Please use a PC Browser to access Register-Tadawul

Q2 Earnings Forecast Report for the 'Magnificent 7': NVIDIA, Tesla, Apple, META, Microsoft, Amazon, Alphabet; Target Price Unveiled

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

Alphabet Inc. Class A GOOGL | 309.29 | -1.01% |

Meta Platforms META | 644.23 | -1.30% |

Apple Inc. AAPL | 278.28 | +0.09% |

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Since the beginning of this year, the S&P 500 index has achieved an 18% increase, significantly driven by the market's immense enthusiasm for artificial intelligence. This excitement has led many large tech companies to reach critical milestones.

This surge has propelled Apple's market capitalization to a new historical record, making it the first company globally to surpass a $3.5 trillion valuation. Meanwhile, Nvidia's market cap successfully crossed the $3 trillion mark, adding approximately $2.1 trillion in just the past year. Additionally, this momentum has helped Amazon become the fifth company in the U.S. stock market to exceed a $2 trillion market cap.

| Stock Name | 2024 Performance | Q2 Earnings Date |

|---|---|---|

| Tesla Motors, Inc.(TSLA.US) | 1.67% | July 23 |

| Alphabet Inc. Class A(GOOGL.US) | 33.72% | July 23 |

| Meta Platforms(META.US) | 40.57% | July 31 |

| Apple Inc.(AAPL.US) | 22.06% | August 1 |

| NVIDIA Corporation(NVDA.US) | 159.42% | August 28 |

| Microsoft Corporation(MSFT.US) | 21.2% | To Be Announced |

| Amazon.com, Inc.(AMZN.US) | 26.84% | To Be Announced |

| Note: Data as of July 16 | ||

Analysts Highlights

In the coming weeks, the highly anticipated second-quarter earnings season will commence, featuring financial results from seven major tech giants: Tesla Motors, Inc.(TSLA.US), Alphabet Inc. Class A(GOOGL.US) (Google's parent company), Meta Platforms(META.US), Apple Inc.(AAPL.US), Amazon.com, Inc.(AMZN.US), Microsoft Corporation(MSFT.US), and NVIDIA Corporation(NVDA.US).

These companies' earnings reports will undoubtedly be the focal point of this quarter's earnings season. According to FactSet, the S&P 500's earnings are projected to grow by nearly 9% year-over-year in the second quarter, potentially marking the largest quarterly increase in two years.

Analysts from Barclays have highlighted the significant contribution of large tech companies to the S&P 500's performance in the first half of 2024, accounting for as much as 42% of the returns, while the rest of the S&P 500 stocks only returned 8%. The bank expects this trend to persist in the U.S. stock market.

They note that market expectations indicate large tech companies will continue to dominate earnings growth in the second quarter of 2024, with an expected earnings per share (EPS) increase of nearly 32%, compared to a projected growth rate of just 3.3% for the rest of the S&P 500.

Wedbush analyst Dan Ives shares a similar view regarding this earnings season. The second-quarter earnings will bring significant positive impact to the tech sector, with the potential for a 15% growth in tech stocks for the entire year of 2024, continuing the robust growth trajectory since the beginning of the year.

Ives emphasizes that the growth and earnings expectations for tech stocks will accelerate due to the "AI revolution." The global deployment of cloud services and corporate spending on artificial intelligence have exceeded Wall Street's expectations, which will positively impact the performance of large tech companies in this critical earnings season.

AI-Driven Growth Expectations for Major Tech Giants

| Company | Revenue Estimate (YoY) | EPS Estimate (YoY) | Average Target Price | Earnings Date |

|---|---|---|---|---|

| Tesla Motors, Inc.(TSLA.US) | $24.56B (-1%) | $0.49 (-37%) | $193.2 | 07/23 After Market |

| Alphabet Inc. Class A(GOOGL.US) | $71.63B (+15%) | $1.83 (+27%) | $200.5 | 07/23 After Market |

| Meta Platforms(META.US) | $38.28B (+20%) | $4.72 (+58%) | $533.6 | 07/31 After Market |

| Apple Inc.(AAPL.US) | $83.99B (+3%) | $1.33 (+6%) | $230.3 | 08/01 After Market |

| NVIDIA Corporation(NVDA.US) | $28.53B (+111%) | $0.59 (+140%) | $140.9 | 08/28 After Market |

| Amazon.com, Inc.(AMZN.US) | $148.7B (+11%) | $1.03 (+63%) | $222.5 | To Be Announced |

| Microsoft Corporation(MSFT.US) | $64.47B (+15%) | $2.94 (+9%) | $502.6 | To Be Announced |

| Note: Data as of July 16; financial data forecasts sourced from Bloomberg; target price forecasts sourced from market data; EPS forecast metrics are based on adjusted GAAP EPS. | ||||

What to Watch

Tesla Motors, Inc.(TSLA.US) will announce its Q2 FY2024 earnings post-market on July 23. According to Bloomberg analysts, Tesla's Q2 revenue is expected to decline by 1% year-over-year but increase by 15% quarter-over-quarter. Despite a decrease in vehicle deliveries leading to a drop in total revenue, adjusted earnings per share (EPS) may exceed expectations.

Key Points to Watch:

- Consecutive quarterly decline in vehicle deliveries, indicating ongoing demand challenges.

- New promotional policies and the launch of Robotaxi could potentially drive a rebound in performance.

- Increased gross margins from Full Self-Driving (FSD) and energy storage deployments may help exceed profit expectations.

View Tesla's Full Earnings Preview Report

Alphabet Inc. Class C(GOOG.US) / Alphabet Inc. Class A(GOOGL.US), Google’s parent company, will release its Q2 earnings post-market on July 23. Bloomberg analysts project a 15% year-over-year revenue growth to $71.6 billion, driven by strong ad spending and improved profit margins in Google Cloud.

Key Points to Watch:

- Overall ad revenue may benefit from enhanced user engagement with AI Overviews, Search Generative Experience, and YouTube.

- YouTube ads could see gains due to AI improvements in targeting and content recommendations.

- Although capital expenditures and other investments may pressure free cash flow, AI-driven revenue growth could mitigate this impact.

Meta Platforms(META.US) is set to report its Q2 FY2024 earnings post-market on July 31. Bloomberg analysts estimate a 58% year-over-year increase in EPS, although user growth and impressions may slow.

Key Points to Watch:

- Ad pricing and election ad spending are crucial factors.

- Regulatory challenges in Europe, particularly the Digital Markets Act, could affect sales growth.

- Meta’s advantage in general AI, leveraging the Llama model and subscription-based chatbots, could drive revenue growth.

Apple Inc.(AAPL.US) will announce its Q3 FY2024 earnings post-market on August 1. Bloomberg analysts forecast a 3% year-over-year increase in revenue and a 6% rise in EPS. The launch of Apple Intelligence is expected to bolster Apple's competitive position.

Key Points to Watch:

- "Apple Intelligence" could trigger a significant upgrade cycle for devices.

- New products launched in Q3, such as the M3 chip-driven MacBook Air, are likely to contribute to growth.

- App Store revenue is projected to grow by 13% year-over-year in Q3.

NVIDIA Corporation(NVDA.US) will release its Q2 FY2025 earnings post-market on August 28. Bloomberg analysts anticipate triple-digit growth in revenue and EPS, supported by robust demand in the data center market.

Key Points to Watch:

- Market expectations for future data center business revenue are driving PE ratio expansion.

- Transitioning products to the Blackwell series may slow H100 order rates.

- Significant inventory buildup among AI server manufacturers could raise concerns about inventory overhang.

Amazon.com, Inc.(AMZN.US) and Microsoft Corporation(MSFT.US) have yet to announce their earnings release dates. In the previous quarter, Amazon AWS revenue grew by 17% year-over-year, and Microsoft Azure saw a notable 31% growth, both exceeding market expectations due to strong AI enthusiasm from enterprise customers.

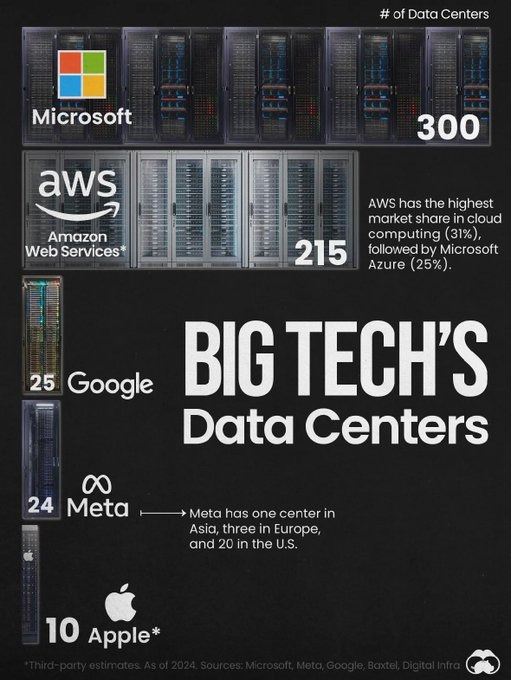

Currently, Microsoft and Amazon lead the AI arms race, each maintaining triple-digit large data centers globally to meet the growing business demands of their customers.

Relevant ETFs for "Magnificent 7"

As the earnings season approaches for the "Magnificent 7" of U.S. stocks, investors may consider various ETFs related to these giants. Below are some noteworthy ETFs, along with their year-to-date performance:

Investors should consider these ETFs based on their risk tolerance and market outlook for the upcoming earnings season. Leveraged and inverse ETFs carry higher risk and are typically suitable for short-term trading strategies rather than long-term investments.