Please use a PC Browser to access Register-Tadawul

Options Corner: Three Options Strategies to Navigate TSMC Earnings

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 276.96 | -3.45% |

TSM 250425 P 135 |

| |

TSM 250425 P 150 |

| |

TSM 250425 C 170 |

|

Hello everyone! Today, we’re going to discuss options strategies for Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) . With TSMC set to release its Q1 earnings report this Thursday, let’s review the key points to watch and how to navigate the upcoming market volatility with some options strategies.

📈 Key Points to Watch:

Net Profit: Expected to grow 56% year-over-year to NT$351.65 billion (approximately $10.86 billion).

Revenue: Expected to grow 42% year-over-year to NT$839.25 billion (approximately $25.5 billion).

Stock Performance: Dragged by cooling AI hype and international macroeconomic conditions.

Future Outlook: 2025 outlook and international macroeconomic risks, U.S. investment plans.

Now, let’s dive into three different options strategies to help you navigate the earnings season.

---

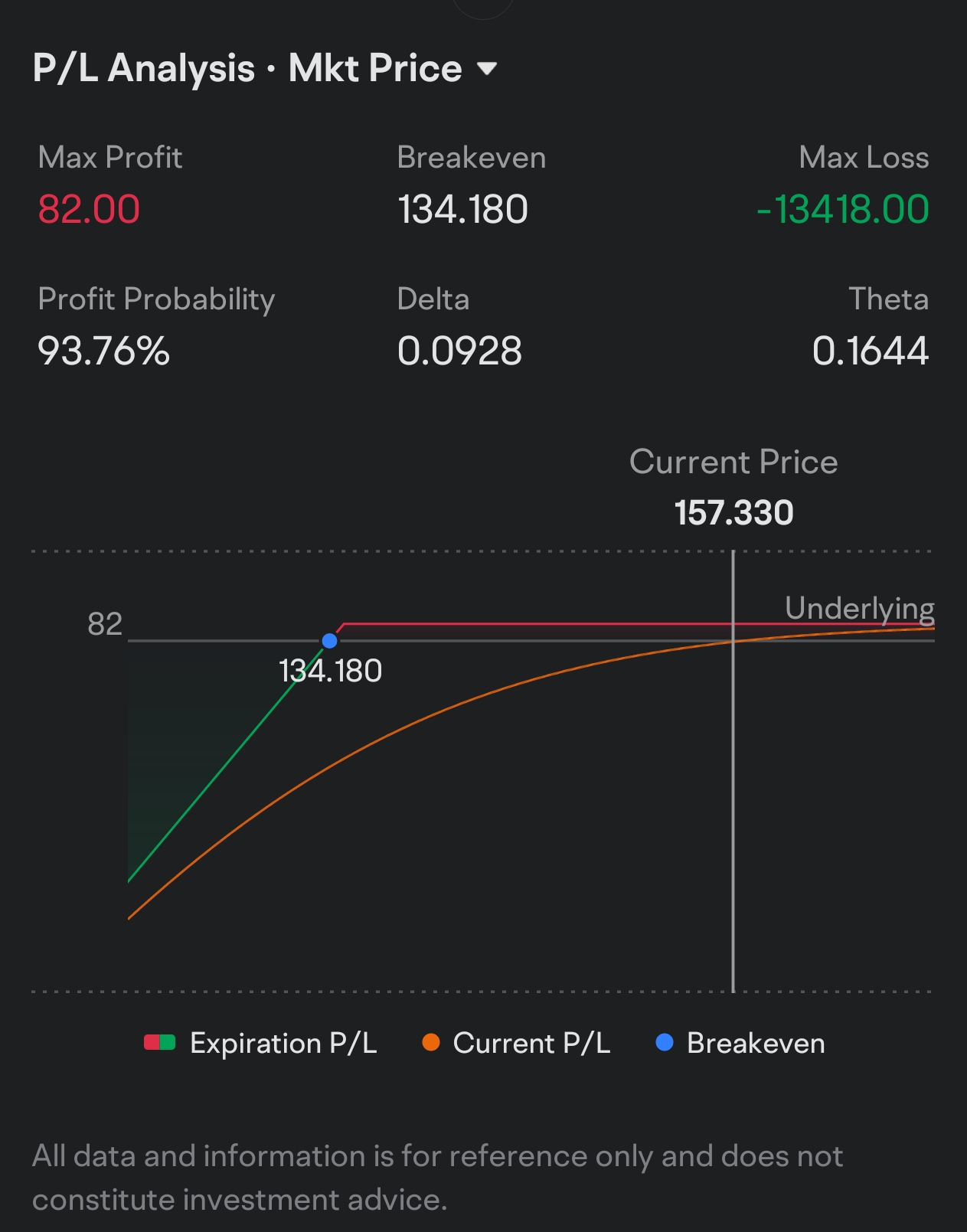

🥇 Strategy 1: Selling Out-of-the-Money Put Options (Sell Put)

How to Execute:

Sell the April 25th expiry put option (TSM 250425 P 135) with a $135 strike price (premium approximately $82).

Logic and Returns:

- Valuation Safety Margin: Current P/E ratio is 22.8x, below the 5-year average of 28x. $135 corresponds to a P/E of 17x, close to historical lows.

- Long-term Fundamental Support: TSMC controls 90% of the global advanced process capacity, with AI chip demand continuing to surge.

- Expectation: Stock price remains above $135 by April 25th.

- Maximum Return: Premium of $82 (if stock price ≥ $135).

- Breakeven Point: $134.18.

- Risk: If the stock price falls below $135, you may be required to buy 100 shares at $135 each, so ensure you have the necessary margin.

🥈 Strategy 2: Protective Hedge – Guard Against Black Swans 🦢

How to Execute:

Already holding 100 shares of TSMC stock (current value $15,733).

Buy the April 25th expiry put option (TSM 250425 P 150) with a $150 strike price (premium $315).

Hedge Cost: $315 (2% of the portfolio value).

Maximum Loss: If the stock price drops to $150, the loss is 4.8%, while retaining upside potential.

Core Logic:

- If TSMC faces a 100% tariff, it could trigger short-term selling.

- Low-Cost Insurance: Manageable premium cost to avoid significant losses due to earnings surprises or policy changes.

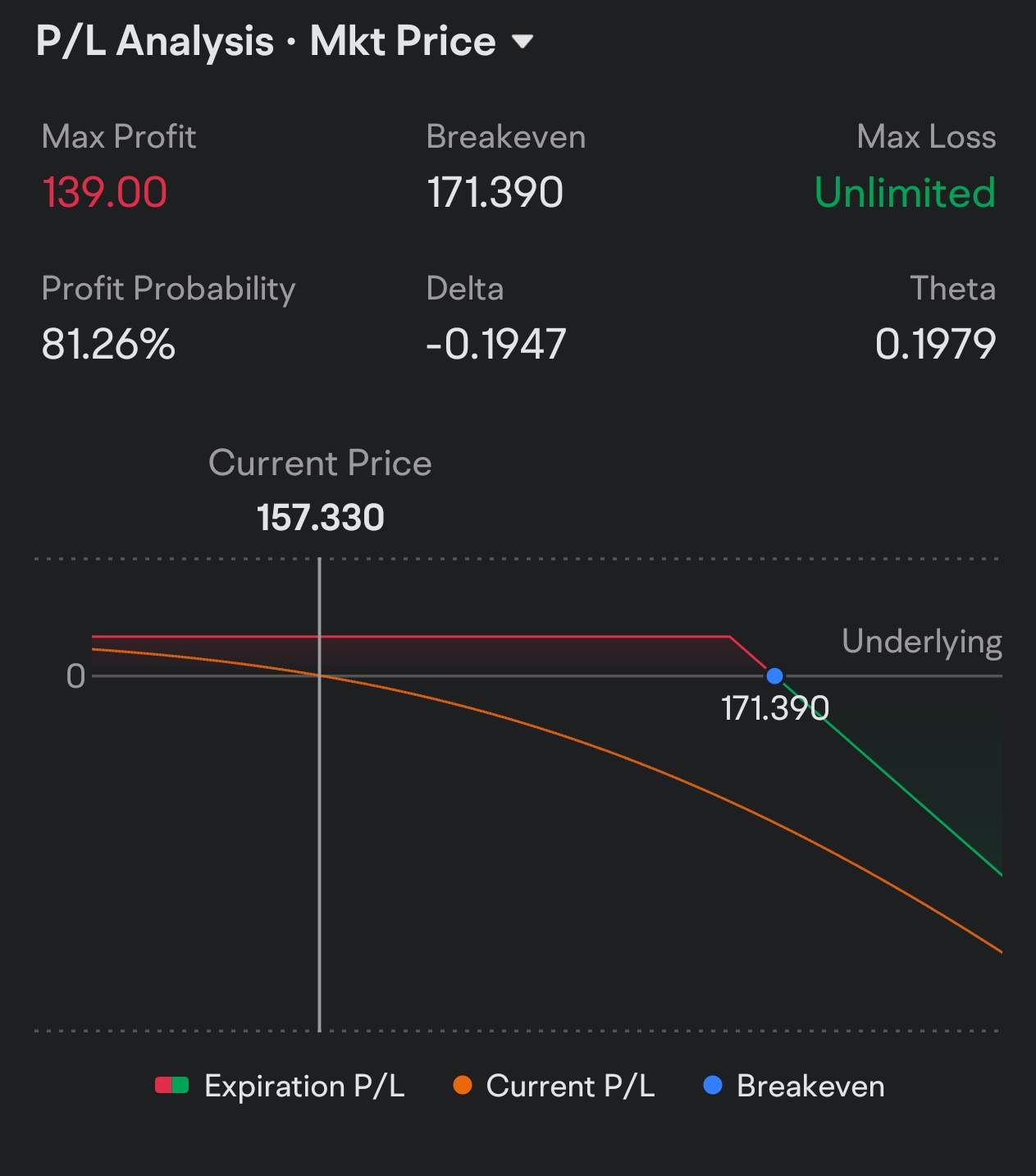

🥉 Strategy 3: Covered Call

Suitable For: Investors Already Holding TSMC Stock

How to Execute: Sell the $170 strike call option (TSM 250425 C 170) (8% upside from current price) (premium $139).

Reasoning:

- Reduce Holding Cost: If the stock price does not exceed $170, the premium boosts returns.

---

📌 Note: The above analysis is based on publicly available market data and does not constitute investment advice. Options trading carries high risk and may result in the loss of your entire principal.

Wishing everyone successful trades and abundant wealth! 💰📊