Please use a PC Browser to access Register-Tadawul

PBF Energy (PBF) Returns To Quarterly Profit Challenging Trailing Loss Narrative

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

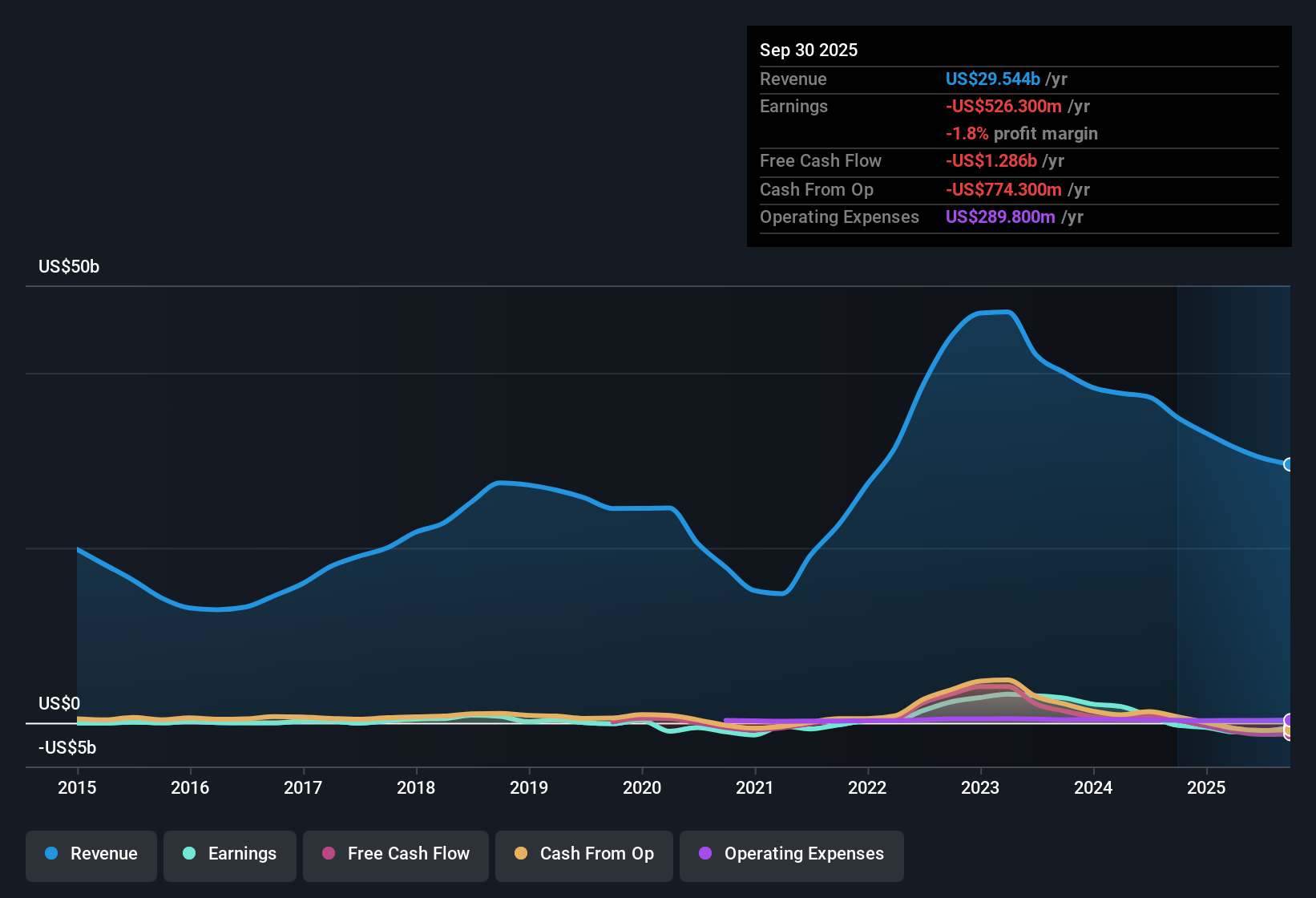

PBF Energy (PBF) has opened FY 2025 with a sharp swing back into the black in the third quarter, reporting revenue of US$7.7b and EPS of US$1.47 on net income of US$170.1m. The company has seen quarterly revenue move from US$8.7b in Q2 2024 to US$7.1b in Q1 2025 and then to US$7.7b in Q3 2025, while EPS has ranged from a loss of US$3.53 in Q1 2025 to a modest loss of US$0.05 in Q2 2025 before returning to positive territory in Q3. This sets up a results season where margin reset and the route back to consistent profitability are front of mind for investors.

See our full analysis for PBF Energy.With the headline numbers on the table, the next step is to line these results up against the widely shared narratives around PBF Energy to see which story threads hold up and which ones the latest margins start to question.

Q3 swings back to profit after four loss making quarters

- Q3 2025 net income of US$170.1 million follows four straight quarters of losses, including a Q1 2025 loss of US$401.8 million and a trailing twelve month loss of US$526.3 million.

- What stands out for the bullish narrative is that this single profitable quarter sits against a trailing loss and a view that tight refinery capacity and cost programs can support stronger margins. Yet the last twelve months still show US$29.5b of revenue paired with a loss, which keeps the bullish focus on margin quality rather than just volumes.

- Bulls point to cost savings programs and tighter global capacity as margin supports, but the move from a Q1 loss of US$401.8 million to a Q3 profit of US$170.1 million has not yet translated into positive trailing earnings. As a result, the case leans heavily on future consistency rather than current trailing averages.

- With trailing EPS at a loss of US$4.62, the bullish idea of higher, more resilient earnings power needs more than one profitable quarter to look embedded in the numbers that long term holders usually watch.

Bulls argue this first profitable quarter could be the start of the margin reset they were looking for, but the trailing loss shows why they still keep a close eye on how many of these profitable quarters PBF can string together. 🐂 PBF Energy Bull Case

Trailing 12 month loss sits against mixed valuation signals

- Over the last twelve months, PBF generated about US$29.5b in revenue and recorded a net loss of US$526.3 million, while the current share price of US$33.67 sits above the DCF fair value of US$31.20 and above the single allowed analyst price target of US$31.92.

- Bears highlight that the company is loss making over the trailing period and argue that this, combined with the share price sitting above both the DCF fair value and the US$31.92 price target, leaves limited support if refining conditions soften.

- The trailing loss of US$526.3 million and negative EPS of US$4.62 contrast with the idea of a business already on a firm earnings base, which cautious investors often look for when a share price trades above both an analyst target and a DCF fair value.

- At the same time, the P/S ratio of 0.1x is below peers at 0.3x and well below the wider US Oil & Gas industry at 1.7x, so bears have to explain why a company with that low sales multiple still shows a loss rather than treating the low P/S as a clear comfort point.

Skeptics warn that paying US$33.67 for a company with a trailing loss and price levels above both US$31.20 DCF fair value and the US$31.92 price target leans on a lot going right on margins, even though the current P/S ratio looks low versus peers. 🐻 PBF Energy Bear Case

Dividend yield 3.27% but not covered by current earnings

- The stock offers a 3.27% dividend yield, yet the payout is described as not well covered by either current earnings or free cash flow, at a time when trailing EPS is a loss of US$4.62 and net income over the last year is a loss of US$526.3 million.

- Consensus narrative talks about cost savings, renewable fuel projects and liquidity as supports for shareholder value, but the combination of a cash dividend with loss making trailing earnings and a recent run of four loss making quarters before Q3 means income focused holders are relying on those improvement plans to sustain the payout.

- With Q3 2025 being the only clearly profitable quarter in the last five reported, dividend coverage over a full year is driven more by the loss making periods than by the most recent profit. This can be a key point to check in filings for anyone depending on that 3.27% yield.

- Investors weighing the consensus view against the raw numbers may treat the current dividend as an extra to monitor rather than a firmly backed income stream while trailing net income remains negative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PBF Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If you think the data points tell another story, shape your own view in a few minutes and Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

PBF Energy couples a trailing twelve month loss of US$526.3 million with uncovered dividends and only one profitable quarter out of the last five.

If that mix of losses and dividend uncertainty feels uncomfortable, you might want to focus on companies with dependable income streams by checking out 16 dividend fortresses right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.