Please use a PC Browser to access Register-Tadawul

PBF Energy (PBF) Valuation Check After Recent 13% Pullback from Earlier 2024 Rally

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

PBF Energy (PBF) has pulled back roughly 13% over the past month after a solid run earlier this year, and that slide is catching the attention of value oriented investors in the refining space.

Zooming out, that 1 month share price pullback sits against a still solid backdrop, with a roughly 19% year to date share price return and a powerful 5 year total shareholder return that suggests long term momentum has not completely faded.

If volatility in refiners has your attention, it is a good moment to broaden the watchlist and explore fast growing stocks with high insider ownership for other potential opportunities.

Given that shares still sit on a strong multiyear run despite a recent pullback, the key question now is whether PBF Energy’s current valuation lags its improving fundamentals, or if the market already reflects its next leg of growth?

Most Popular Narrative: 4.5% Overvalued

With PBF Energy last closing at $31.96 against a narrative fair value of about $30.58, the debate now centers on how durable its refinery driven cash flows really are.

Recent street research highlights a mix of optimism and caution from analysts regarding PBF Energy's outlook. This reflects diverse opinions on key factors that may impact the company's valuation and growth trajectory.

Want to see what is powering this relatively full valuation? The narrative leans on resilient margins, refinery restart upside, and a profit multiple that assumes real staying power. Curious which specific profitability and growth assumptions sit under that fair value line, and how they connect to PBF’s evolving asset base? Dive into the full story to unpack the numbers behind this call.

Result: Fair Value of $30.58 (OVERVALUED)

However, persistent Martinez restart setbacks or tougher coastal regulations could quickly erode margins and challenge the idea that today’s premium valuation is justified.

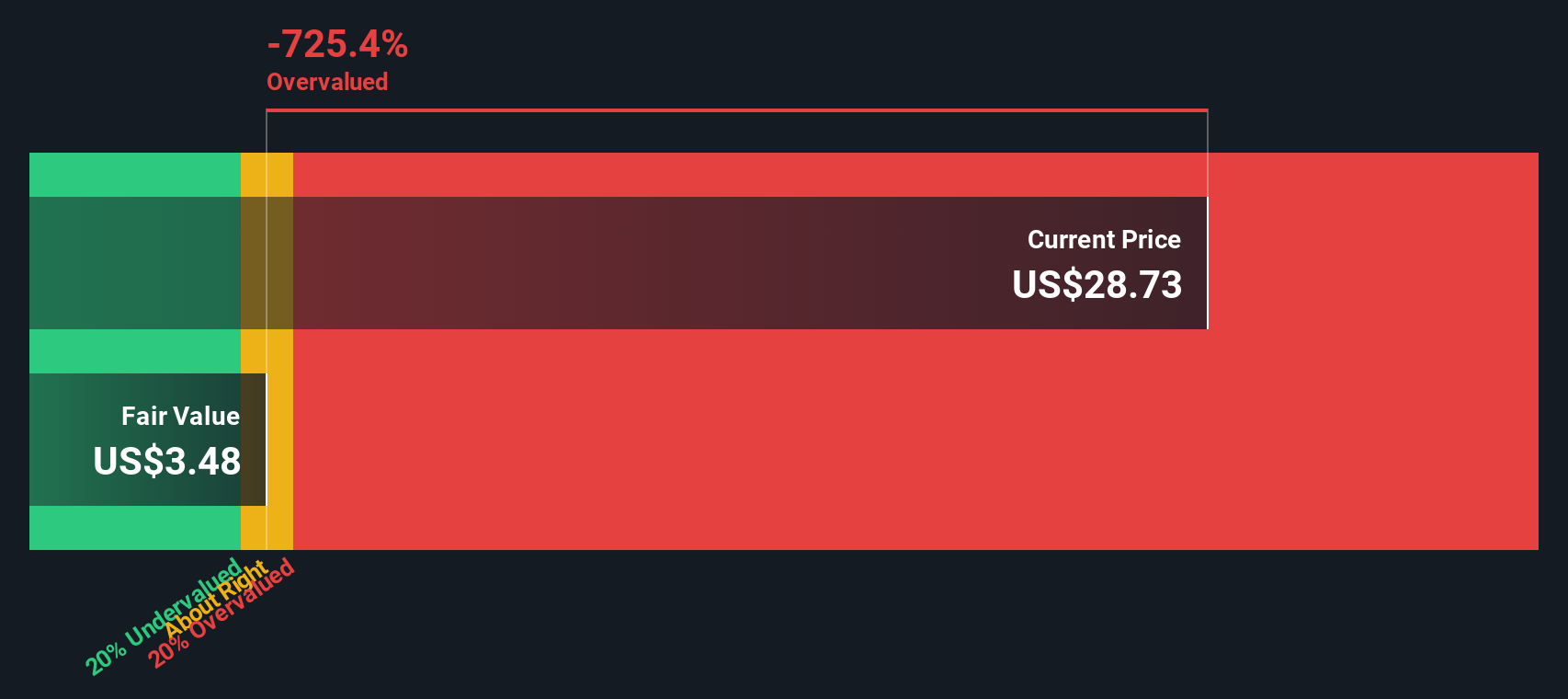

Another Angle on Value

While the narrative fair value suggests PBF Energy is about 4.5% overvalued, our DCF model tells a different story. Shares are trading roughly 25.8% below an estimated fair value of $43.10. Is the market underestimating future cash flows, or is the DCF too optimistic about margins and demand?

Build Your Own PBF Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with PBF. Use the Simply Wall Street Screener to pinpoint fresh, data driven opportunities across sectors before other investors catch on.

- Capture potential mispricings by targeting quality companies trading below intrinsic value through these 905 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Ride structural shifts in automation and machine intelligence by tapping into these 27 AI penny stocks and focus on businesses turning AI into durable revenue growth.

- Strengthen your income strategy by scanning these 15 dividend stocks with yields > 3% and uncover firms combining reliable cash payouts with sustainable balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.