Please use a PC Browser to access Register-Tadawul

Perma-Fix Environmental Services, Inc.'s (NASDAQ:PESI) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Perma-Fix Environmental Services, Inc. PESI | 14.09 | -3.16% |

Perma-Fix Environmental Services, Inc. (NASDAQ:PESI) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 38%, which is great even in a bull market.

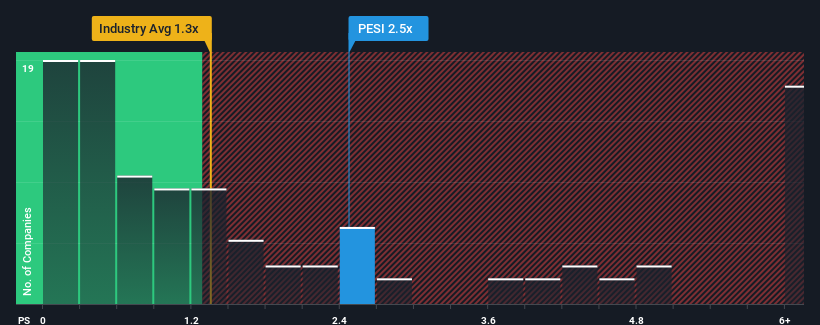

Although its price has dipped substantially, when almost half of the companies in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.3x, you may still consider Perma-Fix Environmental Services as a stock probably not worth researching with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Perma-Fix Environmental Services' P/S Mean For Shareholders?

Perma-Fix Environmental Services hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Perma-Fix Environmental Services' future stacks up against the industry? In that case, our free report is a great place to start.How Is Perma-Fix Environmental Services' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Perma-Fix Environmental Services' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. As a result, revenue from three years ago have also fallen 20% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 26% over the next year. That's shaping up to be materially higher than the 8.8% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Perma-Fix Environmental Services' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

There's still some elevation in Perma-Fix Environmental Services' P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Perma-Fix Environmental Services shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Perma-Fix Environmental Services.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.