Please use a PC Browser to access Register-Tadawul

Positive Sentiment Still Eludes Elevance Health, Inc. (NYSE:ELV) Following 25% Share Price Slump

Elevance Health ELV | 351.90 351.90 | -2.43% 0.00% Pre |

To the annoyance of some shareholders, Elevance Health, Inc. (NYSE:ELV) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

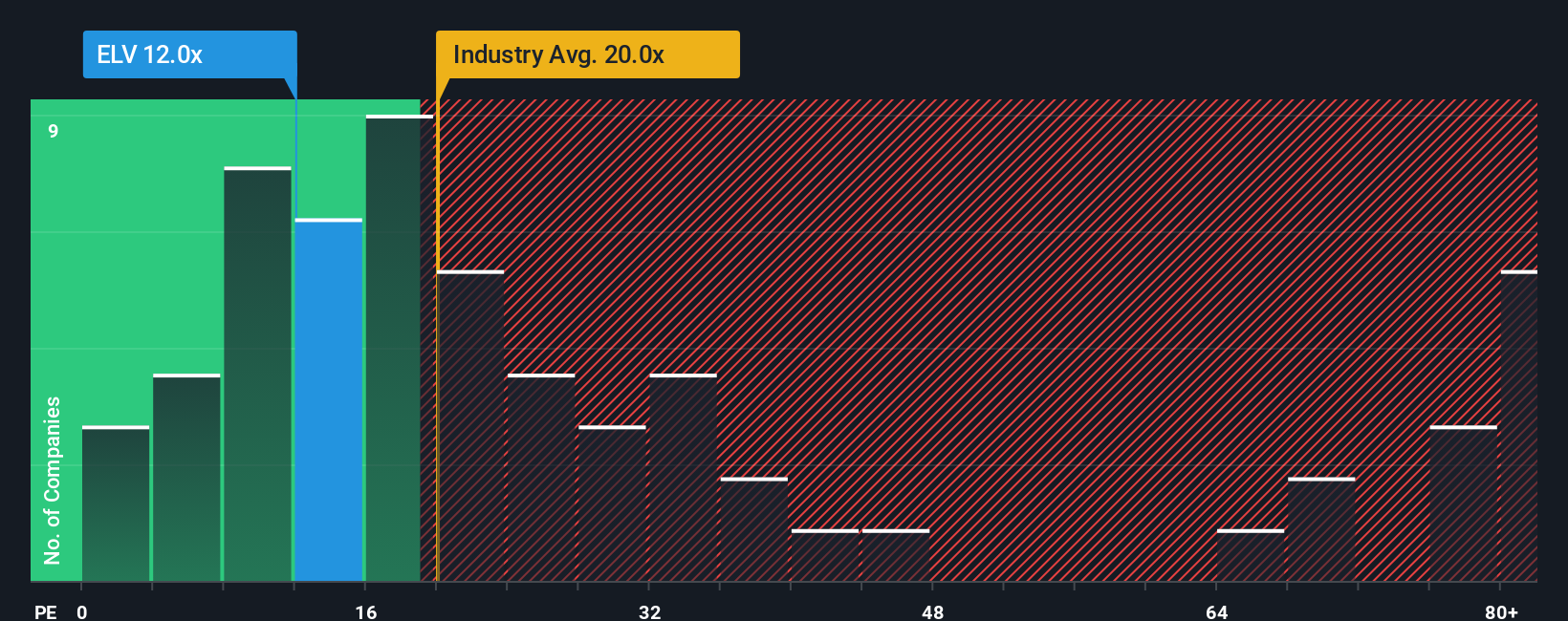

After such a large drop in price, Elevance Health may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Elevance Health's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Elevance Health would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 18%. The last three years don't look nice either as the company has shrunk EPS by 5.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 13% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we find it odd that Elevance Health is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Elevance Health's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Elevance Health's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Elevance Health with six simple checks.

If these risks are making you reconsider your opinion on Elevance Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.