Please use a PC Browser to access Register-Tadawul

Phreesia (NYSE:PHR) Has Debt But No Earnings; Should You Worry?

Phreesia PHR | 16.25 | +1.31% |

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Phreesia, Inc. (NYSE:PHR) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Phreesia Carry?

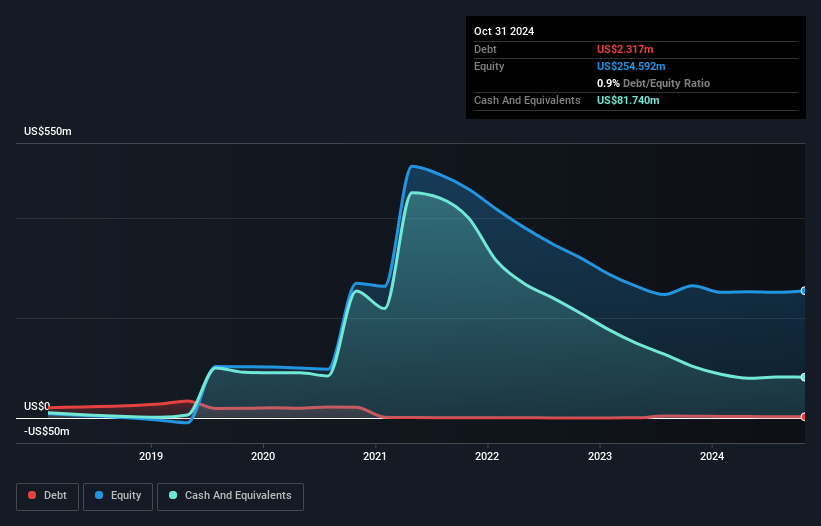

As you can see below, Phreesia had US$2.32m of debt at October 2024, down from US$3.67m a year prior. But it also has US$81.7m in cash to offset that, meaning it has US$79.4m net cash.

A Look At Phreesia's Liabilities

Zooming in on the latest balance sheet data, we can see that Phreesia had liabilities of US$109.2m due within 12 months and liabilities of US$11.9m due beyond that. Offsetting these obligations, it had cash of US$81.7m as well as receivables valued at US$71.4m due within 12 months. So it can boast US$32.0m more liquid assets than total liabilities.

Having regard to Phreesia's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$1.65b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Phreesia has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Phreesia's ability to maintain a healthy balance sheet going forward.

Over 12 months, Phreesia reported revenue of US$405m, which is a gain of 20%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Phreesia?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Phreesia had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$12m of cash and made a loss of US$83m. But the saving grace is the US$79.4m on the balance sheet. That means it could keep spending at its current rate for more than two years. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Phreesia , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.