Please use a PC Browser to access Register-Tadawul

ProFrac Holding Corp. (NASDAQ:ACDC) Held Back By Insufficient Growth Even After Shares Climb 45%

ProFrac Holding Corp. Class A ACDC | 5.31 | -5.52% |

ProFrac Holding Corp. (NASDAQ:ACDC) shareholders are no doubt pleased to see that the share price has bounced 45% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

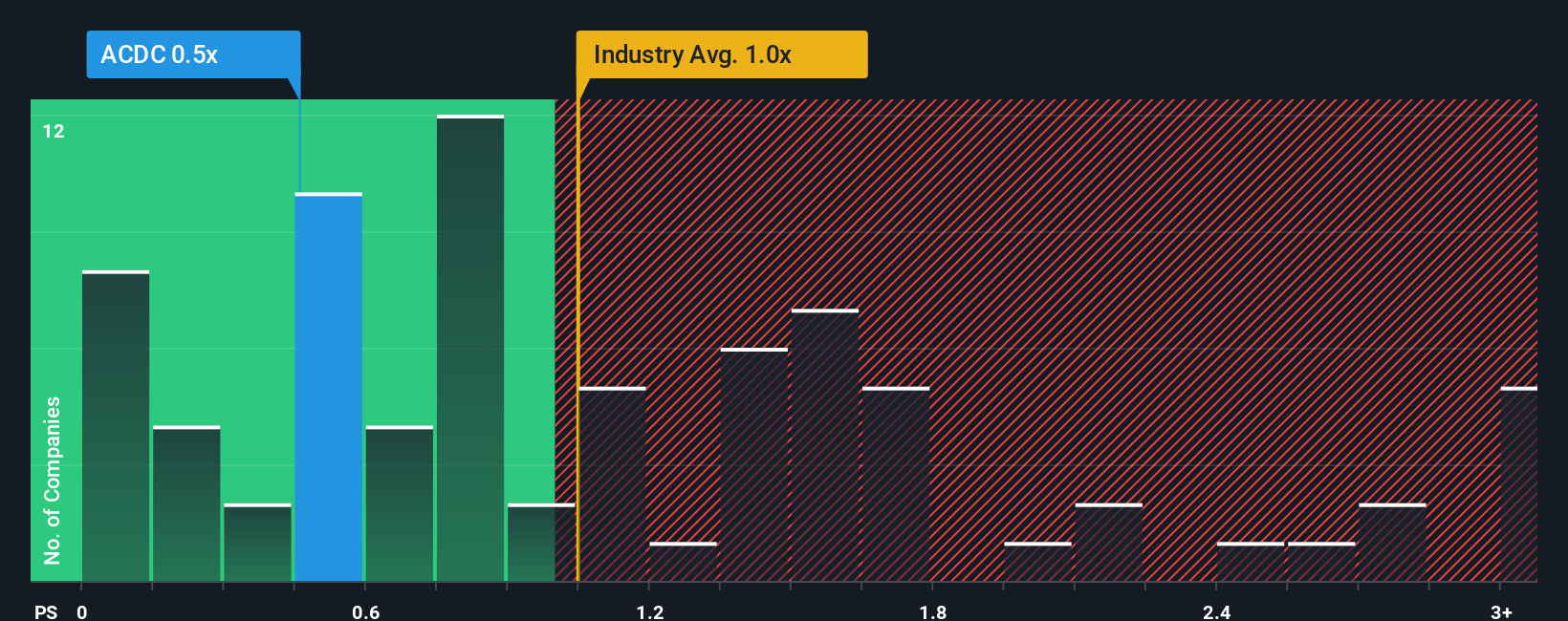

In spite of the firm bounce in price, it would still be understandable if you think ProFrac Holding is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in the United States' Energy Services industry have P/S ratios above 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How ProFrac Holding Has Been Performing

While the industry has experienced revenue growth lately, ProFrac Holding's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on ProFrac Holding will help you uncover what's on the horizon.How Is ProFrac Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as ProFrac Holding's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.1%. Still, the latest three year period has seen an excellent 55% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 4.4% per annum as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.0% each year, which paints a poor picture.

In light of this, it's understandable that ProFrac Holding's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On ProFrac Holding's P/S

ProFrac Holding's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that ProFrac Holding's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.