Please use a PC Browser to access Register-Tadawul

Optimistic Investors Push Power Integrations, Inc. (NASDAQ:POWI) Shares Up 30% But Growth Is Lacking

Power Integrations, Inc. POWI | 45.51 | -0.35% |

Power Integrations, Inc. (NASDAQ:POWI) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

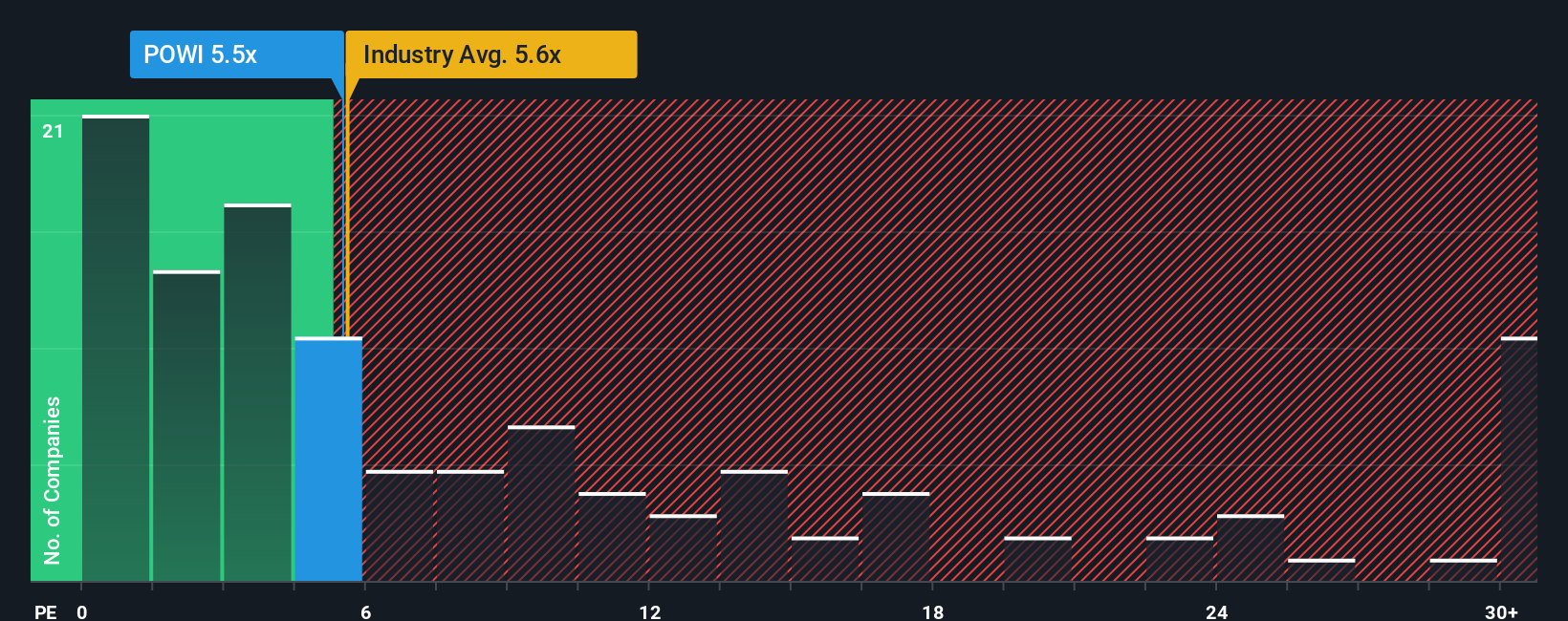

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Power Integrations' P/S ratio of 5.8x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in the United States is also close to 5.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Power Integrations Has Been Performing

Recent times haven't been great for Power Integrations as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Power Integrations.Do Revenue Forecasts Match The P/S Ratio?

Power Integrations' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Still, lamentably revenue has fallen 36% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 5.2% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 46% growth forecast for the broader industry.

In light of this, it's curious that Power Integrations' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Power Integrations' P/S?

Power Integrations appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Power Integrations' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

If you're unsure about the strength of Power Integrations' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.