Please use a PC Browser to access Register-Tadawul

Public Storage (PSA): Assessing Valuation After Senior Notes Offering for Debt Reduction and Expansion Plans

Public Storage PSA | 274.45 | +0.91% |

Most Popular Narrative: 11.3% Undervalued

According to the most widely followed narrative, Public Storage is considered significantly undervalued at the current price, with analysts projecting higher long-term growth and a fair value target well above today's levels.

Urban densification and the continued shrinkage of residential living space in major metro markets are driving durable demand for self-storage. This benefits Public Storage's occupancy rates and supports long-term revenue growth, as evidenced by robust leasing activity and positive stabilization trends in high-density regions like the West Coast.

Ever wondered why analysts are bullish despite the recent pullback? The explanation comes from ambitious growth forecasts and a profit playbook that could set a new benchmark for the sector. Bold expansion, resilient margins, and powerful demand trends are all factored into one striking valuation. Curious which financial levers are setting this price tag?

Result: Fair Value of $322.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent oversupply in key markets or regulatory hurdles, such as potential rent controls, could challenge Public Storage’s projected growth and profitability trajectory.

Find out about the key risks to this Public Storage narrative.Another View: Market Multiples Tell a Different Story

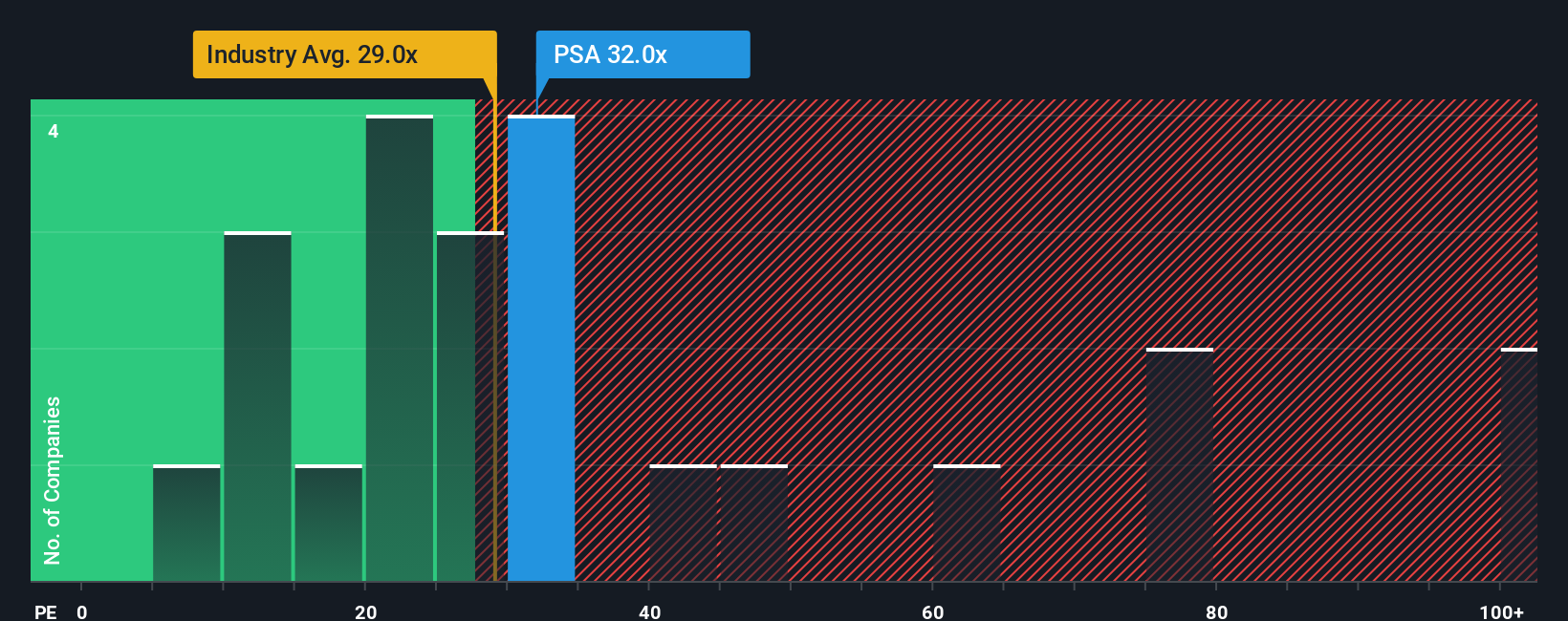

While the SWS DCF model finds Public Storage undervalued, looking at a market-based valuation approach raises questions. Compared to sector averages, the company appears expensive on its earnings ratio, which could challenge the optimistic growth scenario. Could market sentiment be missing something, or are expectations already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Public Storage Narrative

If these perspectives do not match your take or you want a hands-on approach, you can dig into the numbers and shape your own insights in minutes. Do it your way

A great starting point for your Public Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock the next big winner for your portfolio by checking out proven stock ideas waiting on Simply Wall St. Don’t let unique market moves, hidden value, or disruptive technology leaders pass you by.

- Uncover potentially undervalued companies positioned to deliver strong returns by tapping into undervalued stocks based on cash flows and see which stocks stand out on valuation.

- Boost your dividend income by starting with dividend stocks with yields > 3% to find stocks with yields above 3% and robust financial fundamentals.

- Get ahead of the AI revolution by scanning AI penny stocks for emerging players harnessing artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.