Please use a PC Browser to access Register-Tadawul

Option Signals | Multiple AMD Call Options Surge Over Tenfold, Leading Total Trading Volume; GLXY and SoundHound AI Face Significant Bearish Put Option Bets

Dow Jones Industrial Average DJI | 48458.05 | -0.51% |

NASDAQ IXIC | 23195.17 | -1.69% |

S&P 500 index SPX | 6827.41 | -1.07% |

SPXW 091025 P 6575 |

| |

Advanced Micro Devices, Inc. AMD | 210.78 | -4.81% |

Market Overview

As of the latest intraday close, the Dow Jones Industrial Average(DJI.US) remained flat at 46,601.78 points. The NASDAQ(IXIC.US) rose by 1.12%, closing at 23,043.38 points, while the S&P 500 index(SPX.US) increased by 0.58%, ending at 6,753.72 points.

Notably, the trading volume for S&P 500 (SPX) put options reached 2.0165 million contracts, while call options saw a volume of 1.7616 million contracts. The put/call volume ratio was approximately 1.14, indicating a stronger bearish sentiment among investors towards the index. Among these, the SPXW 091025 P 6575 put option had a trading volume of 16,400 contracts, with a VOL/OI ratio of 53.14. This contract has a strike price of 6,575.00 and saw a decrease of 69.15%.

Top 10 Options Trading Volume:

Advanced Micro Devices, Inc.(AMD.US): As of the latest intraday close, the stock surged 11.37%. Total options trading volume for the day reached 2.58 million contracts, an increase of 1.2972 million contracts compared to the previous day, representing a 1.01x increase in trading activity. Open interest stood at 4.09 million contracts.

Recently, AMD signed a four-year partnership agreement with OpenAI to supply tens of thousands of AI chips, a deal expected to bring AMD tens of billions in revenue growth. Additionally, OpenAI will receive warrants for AMD shares, further boosting AMD's future prospects. Jefferies upgraded AMD's rating from "Hold" to "Buy," raising its price target significantly from $170 to $300.

NVIDIA Corporation(NVDA.US): As of the latest intraday close, the stock gained 2.2%. Total options trading volume for the day reached 1.98 million contracts, up 127,300 contracts from the previous day, representing a 0.07x increase in trading activity. Open interest stood at 19.41 million contracts.

Reports indicate that Nvidia is participating in Elon Musk's $20 billion AI financing plan. Musk’s AI startup, xAI, is advancing a $20 billion funding initiative, with Nvidia investing $2 billion in equity. This financing will combine equity and debt and is tied to Nvidia GPU purchases for deployment in xAI’s Colossus 2 super data center.

Tesla Motors, Inc.(TSLA.US): As of the latest intraday close, the stock rose 1.29%. Total options trading volume for the day reached 1.8 million contracts, down 501,200 contracts from the previous day, representing a 0.22x decrease in trading activity. Open interest stood at 8.14 million contracts.

Tesla’s newly launched Model 3/Y standard editions caused market turbulence, as the two models saw a $5,000 price cut but reduced configurations, falling short of Wall Street expectations. Dan Ives, one of Tesla’s most bullish analysts, noted that the market had anticipated deeper price cuts. While the upgraded FSD software offers growth potential, the $5,000 reduction is seen as insufficient to significantly boost demand.

Amazon.com, Inc.(AMZN.US): As of the latest intraday close, the stock climbed 1.55%. Total options trading volume for the day reached 1.03 million contracts, up 508,100 contracts from the previous day, representing a 0.97x increase in trading activity. Open interest stood at 4.5 million contracts.

Bull Run Corp(BULL.US): As of the latest intraday close, the stock fell 1.09%. Total options trading volume for the day reached 890,000 contracts, up 569,500 contracts from the previous day, representing a 1.75x increase in trading activity. Open interest stood at 1.37 million contracts.

OpenDoor Technologies(OPEN.US): As of the latest intraday close, the stock dropped 8.61%. Total options trading volume for the day reached 720,000 contracts, up 13,700 contracts from the previous day, representing a 0.02x increase in trading activity. Open interest stood at 3.3 million contracts.

Intel Corporation(INTC.US): As of the latest intraday close, the stock rose 0.7%. Total options trading volume for the day reached 640,000 contracts, down 15,900 contracts from the previous day, representing a 0.02x decrease in trading activity. Open interest stood at 7.07 million contracts.

Apple Inc.(AAPL.US): As of the latest intraday close, the stock gained 0.62%. Total options trading volume for the day reached 540,000 contracts, up 66,600 contracts from the previous day, representing a 0.14x increase in trading activity. Open interest stood at 5.67 million contracts.

POET Technologies Inc Ordinary Shares(POET.US): As of the latest intraday close, the stock surged 17.01%. Total options trading volume for the day reached 540,000 contracts, down 71,800 contracts from the previous day, representing a 0.12x decrease in trading activity. Open interest stood at 680,000 contracts.

The optical chip manufacturer completed a $75 million financing round, with plans to use the funds for corporate growth, acquisitions, and expansion of its R&D and light source businesses. The company’s stock has risen over 32% year-to-date.

Strategy (MSTR.US): As of the latest intraday close, the stock gained 0.73%. Total options trading volume for the day reached 510,000 contracts, down 53,800 contracts from the previous day, representing a 0.1x decrease in trading activity. Open interest stood at 2.82 million contracts.

| Code | Closing Price | Volume | Open Interest | PUT/CALL |

|---|---|---|---|---|

| Advanced Micro Devices, Inc.(AMD.US) | 235.56 | 2.58M | 4.09M | 0.9 |

| NVIDIA Corporation(NVDA.US) | 189.11 | 1.98M | 19.41M | 1.0 |

| Tesla Motors, Inc.(TSLA.US) | 438.69 | 1.8M | 8.14M | 0.8 |

| Amazon.com, Inc.(AMZN.US) | 225.22 | 1.03M | 4.5M | 0.7 |

| Bull Run Corp(BULL.US) | 12.66 | 0.89M | 1.37M | 0.5 |

| OpenDoor Technologies(OPEN.US) | 8.49 | 0.72M | 3.3M | 0.5 |

| Intel Corporation(INTC.US) | 37.43 | 0.64M | 7.07M | 0.7 |

| Apple Inc.(AAPL.US) | 258.06 | 0.54M | 5.67M | 0.7 |

| POET Technologies Inc Ordinary Shares(POET.US) | 9.22 | 0.54M | 0.68M | 0.0 |

| Strategy (MSTR.US) | 330.8 | 0.51M | 2.82M | 0.9 |

PUT/CALL: Counts the percentage of open put and call option holdings for the listed stocks during the trading day.

Options Activity Tracking:

Galaxy Digital Inc. Ordinary Shares - Class A(GLXY.US): As of the latest intraday close, the stock rose 4.57%. The GLXY 171025 P 38 put option, with a strike price of $38.0 and expiring on October 17, 2025, saw a trading volume of 40,200 contracts and dropped 36.36%.

NuScale Power(SMR.US): As of the latest intraday close, the stock fell 2.58%. The SMR 171025 C 40.5 call option, with a strike price of $40.5 and expiring on October 17, 2025, had a trading volume of 30,600 contracts and decreased by 29.15%.

SoundHound AI(SOUN.US): As of the latest intraday close, the stock increased 3.74%. The SOUN 101025 P 19.5 put option, with a strike price of $19.5 and expiring on October 10, 2025, saw a trading volume of 47,500 contracts and dropped 39.53%.

Advanced Micro Devices, Inc.(AMD.US): As of the latest intraday close, the stock surged 11.37%. The AMD 101025 P 230 put option, with a strike price of $230.0 and expiring on October 10, 2025, had a trading volume of 45,800 contracts and fell 80.95%.

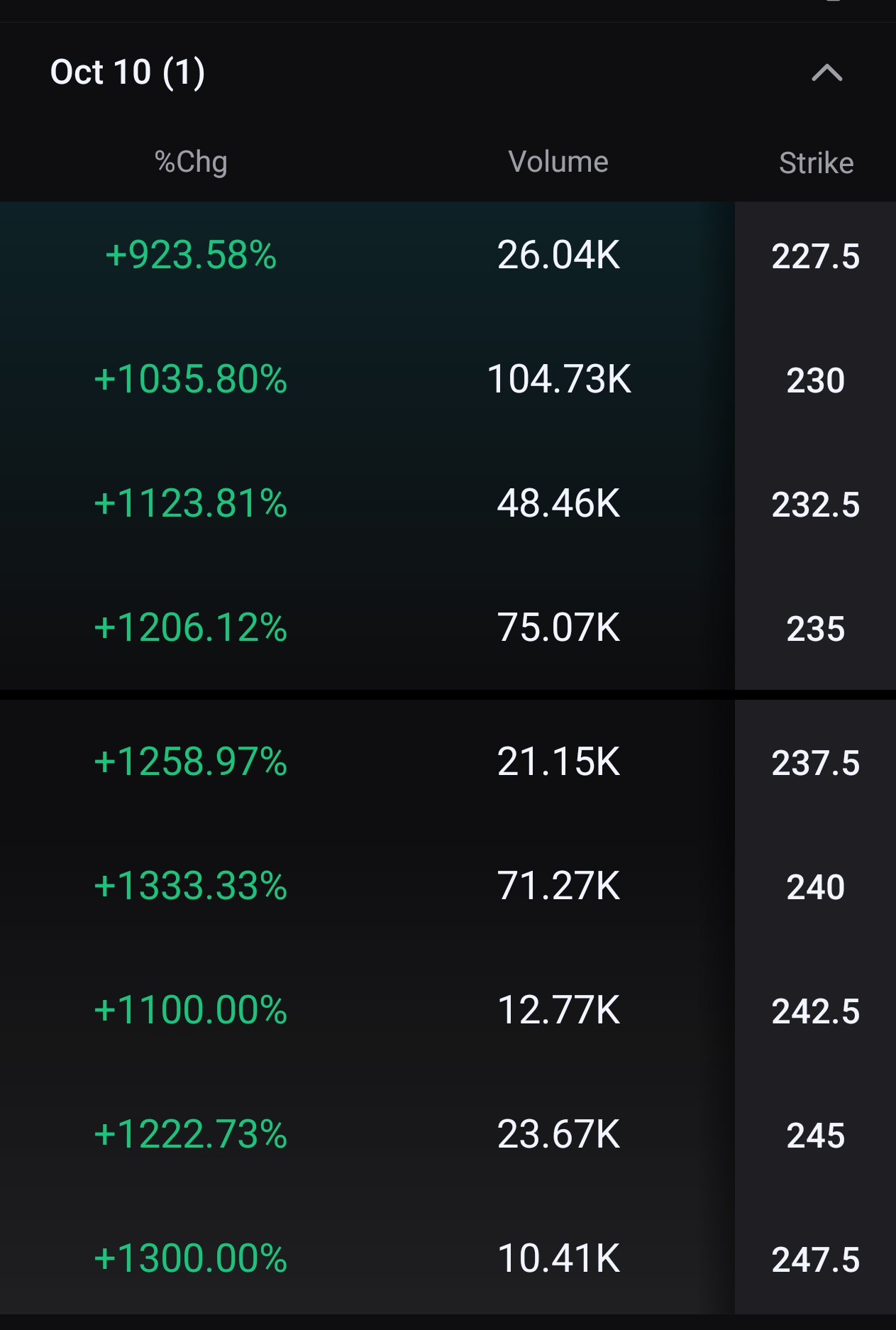

There was significant activity in call options, with some increasing over tenfold. Notably, the AMD 101025 C 230 call option, with a strike price of $230 and expiring on October 10, 2025, saw a trading volume of 104,700 contracts and surged 1035.8%.

| Code | Option Type | Strike Price | Expiration Date | Volume | Open Interest | Vol/OI |

|---|---|---|---|---|---|---|

| Galaxy Digital Inc. Ordinary Shares - Class A(GLXY.US) | PUT | $38.0 | 10/17/25 | 40.2K | 134 | 299.97 |

| NuScale Power(SMR.US) | CALL | $40.5 | 10/17/25 | 30.64K | 123 | 249.06 |

| SoundHound AI(SOUN.US) | PUT | $19.5 | 10/10/25 | 47.55K | 237 | 200.62 |

| Advanced Micro Devices, Inc.(AMD.US) | PUT | $230.0 | 10/10/25 | 45.84K | 232 | 197.58 |

| Advanced Micro Devices, Inc.(AMD.US) | PUT | $227.5 | 10/10/25 | 19.8K | 128 | 154.7 |

| Advanced Micro Devices, Inc.(AMD.US) | PUT | $222.5 | 10/10/25 | 39.92K | 266 | 150.06 |

| Super Micro Computer, Inc.(SMCI.US) | CALL | $64.0 | 10/17/25 | 24.04K | 187 | 128.57 |

| Gap, Inc. (The) Common Stock(GAP.US) | CALL | $21.5 | 10/10/25 | 21.65K | 222 | 97.51 |

| Cisco Systems, Inc.(CSCO.US) | CALL | $73.0 | 10/17/25 | 14.03K | 162 | 86.63 |

| Advanced Micro Devices, Inc.(AMD.US) | CALL | $255.0 | 10/17/25 | 12.01K | 144 | 83.42 |

vol/oi: The ratio of options volume to the number of open positions in the contract, with higher vol/oi indicating that the market is creating an abnormal number of new positions.

Read More: A quick look at the pros and cons of index options!