Please use a PC Browser to access Register-Tadawul

PotlatchDeltic (PCH): Fresh Look at Valuation After Recent Share Price Rebound

PotlatchDeltic Corporation PCH | 43.12 | +4.28% |

PotlatchDeltic (PCH) has been quietly grinding higher, up nearly 2% today and 3% over the past week, even though the stock is still down over the past month and past 3 months.

That recent uptick fits into a mixed picture, with a modest year to date share price return of 2.46% and a slightly negative 1 year total shareholder return. This suggests momentum is only just starting to rebuild as investors reassess the risk reward trade off at around $40.05 per share.

If PotlatchDeltic has you thinking about where else value and momentum might be emerging, it could be worth scanning the market for fast growing stocks with high insider ownership as potential next ideas.

With earnings recovering, a sizable implied discount to analyst targets and solid long term timberland assets, the real question now is whether PotlatchDeltic is a quietly undervalued REIT or if the market already captures its future growth.

Most Popular Narrative: 15.7% Undervalued

With PotlatchDeltic last closing at $40.05 against a narrative fair value of $47.50, the story points to meaningful upside if forecasts land.

Accelerated capital allocation actions, including aggressive share repurchases at a substantial discount to NAV and continued portfolio optimization, position PotlatchDeltic for enhanced per share earnings growth and return of capital to shareholders as macro and industry fundamentals improve. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.4x on those 2028 earnings, down from 77.2x today.

Curious how modest top line growth, sharply higher margins and shrinking share count can still argue for a premium multiple in a cyclical REIT, dig in.

Result: Fair Value of $47.50 (UNDERVALUED)

However, sustained housing market weakness or region specific disruptions like wildfires and regulatory changes could cap lumber demand and pressure PotlatchDeltic’s earnings rebound.

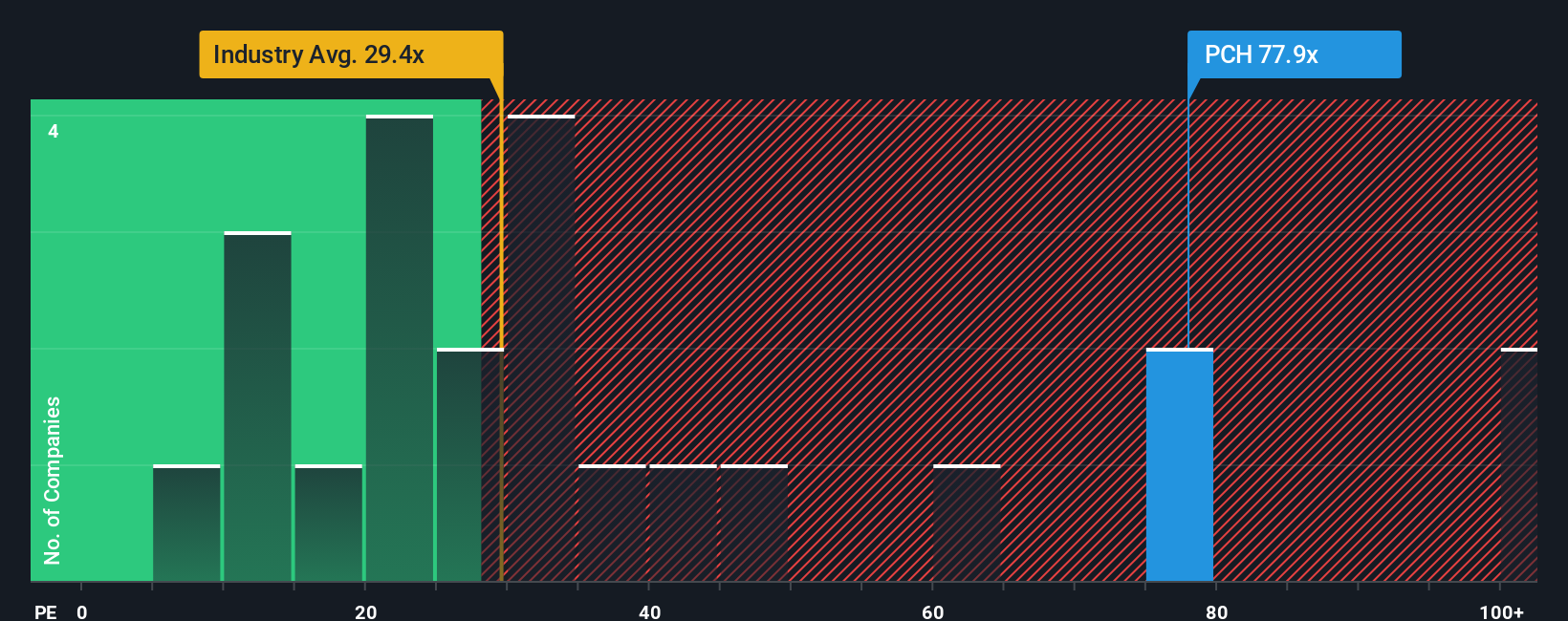

Another View: Multiples Flash a Caution Sign

While our narrative fair value points to upside, today’s 48.2x price to earnings looks rich against a 38.3x fair ratio, a 34.8x peer average and a 28.3x sector mark. If sentiment cools, the share price could slide back toward those lower anchors.

Build Your Own PotlatchDeltic Narrative

If you see the story differently or want to stress test your own assumptions using the same toolkit, you can build a full narrative in under three minutes: Do it your way.

A great starting point for your PotlatchDeltic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move

Do not stop with PotlatchDeltic alone, use the Simply Wall Street Screener to uncover fresh, data driven opportunities before other investors catch on.

- Target income right now by scanning these 15 dividend stocks with yields > 3% that combine solid yields with balance sheets built to support those payouts.

- Ride structural growth by focusing on these 30 healthcare AI stocks transforming diagnostics, drug discovery and patient care with real world AI adoption.

- Capture asymmetric upside by hunting through these 80 cryptocurrency and blockchain stocks positioned to benefit from blockchain infrastructure, tokenisation and next generation payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.