Please use a PC Browser to access Register-Tadawul

Phillips 66 (NYSE:PSX) CEO Mark Lashier Discusses Future Vision At THRIVE Energy Conference

Phillips 66 PSX | 159.77 | +2.25% |

Phillips 66 (NYSE:PSX) experienced a 2.70% price increase over the last month, coinciding with several strategic moves and market developments. The company actively engaged in investor communications, highlighted by a fireside chat with CEO Mark Lashier, which reinforced transparency and governance efforts amid investor activism led by Elliott Investment Management. This engagement occurred parallel to large overarching market trends, where the tech-heavy Nasdaq faced significant losses, yet rebounded, contributing to a mixed market sentiment. Additionally, Phillips 66 declared a quarterly dividend of $1.15 per share, maintaining its commitment to shareholder returns, which may have provided some positive sentiment. Meanwhile, broader market volatility embedded in the uncertainty around U.S. economic policy influenced investor behavior. Despite market challenges where indexes like the Dow Jones remained flat, Phillips 66's board and governance initiatives appeared to distinguish its performance, aligning it well against pronounced market fluctuations during this time.

Phillips 66 has delivered a total return of 226.52% over the past five years, a period marked by significant corporate maneuvers and investor engagement. The commitment to regular shareholder returns is evident through consistent dividend declarations, such as the recent US$1.15 per share payout, fostering long-term investor confidence. This period also saw robust share buyback activity; for instance, 4.70 million shares were repurchased in Q4 2024 for US$610.11 million. These financial maneuvers have been key to enhancing shareholder value.

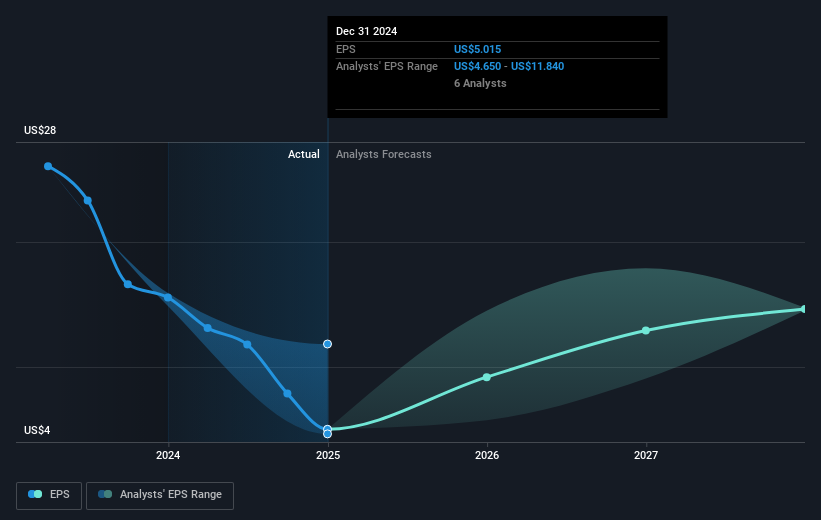

Despite facing a challenging year with a decline in annual net income from US$7.02 billion to US$2.12 billion, Phillips 66 has been actively restructuring, including plans to cease operations at the Los Angeles Refinery. Governance changes, driven by activist shareholder Elliott Management, have further aligned the company with investor interests by improving board oversight and strategic direction. Although recent earnings showed a downturn, the company's earnings growth over the five-year span has contributed to substantial shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.