Please use a PC Browser to access Register-Tadawul

Pulmonx Corporation (NASDAQ:LUNG) Not Doing Enough For Some Investors As Its Shares Slump 29%

Pulmonx Corp. LUNG | 1.50 | +5.99% |

The Pulmonx Corporation (NASDAQ:LUNG) share price has fared very poorly over the last month, falling by a substantial 29%. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

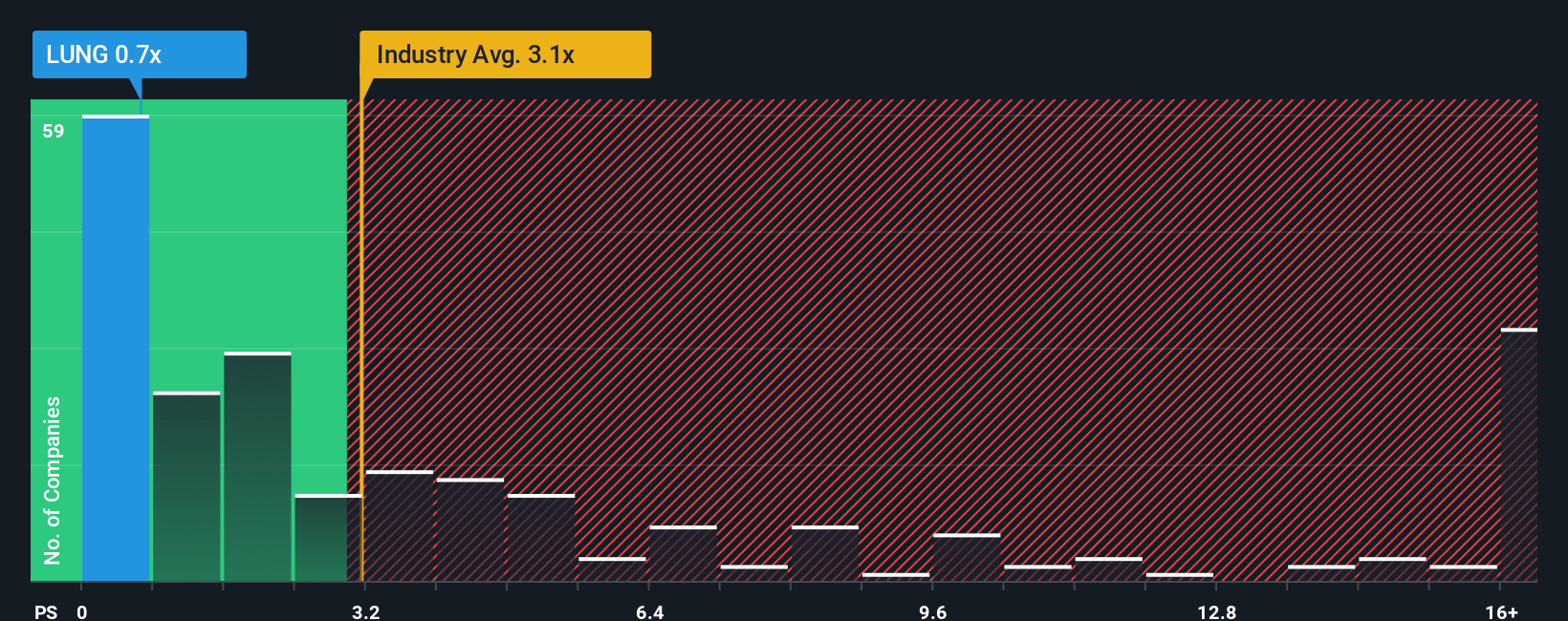

After such a large drop in price, Pulmonx may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Has Pulmonx Performed Recently?

With revenue growth that's superior to most other companies of late, Pulmonx has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Pulmonx's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Pulmonx?

The only time you'd be truly comfortable seeing a P/S as depressed as Pulmonx's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Pleasingly, revenue has also lifted 76% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 17% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 124% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why Pulmonx is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Pulmonx have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Pulmonx's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

If you're unsure about the strength of Pulmonx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.