Please use a PC Browser to access Register-Tadawul

Optimistic Investors Push Transcat, Inc. (NASDAQ:TRNS) Shares Up 27% But Growth Is Lacking

Transcat, Inc. TRNS | 78.30 | +0.40% |

Despite an already strong run, Transcat, Inc. (NASDAQ:TRNS) shares have been powering on, with a gain of 27% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

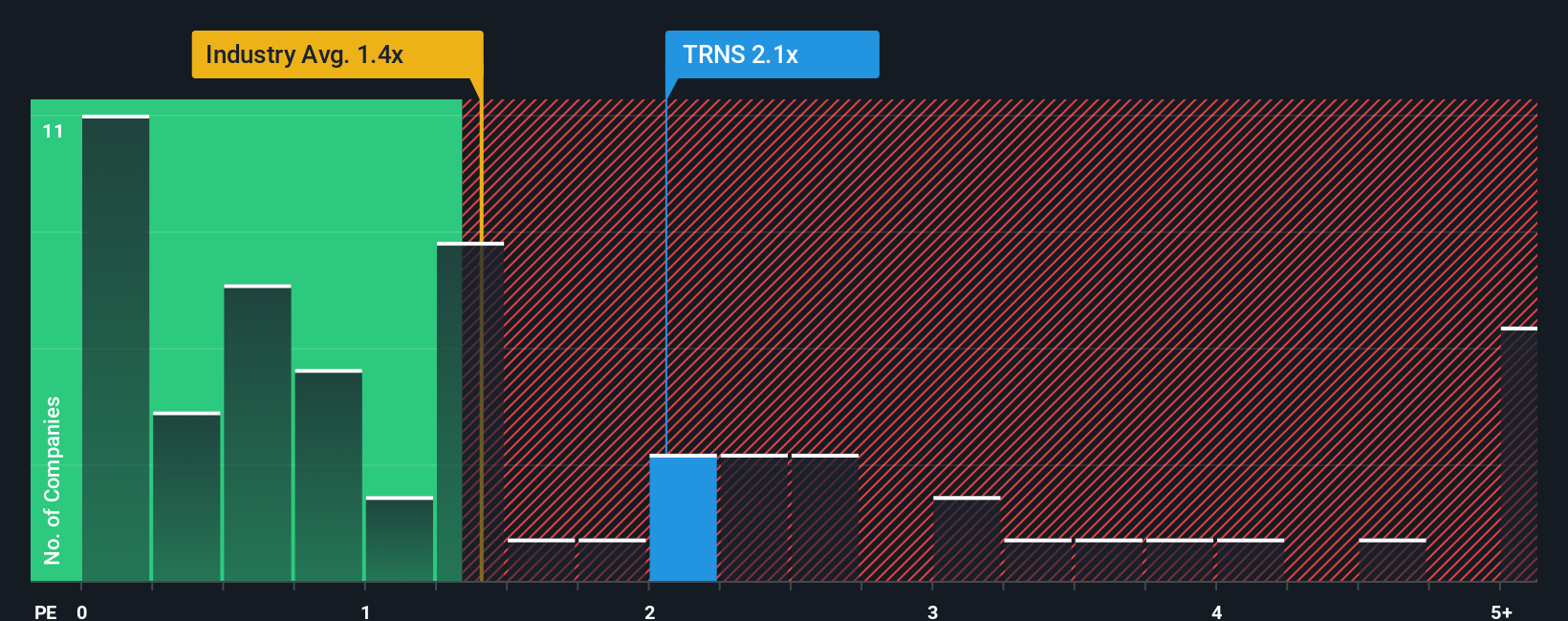

Following the firm bounce in price, given close to half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Transcat as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Transcat's P/S Mean For Shareholders?

Recent times haven't been great for Transcat as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Transcat's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Transcat's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 42% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 7.0% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 10% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Transcat's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Transcat's P/S

Transcat's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Transcat currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Transcat is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.