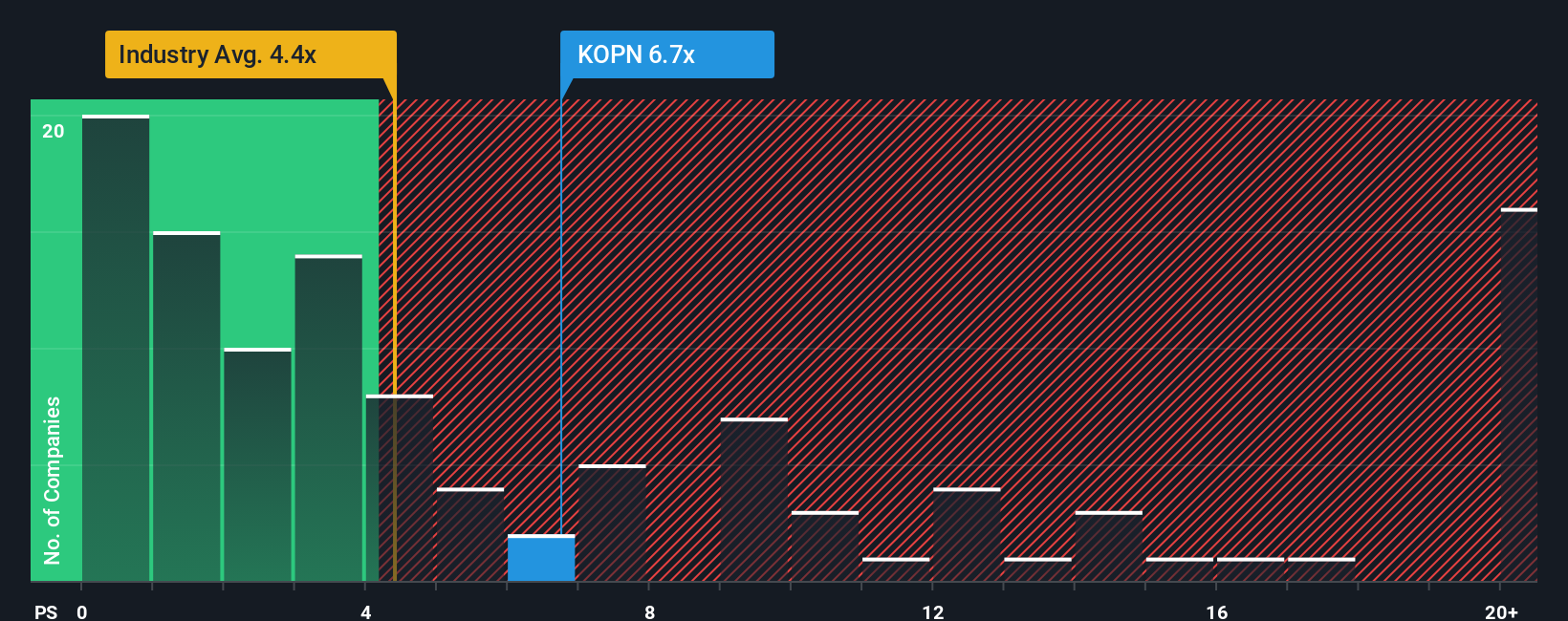

Since its price has surged higher, Kopin may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 6.7x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 4.4x and even P/S lower than 1.9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Kopin's Recent Performance Look Like?

Kopin could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Kopin's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kopin's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The latest three year period has also seen a 12% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 16% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 22% per annum growth forecast for the broader industry.

In light of this, it's alarming that Kopin's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Kopin's P/S Mean For Investors?

Kopin's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Kopin trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.