Please use a PC Browser to access Register-Tadawul

Oscar Health (OSCR): Reassessing Valuation After New Analyst Coverage and Broward Health Network Expansion

Oscar Health, Inc. Class A OSCR | 13.23 | -3.64% |

Oscar Health (OSCR) just caught fresh attention after Stephens and Co. initiated coverage, and the stock responded with a multi day climb. At the same time, a new Broward Health partnership hints at real-world growth.

Those catalysts are landing on top of a mixed but improving track record, with a roughly 19.8% 1 month share price return and a powerful 3 year total shareholder return of about 623%. This suggests underlying momentum is still very much alive despite recent volatility.

If Oscar’s move has you thinking more broadly about healthcare, this could be a good moment to scan other ideas using our curated healthcare stocks.

But with shares now near one new target and still well below another, and with revenue growing while profits lag, is Oscar Health quietly undervalued here or is the market already baking in the next leg of growth?

Most Popular Narrative: 15.7% Overvalued

With Oscar Health last closing at $16.63 against a narrative fair value of $14.38, the story leans toward optimism that may already be priced in.

The analysts have a consensus price target of $11.143 for Oscar Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.0.

Want to see what kind of revenue runway, margin rebound, and future earnings multiple are needed to back this valuation story? The underlying forecasts are anything but cautious.

Result: Fair Value of $14.38 (OVERVALUED)

However, rapid digital adoption, aggressive repricing, and Oscar’s sizable capital cushion could accelerate margin recovery and could force a rethink of today’s cautious valuation narrative.

Another View: Market Multiples Point the Other Way

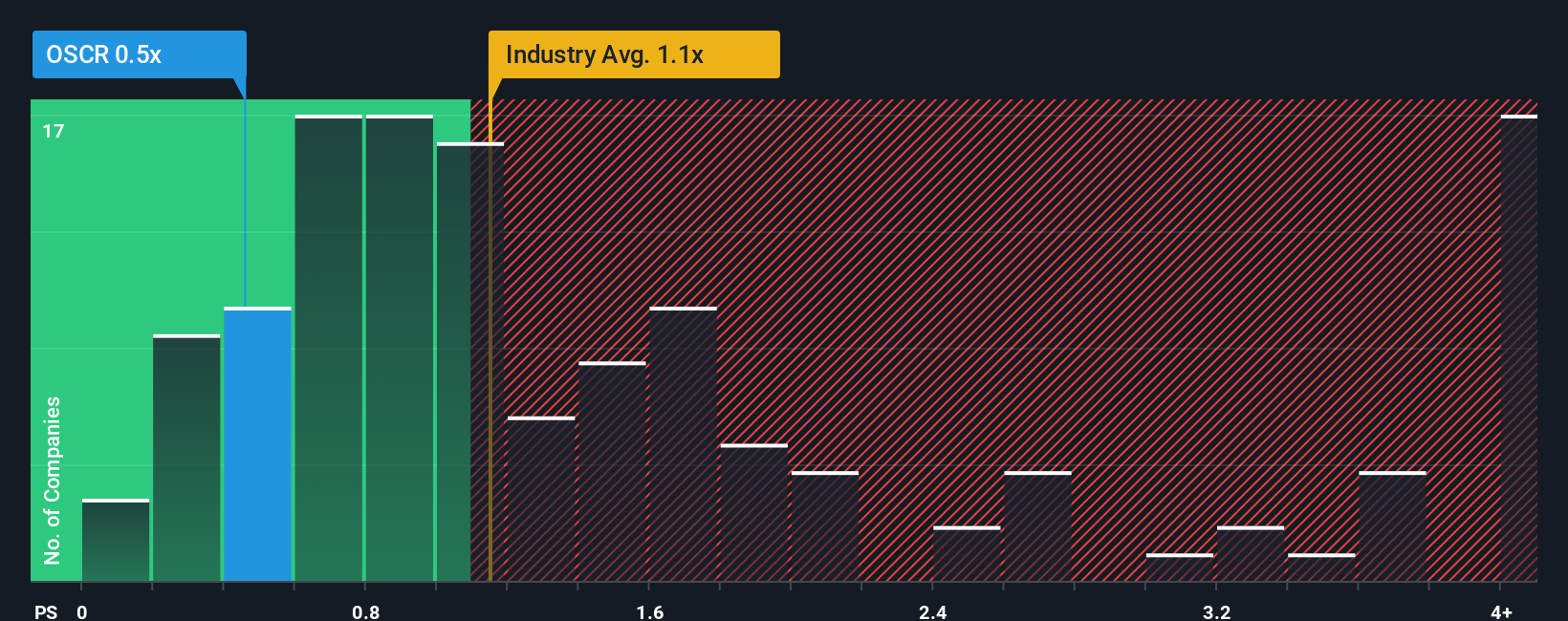

While the narrative fair value suggests Oscar Health is 15.7% overvalued, its current price to sales ratio of 0.4 times tells a different story. That is meaningfully below both the 0.7 times peer average and a 0.6 times fair ratio that the market could move toward.

In practical terms, the stock is priced as if growth will disappoint, even though earnings are forecast to improve sharply. This raises the question of whether sentiment is too cautious or whether the narrative model is simply capturing risks that multiples miss.

Build Your Own Oscar Health Narrative

If you look at the numbers and reach a different conclusion, dig into the details and craft a personalized view in minutes with Do it your way.

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when you can quickly scan new possibilities using targeted screeners built to uncover stocks with real potential, not just hype.

- Capitalize on mispriced opportunities by using these 908 undervalued stocks based on cash flows, which highlights companies trading below what their cash flows suggest they are worth.

- Ride structural growth trends in technology and automation with these 26 AI penny stocks, which points you toward early leaders in intelligent software and infrastructure.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3%, which combines attractive yields with businesses capable of sustaining their payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.