Please use a PC Browser to access Register-Tadawul

Portillo's Inc.'s (NASDAQ:PTLO) Shares Bounce 26% But Its Business Still Trails The Market

Portillo's, Inc. Class A PTLO | 5.66 | 0.00% |

Portillo's Inc. (NASDAQ:PTLO) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 50% over that time.

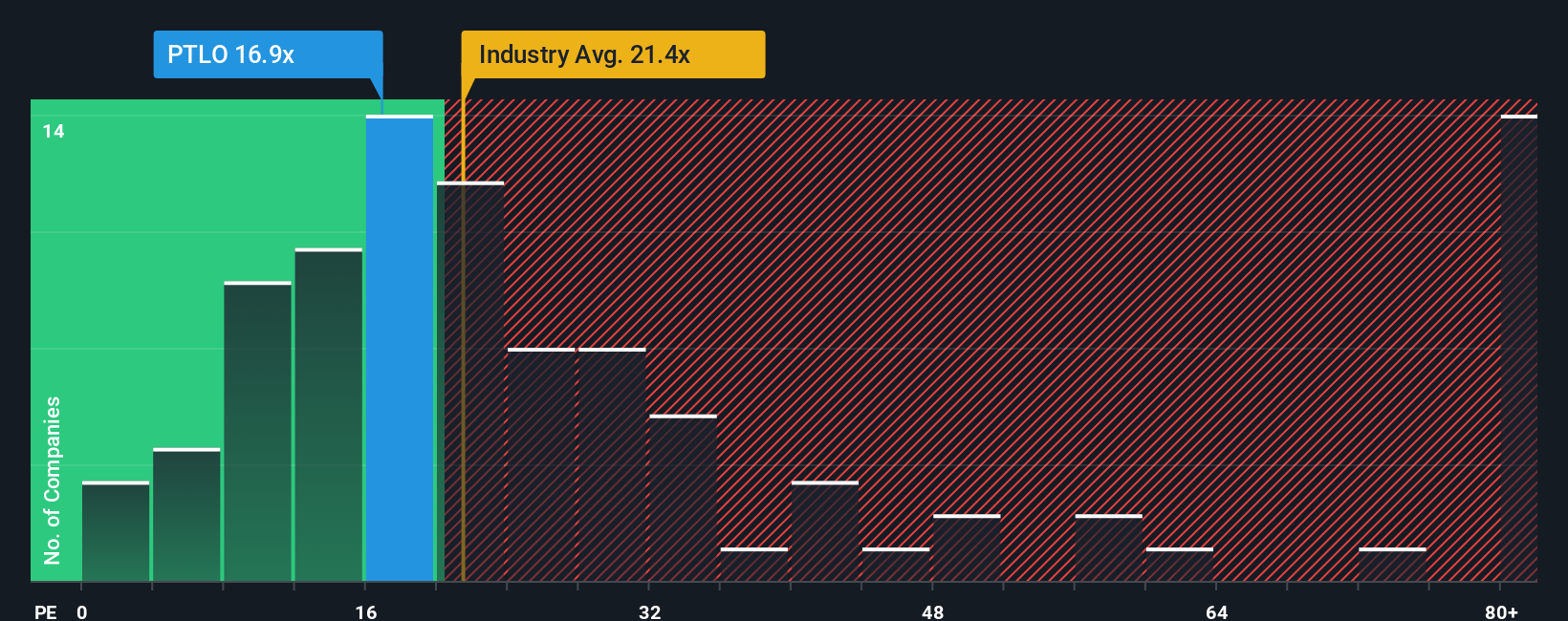

Even after such a large jump in price, Portillo's' price-to-earnings (or "P/E") ratio of 17.4x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 35x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Portillo's' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is Portillo's' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Portillo's' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 16%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings growth is heading into negative territory, declining 30% over the next year. That's not great when the rest of the market is expected to grow by 16%.

In light of this, it's understandable that Portillo's' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite Portillo's' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Portillo's maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Portillo's has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Portillo's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.