Please use a PC Browser to access Register-Tadawul

Oscar Health Q4 Loss Of US$353 Million Tests Profitability Turnaround Narrative

Oscar Health, Inc. Class A OSCR | 13.25 | -3.50% |

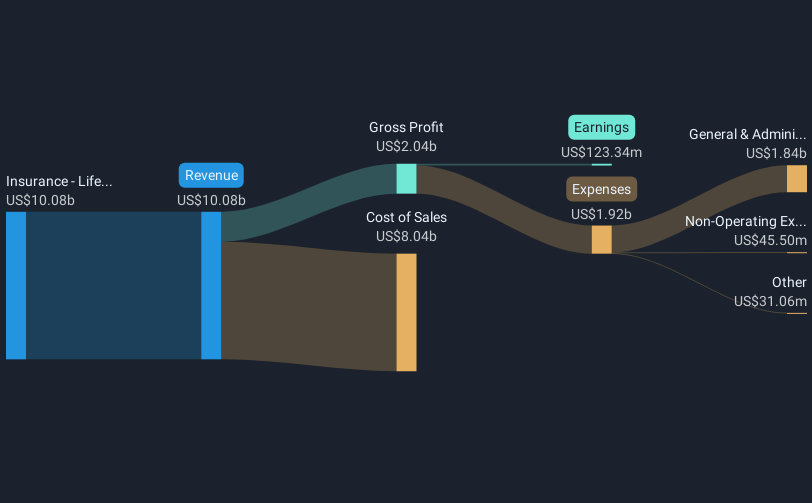

Oscar Health (OSCR) just wrapped up FY 2025 with Q4 revenue of US$2.8b and a basic EPS loss of US$1.24, while trailing twelve month figures show revenue of US$11.7b and a basic EPS loss of US$1.69. Over recent periods, the company has seen quarterly revenue range from US$2.4b in Q4 2024 to US$3.0b in Q1 2025, with basic EPS swinging from a profit of US$1.10 in Q1 2025 to losses of US$0.53 to US$1.24 in the following quarters. This keeps the focus squarely on how quickly margins can move toward consistent profitability.

See our full analysis for Oscar Health.With the latest numbers on the table, the next step is to set these results against the most common narratives around Oscar Health to see which views hold up and which ones the fresh margin picture starts to question.

TTM loss of US$443 million keeps profitability in focus

- On a trailing twelve month basis to Q4 FY 2025, Oscar Health generated about US$11.7b of revenue and reported a net loss of US$443.2 million, which translates to a basic EPS loss of US$1.69.

- What bullish investors highlight is the contrast between this loss and forecasts calling for very strong earnings growth, yet the latest annual loss still shows the business is firmly in investment mode rather than generating consistent profits.

- The bullish narrative points to an annualized 28.7% reduction in losses over five years and expected earnings growth of about 107.09% per year, while the most recent four quarters still add up to a sizeable loss of more than US$400 million.

- Bulls also reference an expected move into profitability within three years, so the current TTM EPS loss of US$1.69 gives you a clear yardstick for how much progress is still needed for that view to play out.

Bulls argue that these TTM figures are just the setup and that the real story is in the turnaround that could follow. If you want to see that case laid out in full you can head over to the detailed bull thesis for Oscar Health: 🐂 Oscar Health Bull Case

Quarterly profit swing from US$275 million to US$353 million loss

- Within FY 2025, net income moved from a profit of US$275.3 million in Q1 (EPS of US$1.10) to a loss of US$352.6 million in Q4 (EPS loss of US$1.24), with Q2 and Q3 also in loss territory between about US$137 million and US$228 million.

- Bears lean on these swings to argue that the path to stable profitability is still bumpy, even though forecasts point to future margin improvement.

- The cautious view flags concerns around high medical loss ratios and rising medical costs, and the shift from a strong Q1 profit to three consecutive loss quarters in the same fiscal year gives them specific recent data to point to.

- At the same time, analysts that expect profit margins to move from about a 1.5% loss today to a positive range over the next few years will likely be watching whether these quarterly losses start to shrink consistently from the Q4 FY 2025 level of around US$353 million.

Skeptics argue that swings of this size keep the risk side of the story front and center. If you want to see how that argument is built around the numbers you can read the detailed bear thesis for Oscar Health: 🐻 Oscar Health Bear Case

P/S of 0.3x stands out against sector

- Oscar Health trades at a P/S of 0.3x, which is below both the US insurance industry average of 1.1x and a peer average of 0.6x, using the current share price of US$12.88 against the company’s revenue base of roughly US$11.7b.

- Supporters of the bullish view see this gap as room for upside if the earnings path materializes, while more cautious investors focus on the backdrop of slower forecast revenue growth.

- The rewards summary points to revenue forecast growth of 8.5% per year compared with a 10.4% forecast for the broader US market, so the lower P/S multiple sits alongside revenue growth that is expected to trail the wider market.

- This mix of a discounted P/S ratio and slower projected top line growth means a lot of the debate comes back to whether the strong earnings growth forecasts and expected move to profitability within three years are realistic enough to justify any re rating from the current 0.3x level.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oscar Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data sparks a different angle for you, shape that view into your own narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Oscar Health.

See What Else Is Out There

Oscar Health is still posting sizeable TTM losses of US$443.2 million and saw profits swing sharply back to losses across FY 2025.

If those profit swings and ongoing losses feel uncomfortable, use our 83 resilient stocks with low risk scores to quickly size up companies where earnings and risk profiles look more stable right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.