Please use a PC Browser to access Register-Tadawul

PepsiCo Stock Slides 4.9% in 2024: What Does That Mean for Its Value?

PepsiCo, Inc. PEP | 165.94 | -0.75% |

- Wondering if PepsiCo is a good buy right now? You are not alone, especially with so much talk going around about whether the stock is undervalued or overpriced in today’s market.

- The share price has seen a bit of a rollercoaster lately, dropping 2.3% this past week but gaining 2.3% over the last month. It is currently about 4.9% lower so far in 2024.

- PepsiCo has been making headlines for its ongoing global expansion, with a recent focus on healthier beverages and snacks as part of its sustainability initiatives. Strategic moves like these often prompt investors to reconsider both the company’s growth prospects and any risks that might be influencing its share price.

- When we look at its valuation, PepsiCo checks the “undervalued” box in just 2 out of 6 key areas, giving it a 2/6 valuation score. Let’s break down what that means, how typical valuation models stack up, and, more importantly, explore a smarter way to judge if PepsiCo is a real bargain by the end of the article.

PepsiCo scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PepsiCo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method helps investors judge if a stock’s price is supported by realistic expectations for growth and profitability.

For PepsiCo, the current Free Cash Flow stands at approximately $6.4 billion. Analysts forecast the company’s FCF to grow steadily, with simplywall.st extrapolations projecting it to rise to just under $15 billion by 2035. While analysts provide detailed projections for the next five years, these longer-term figures rely on reasonable growth assumptions with annual increases moderating over time.

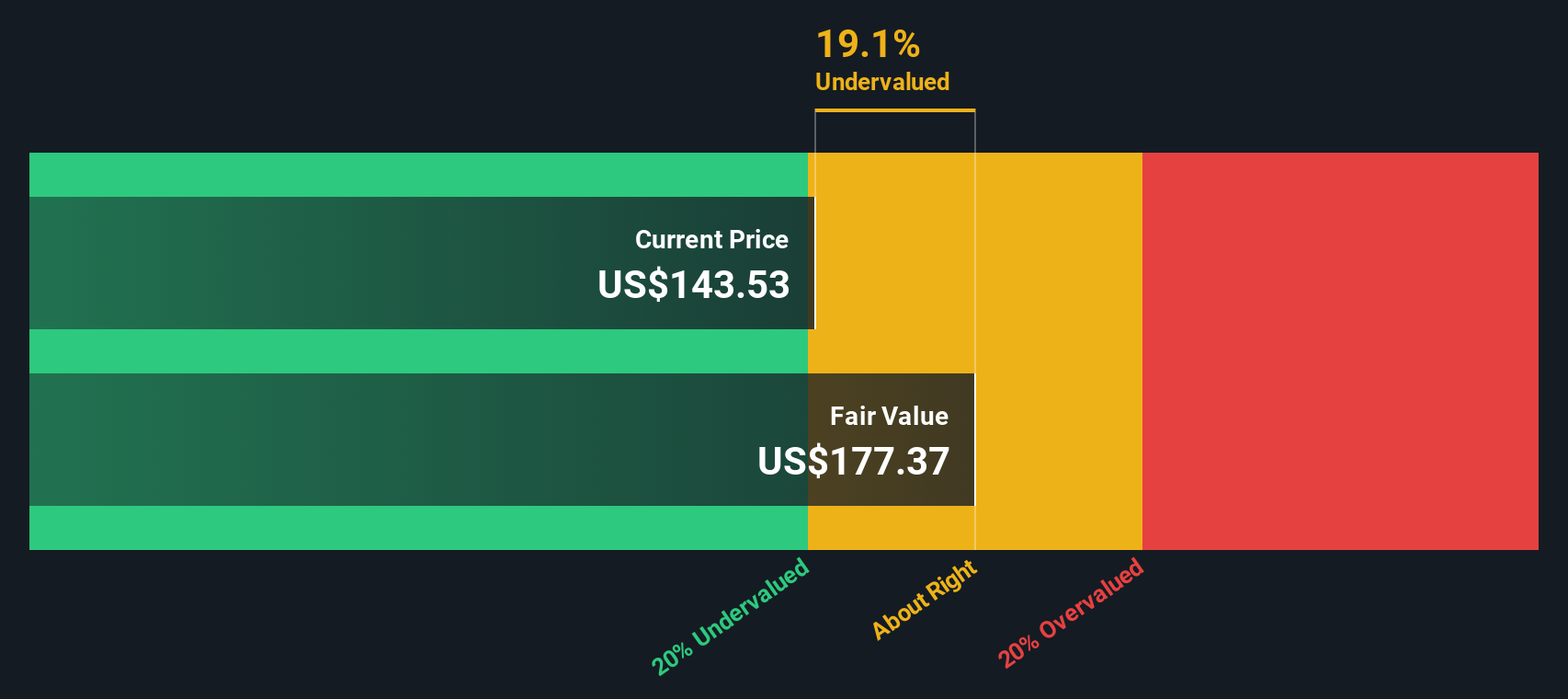

According to this DCF analysis, PepsiCo’s intrinsic value is calculated at $224.04 per share. At today’s market price, this implies the stock is trading at a 36.2% discount to its estimated fair value. This suggests it could be significantly undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PepsiCo is undervalued by 36.2%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: PepsiCo Price vs Earnings (PE Ratio)

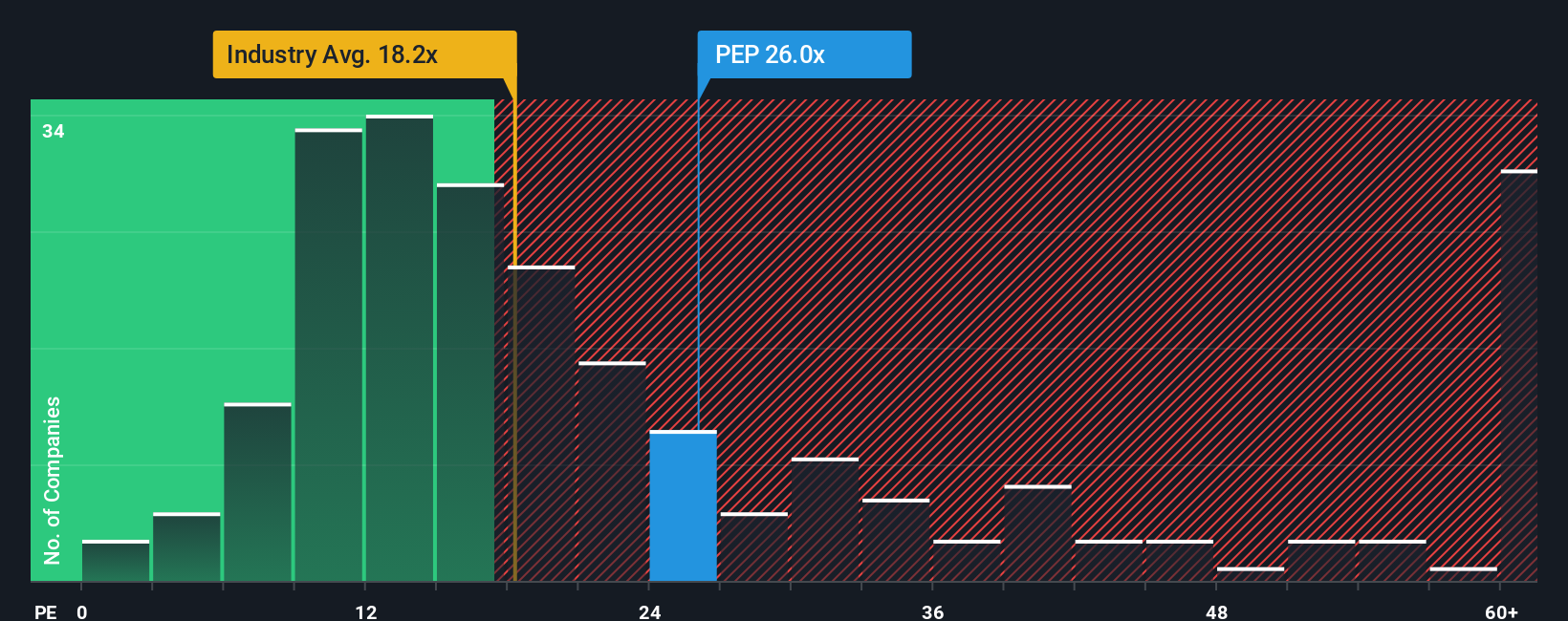

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like PepsiCo, as it directly links a company's share price to its earnings. This makes it a simple way for investors to gauge how much they are paying for each dollar of profit, which is especially helpful for established, consistently profitable businesses.

In general, a higher PE ratio can reflect expectations for faster earnings growth or lower business risk. A lower PE may signal slower growth or more uncertainty. What counts as a "normal" or "fair" PE depends on how much investors believe a company's future prospects justify paying a premium over current earnings.

Currently, PepsiCo trades at a PE ratio of 27x. This is noticeably higher than the beverage industry average of 17.6x and also above the peer group average of 25.6x. However, Simply Wall St’s Fair Ratio for PepsiCo is 26.7x. The Fair Ratio is unique because it adjusts for factors like the company's expected earnings growth, profit margins, risk profile, industry dynamics, and even PepsiCo’s size and market standing. By going beyond surface-level comparisons to peers or industry averages, the Fair Ratio delivers a more tailored valuation benchmark for investors.

In PepsiCo’s case, its current PE of 27x is very close to the fair value ratio of 26.7x. This suggests that the stock is valued about right when all relevant growth, profitability, and risk factors are considered.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PepsiCo Narrative

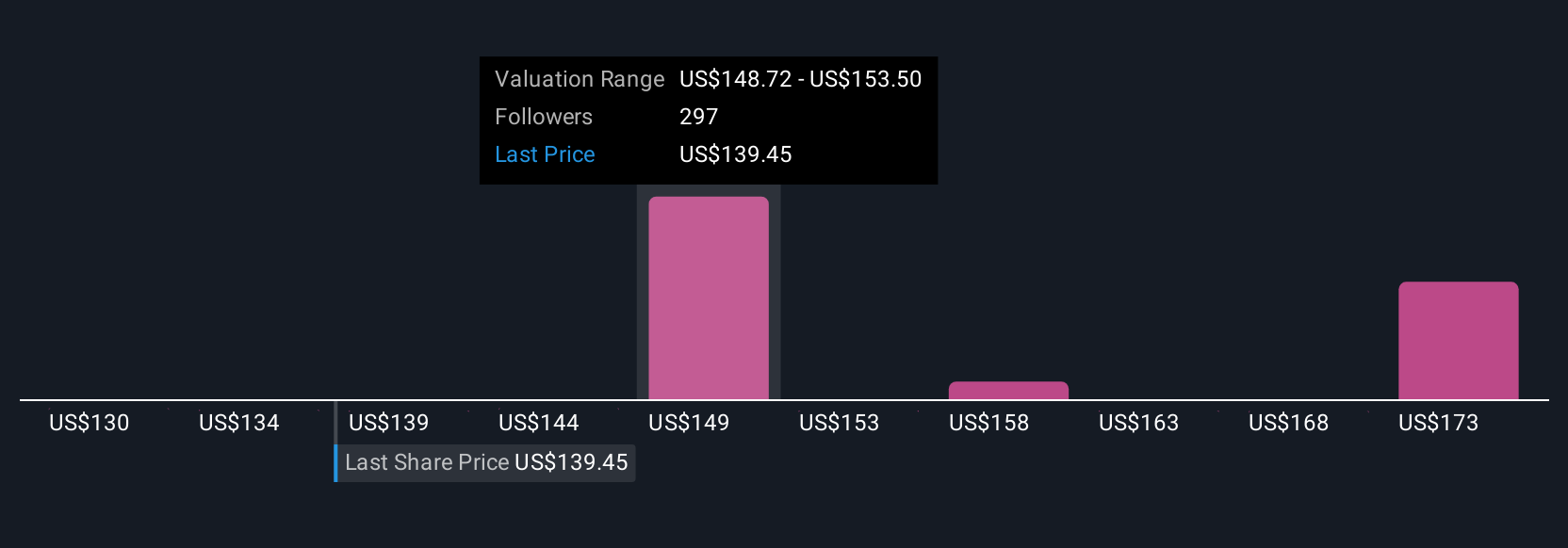

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects the story you believe about a company, such as PepsiCo’s future strategies, risks, and industry shifts, to actual financial forecasts and a personal fair value estimate. Instead of relying only on technical models, Narratives let you shape your own investment perspective by estimating future revenues, earnings, and margins. This approach makes your view a part of the numbers.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy and interactive tool to compare their own fair value with the current market price and discuss when to buy or sell. These values update automatically as news and earnings reports are released. Narratives make investing more dynamic and grounded, empowering you to respond when new information changes the company’s outlook in real time. For example, one investor with a cautious forecast values PepsiCo at $115 per share and focuses on slow growth and margin risks. In contrast, a more optimistic outlook with higher margin expectations and international expansion leads another investor to set fair value at $175 per share. Each Narrative helps you decide what PepsiCo is truly worth to you.

Do you think there's more to the story for PepsiCo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.