Please use a PC Browser to access Register-Tadawul

Positive Sentiment Still Eludes Siebert Financial Corp. (NASDAQ:SIEB) Following 25% Share Price Slump

Siebert Financial Corp. SIEB | 3.05 | +7.44% |

Siebert Financial Corp. (NASDAQ:SIEB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

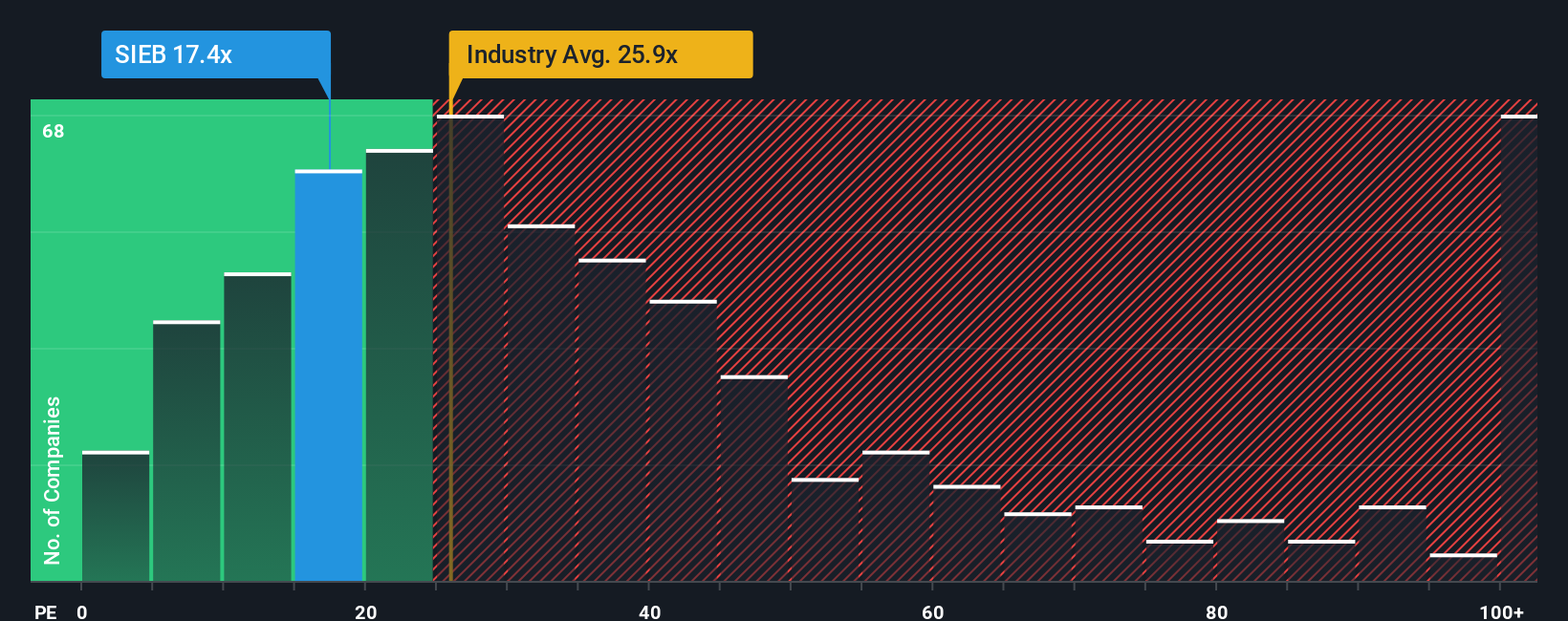

After such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may consider Siebert Financial as an attractive investment with its 16.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Siebert Financial's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Siebert Financial?

Siebert Financial's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. Still, the latest three year period has seen an excellent 355% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 16% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Siebert Financial is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Siebert Financial's P/E?

The softening of Siebert Financial's shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Siebert Financial revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You might be able to find a better investment than Siebert Financial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.