Please use a PC Browser to access Register-Tadawul

Oracle (ORCL): Evaluating Valuation After Record AI Cloud Contracts and New Co-CEOs Spark Growth Optimism

Oracle Corporation ORCL | 189.97 | -4.47% |

Oracle’s (ORCL) latest surge in market value can be traced to a blend of headline-making AI and cloud contracts, record-setting increases in future revenue commitments, and fresh leadership at the top. With new co-CEOs in place, the company is positioning itself to capture the growing wave of AI spending. At the same time, some market watchers weigh the risks around its ambitious outlook.

A string of major events has kept Oracle in the headlines this year, from its $300 billion OpenAI cloud deal and multi-billion-dollar bond offerings to high-profile AI launches and executive shakeups. Even after such a strong run, momentum is holding firm; Oracle’s one-year total shareholder return is up over 69%, and longer-term investors have seen healthy multi-year gains as the company leans further into cloud and AI opportunities. With continued contract wins and fresh leadership, optimism remains high that this stock’s growth story is far from over.

If Oracle’s bold moves in AI and cloud are catching your attention, it might be the perfect time to see what other tech and AI disruptors are gaining steam. See the full list for free.

Yet with Oracle shares already up nearly 70% this year and trading near all-time highs, investors are now left weighing whether the optimism has gone too far or if there is still room to run from here. Is this a legitimate buying opportunity, or has the market already priced in years of future growth?

Most Popular Narrative: 14.2% Undervalued

With Oracle last closing at $286.14 and the most popular narrative assigning a fair value of $333.49, the narrative points to notable upside potential based on soaring cloud and AI momentum. Market-watchers have set a higher bar for long-term growth after the company’s recent run, sparking new debate over just how much future growth and profit the current price really bakes in.

Major AI contracts, including several multi-billion-dollar and a $30B+ annual revenue agreement, have fundamentally altered Oracle's long-term growth trajectory and fortified its positioning as a leading global hyperscaler.

What’s driving this bold valuation call? It hinges on blockbuster gains that few expected. The outlook rests on aggressive jumps in revenue, expanding profit margins, and a premium future multiple that signals serious confidence. Want a peek behind the curtain and see precisely which numbers underpin this punchy price target?

Result: Fair Value of $333.49 (UNDERVALUED)

However, Oracle’s outlook still hinges on continued explosive AI demand and flawless execution. Both factors could falter unexpectedly and challenge current bullish assumptions.

Another View: What Do Earnings Ratios Say?

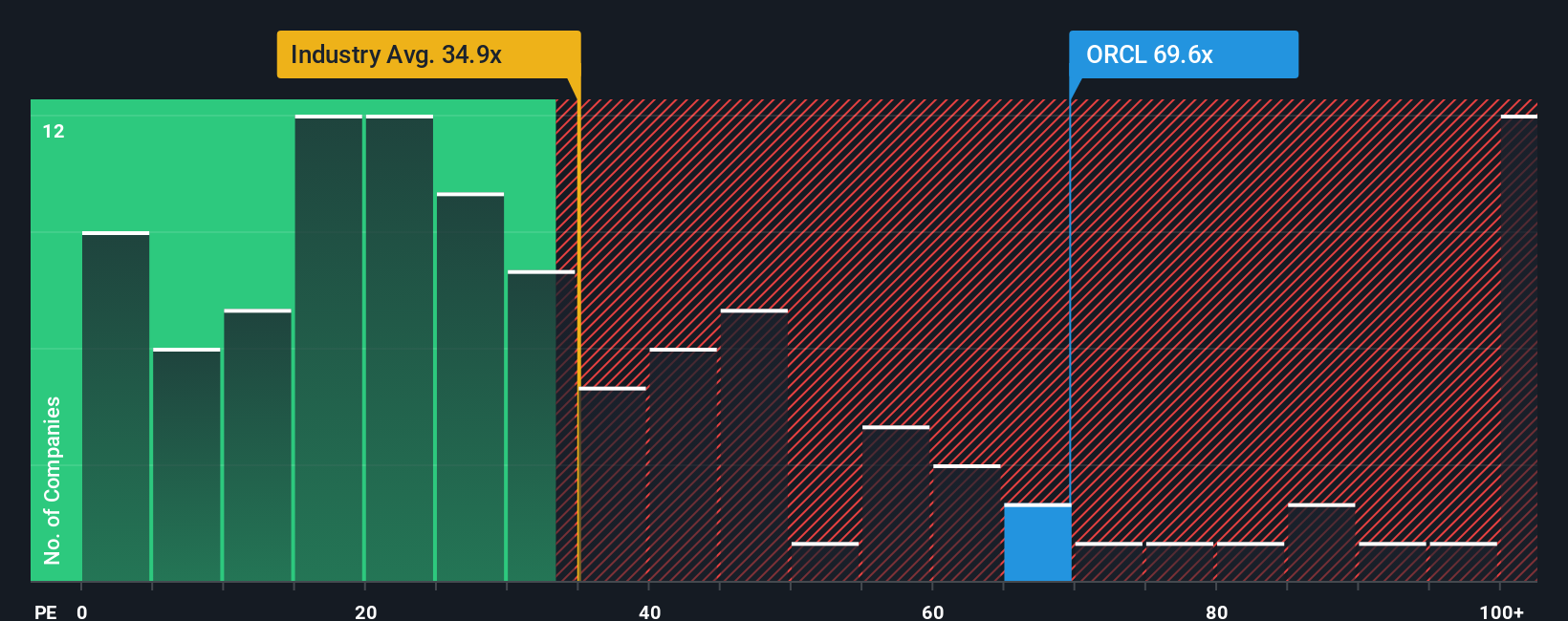

Looking at Oracle’s price-to-earnings ratio provides a different perspective. Shares currently trade at 65.4 times earnings, which is significantly pricier than both the US software industry average (35.7x) and even our fair ratio estimate (61.1x). This premium suggests the market expects exceptional growth, but it also raises questions about valuation risk if expectations slip. Could momentum alone justify this much optimism, or is there a risk of disappointment if the narrative changes?

Build Your Own Oracle Narrative

If you see things differently or want to dig deeper into the data yourself, you can craft a personal narrative in just a few minutes, your way. Do it your way

A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The next breakout stock could be just around the corner, so broaden your search and upgrade your investing toolkit with these exclusive opportunities from Simply Wall Street:

- Unlock cash flow potential by targeting undervalued companies with robust earnings using these 896 undervalued stocks based on cash flows.

- Supercharge your portfolio with high-yield picks by tapping into these 19 dividend stocks with yields > 3% to spot reliable dividend payers exceeding a 3% yield.

- Get ahead of tomorrow’s digital transformation by seeking out next-generation innovators among these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.