Please use a PC Browser to access Register-Tadawul

Oracle’s Valuation in Focus After 30% Drop Amid Cloud Competition News

Oracle Corporation ORCL | 146.67 | -5.17% |

- Wondering if Oracle is truly worth its current price tag? Let’s dive into what actually drives the value behind this tech powerhouse.

- Oracle's shares have been on a rollercoaster lately, dropping 10.6% over the last week and 30.5% for the month. Even so, they are still up 18.7% year-to-date and have soared 259.6% over five years.

- Recent headlines have pointed to shifting investor sentiment and renewed competition in the cloud space. This partly explains the recent drops. Coverage around strategic partnerships and tech investments has added both excitement and uncertainty to the stock’s narrative.

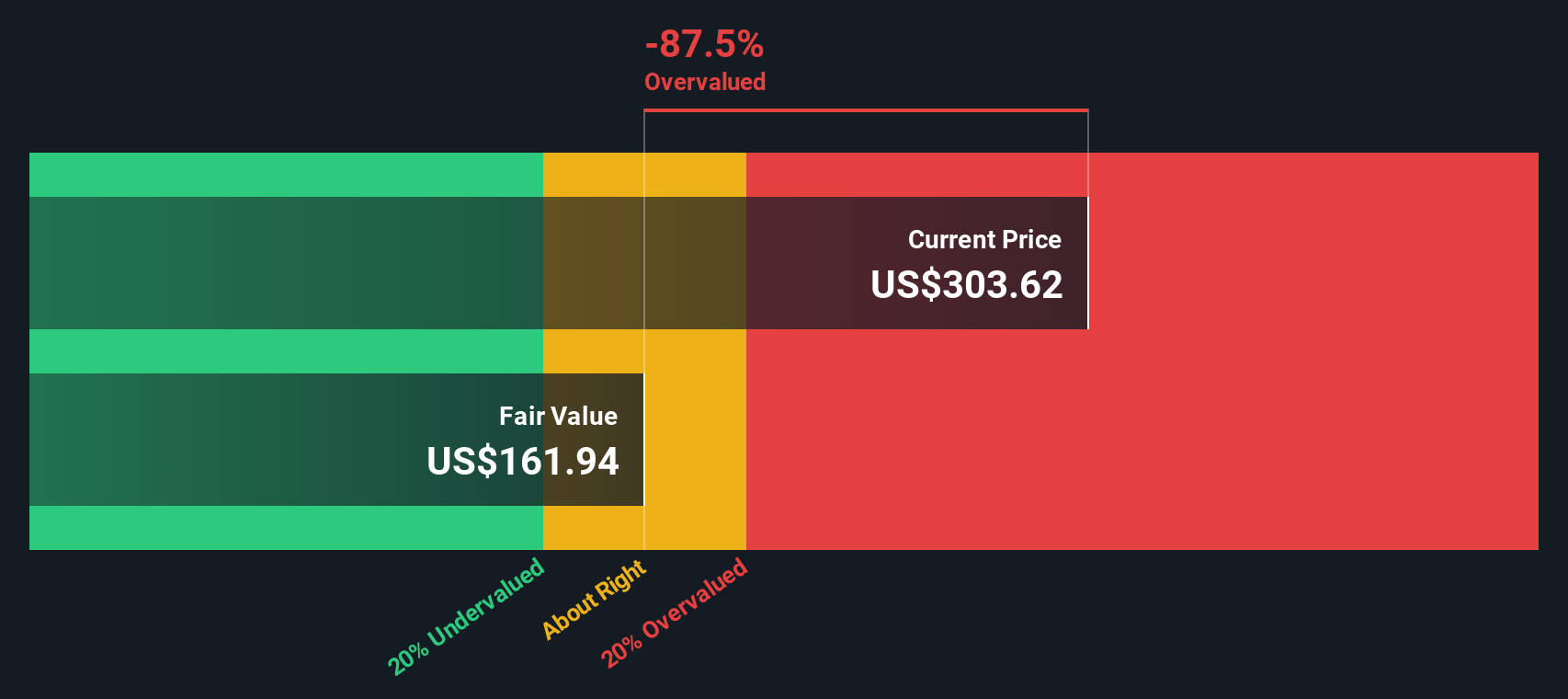

- When it comes to valuation checks, Oracle lands a 3 out of 6. This is not bad, but it may not be the kind of slam dunk value some are hoping for. Next, we will explore how these valuation numbers are calculated. Stick around, because the best way to judge if Oracle is actually a bargain might surprise you.

Approach 1: Oracle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today’s value, providing an estimate of intrinsic worth. For Oracle, this involves analyzing its future Free Cash Flow (FCF) in US dollars and calculating what all those future dollars are worth to investors right now.

Oracle reported a last twelve months FCF of approximately $5.84 Billion. Analysts provide direct projections for the next five years. Beyond that period, cash flows are extrapolated by Simply Wall St. According to these projections, Oracle’s FCF could grow significantly, with forecasts showing a rise to roughly $20.34 Billion by 2030.

Using a 2 Stage Free Cash Flow to Equity model, the DCF calculation estimates Oracle’s intrinsic value at $210.22 per share. This suggests the stock is trading at about a 6.3% discount, indicating that shares are slightly undervalued based on these long-term cash flow estimates.

Result: ABOUT RIGHT

Oracle is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

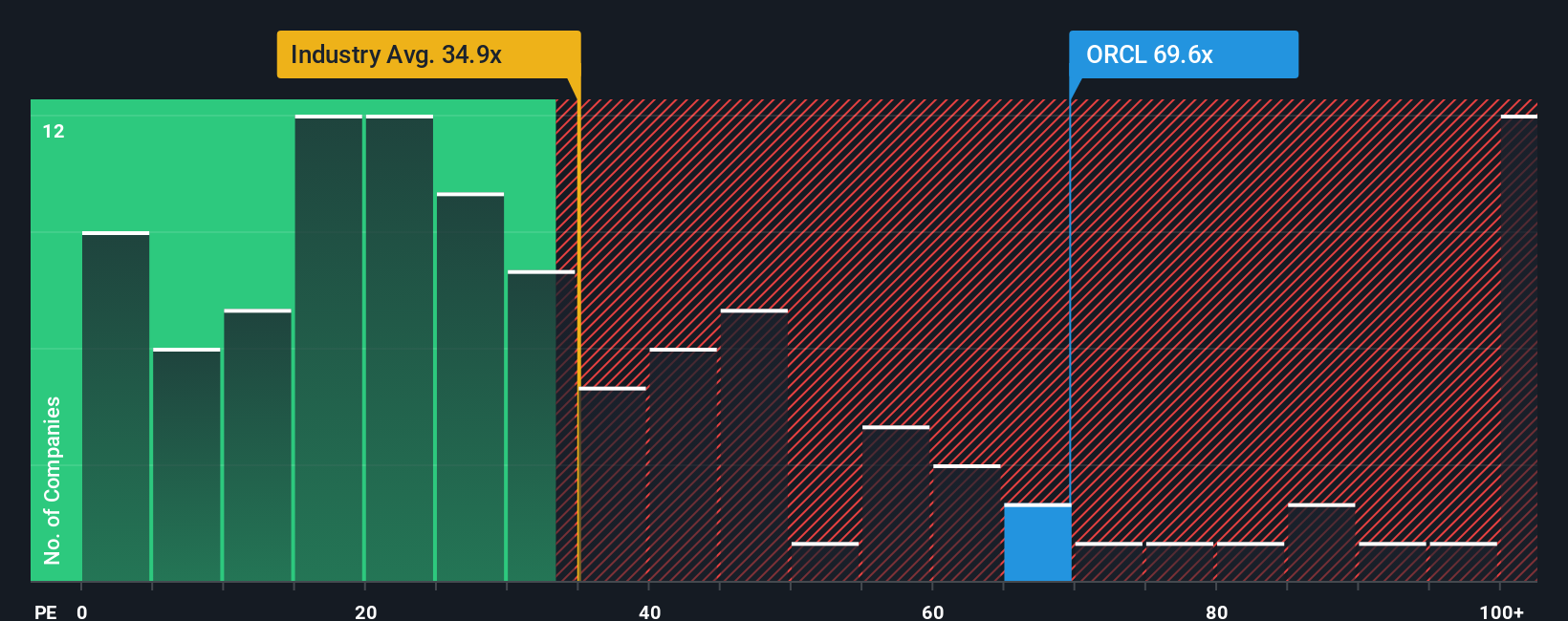

Approach 2: Oracle Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and meaningful valuation metric for profitable, established companies like Oracle. It shows how much investors are willing to pay for each dollar of a company’s earnings, making it a practical lens for comparing stock value, especially when a business has a consistent profit track record.

Assessing what counts as a “normal” or “fair” PE ratio involves more than a simple rule of thumb. Investors often reward higher growth companies with a loftier PE, while added risk can bring it down. Industry trends and profit stability also influence what is considered appropriate for a mature tech firm.

Currently, Oracle trades at a PE of 45.15x. This is noticeably higher than the Software industry average of 29.78x but remains well below the average for its peers at 70.27x. Benchmarking these numbers is useful; however, they only tell part of the story.

Simply Wall St’s proprietary Fair Ratio goes a step further by factoring in Oracle’s expected earnings growth, risk profile, profit margins, industry, and market capitalization. For Oracle, the Fair Ratio stands at 61.56x. This nuanced approach provides a more tailored benchmark than a raw peer or industry comparison.

With Oracle’s current PE ratio (45.15x) below its Fair Ratio (61.56x), the stock appears comfortably undervalued based on this standard. The difference is significant enough to suggest potential value for investors looking beyond headline multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Oracle Narrative

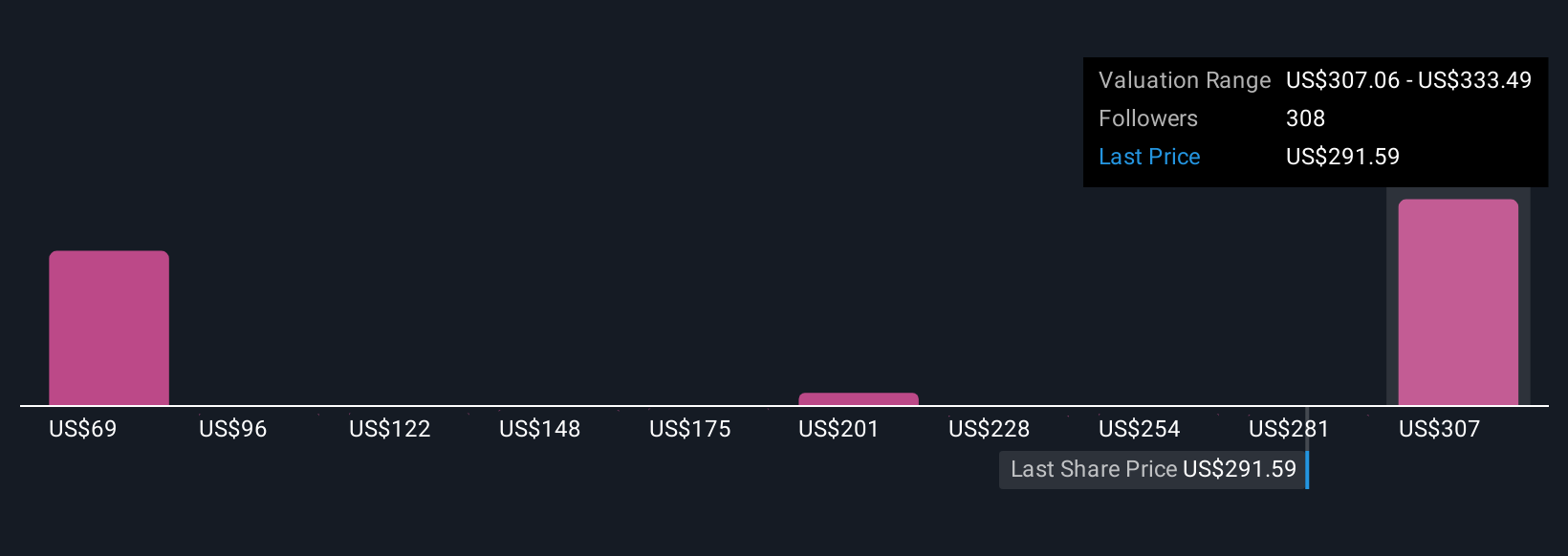

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, blending your insight about its business, future growth, and risks, with financial forecasts and a derived fair value. This makes your investment decisions both grounded and meaningful.

Instead of just taking numbers at face value, Narratives connect what you believe about Oracle, whether it is rapid growth in AI partnerships or concerns about rising competition, to realistic forecasts of revenues, earnings, and margins. This approach transforms abstract financials into a clear investment thesis that is unique to your perspective.

Narratives are an easy and accessible tool available on Simply Wall St’s Community page, where millions of investors share, compare, and discuss their viewpoints. They help you decide when to buy, hold, or sell by comparing your calculated Fair Value to the market price, updating automatically as new news or earnings are released.

For example, some investors forecast a bullish fair value of $389.81 per share based on hypergrowth in AI, while others take a more cautious view with a $212.00 fair value reflecting competition and margin pressures. This shows how your story and expectations directly inform actionable valuations.

Do you think there's more to the story for Oracle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.