Please use a PC Browser to access Register-Tadawul

Patterson UTI Energy (PTEN) Valuation Check After Launch Of Eos Completions Digital Platform

Patterson-UTI Energy, Inc. PTEN | 8.41 | -1.06% |

Patterson-UTI Energy (PTEN) is in focus after subsidiary NexTier Completion Solutions launched its eos Completions Digital Platform, a tool built to feed real-time field data directly into operator workflows and wellsite decisions.

Against this product launch backdrop, Patterson-UTI Energy’s share price has shown building momentum, with a 1-month share price return of 20.71% and a 90-day share price return of 28.67%. The 3-year total shareholder return of negative 46.26% contrasts with a 5-year total shareholder return of 43.65%.

If this kind of oilfield tech story has your attention, it could be a good moment to broaden your search and check out aerospace and defense stocks as another source of ideas.

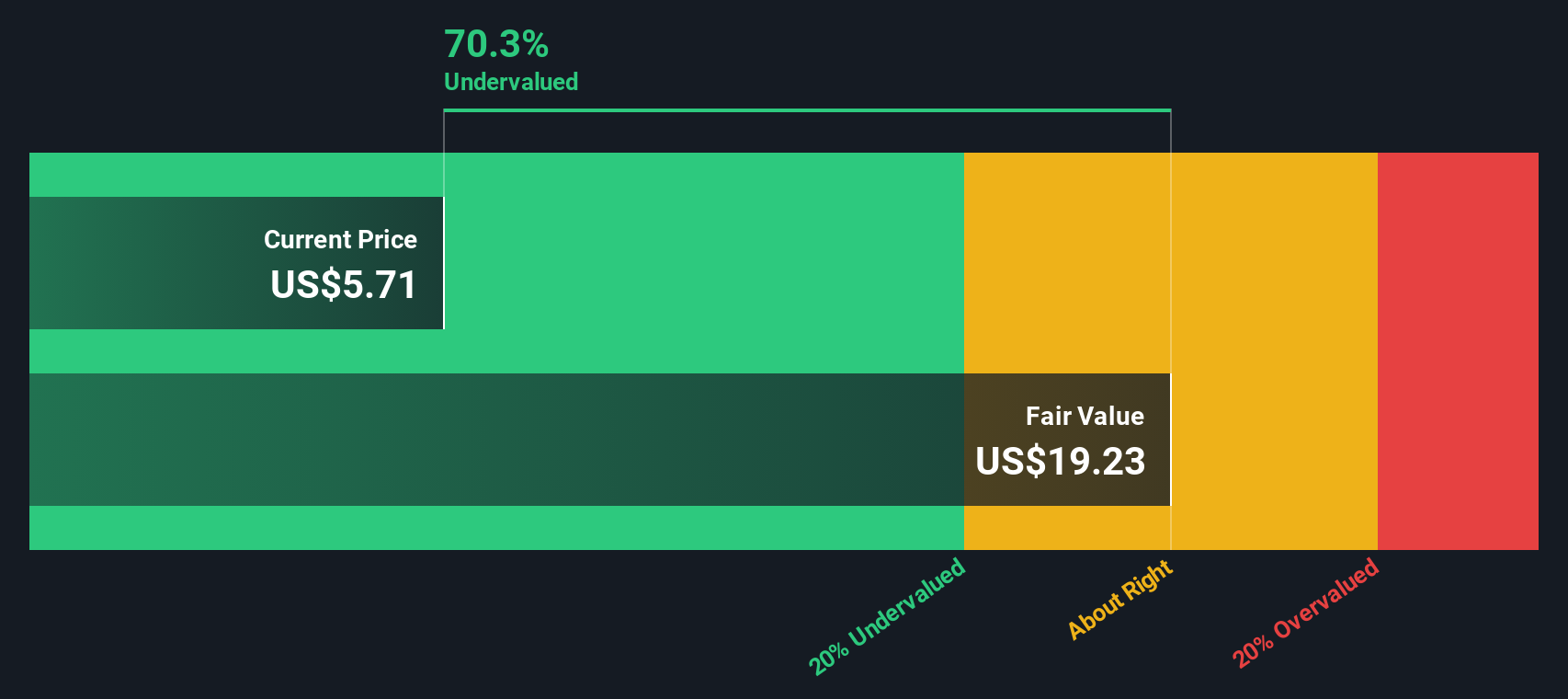

With shares up strongly in recent months but still showing a 3 year total shareholder return decline and a wide gap to one intrinsic value estimate, the key question now is whether PTEN is genuinely cheap or if the market is already factoring in potential future growth.

Most Popular Narrative: 8.5% Overvalued

The most followed narrative puts Patterson-UTI Energy’s fair value at $7.20, slightly below the last close of $7.81, which sets up an interesting tension.

Adoption and commercialization of differentiated automation, digital drilling, and emissions-reducing technologies (including the PTEN Digital Performance Center, Cortex automation suite, and Emerald 100%-natural-gas fleets) position Patterson-UTI to capture premium contract pricing and achieve structurally higher EBITDA margins.

Tightening supply of high-spec/low-emission drilling and completions equipment, combined with industry-wide underinvestment in lower-tier assets, should keep Patterson-UTI's premium fleets fully utilized and allow for stronger pricing discipline, supporting improved net margins and returns on capital.

Curious how a modestly lower revenue path, margin rebuild, and a future earnings multiple come together to support that $7 handle and still flag limited upside?

Result: Fair Value of $7.20 (OVERVALUED)

However, softer drilling and completions activity, together with high ongoing technology and equipment spending, could pressure margins and challenge the premium-pricing thesis behind that $7 handle.

Another View: Cash Flows Tell a Different Story

The narrative-based fair value of $7.20 suggests Patterson-UTI Energy is slightly overvalued at the current $7.81 share price. Yet our DCF model points to a future cash flow value of $24.59, which is a very large gap. Is sentiment holding the stock back, or is the cash flow model too optimistic?

Build Your Own Patterson-UTI Energy Narrative

If you are not fully sold on this view or prefer to stress test the assumptions with your own inputs, you can build a personalized Patterson-UTI Energy story in just a few minutes. To begin, start with Do it your way.

A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more stock ideas?

If PTEN has sparked your interest, do not stop here. Use the Simply Wall St Screener to quickly uncover other opportunities that might suit your approach.

- Spot potential value by scanning these 867 undervalued stocks based on cash flows that line up with your expectations on cash flows and pricing.

- Follow real growth themes by checking these 25 AI penny stocks that sit at the intersection of technology and earnings potential.

- Strengthen your income watchlist by reviewing these 13 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.