Please use a PC Browser to access Register-Tadawul

Redwire (RDW): Revisiting Valuation After Q3 Miss, Lowered Outlook, and Sharp Share Price Drop

Redwire Corp RDW | 11.75 | -8.27% |

Redwire (NYSE:RDW) shares slid after the company’s third-quarter earnings announcement. Revenue missed expectations, losses widened, and operating margins worsened. The company also cut its full-year outlook because of delayed U.S. government contracts.

Redwire's share price took a sharp hit following its earnings release, dropping 16.7% over the past week and tumbling 33% in the last month. This marks a continuation of negative momentum for 2025, with a year-to-date share price return of -61.5%. The three-year total shareholder return is still sitting at an impressive 167%. The recent pullback reflects both near-term uncertainty from lowered guidance and a reassessment of growth risks by investors.

If Redwire’s volatility has you thinking about opportunity elsewhere, now’s a smart time to expand your search and discover See the full list for free.

With shares trading over 60% lower this year and the stock now sitting at a steep discount to analyst price targets, is Redwire an overlooked opportunity for contrarians, or is the market rightly cautious about its growth prospects?

Most Popular Narrative: 61.8% Undervalued

Redwire's fair value, according to the most widely followed narrative, comes in over 60% above its last close price of $6.56. This sharp gap highlights a striking disconnect between current market sentiment and the narrative's optimistic view, setting the stage for eye-opening financial projections.

Redwire is positioned to benefit from accelerated global investment in space exploration and defense, evidenced by new commitments from NATO allies, significant funding initiatives in the U.S., and increasing space budgets in allied countries. These trends are likely to drive robust top-line revenue growth and future contract backlogs.

Want to uncover what’s fueling such a high fair value? The narrative leans on ambitious growth assumptions, bold margin recovery, and a future profit multiple rarely seen in this sector. Intrigued by how these dramatic projections stack up against current results? Discover which forecasts underpin this striking valuation.

Result: Fair Value of $17.17 (UNDERVALUED)

However, persistent delays in government contract awards and volatility in large, complex projects could quickly undermine even the most optimistic scenario for Redwire's rebound.

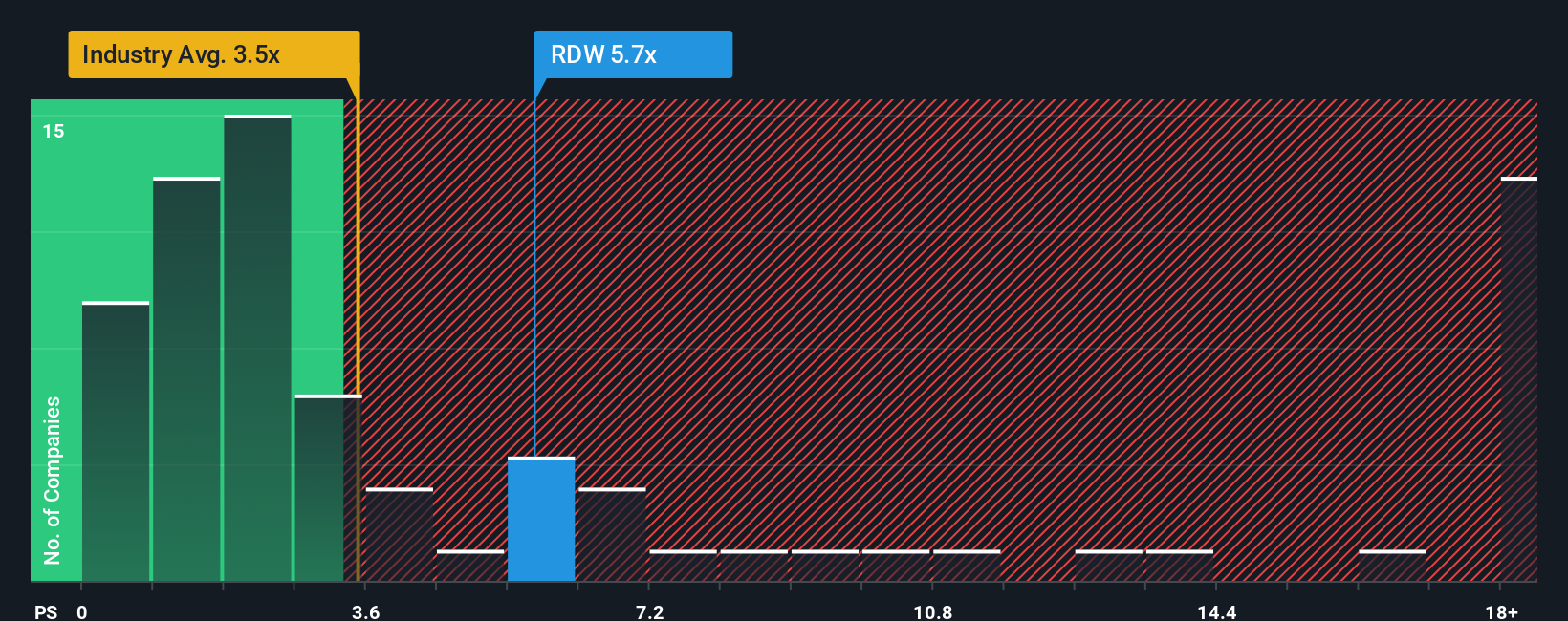

Another View: Multiples Tell a Cautionary Story

Taking a look at Redwire's valuation through its revenue multiple paints a more cautious picture. The company's price-to-sales ratio stands at 3.7x, pricier than both the US Aerospace & Defense industry average of 3x and the peer group average of 1.7x. Even compared to the fair ratio of 2.2x, Redwire appears expensive. This suggests the market is already pricing in a lot of future success, which could add risk for investors if those high expectations are not met. Could this premium signal opportunity, or is it a red flag?

Build Your Own Redwire Narrative

If you have your own perspective or want to chart a different path, it takes just a few minutes to dig into the data and craft your own view. Do it your way

A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just watch from the sidelines while others spot the market’s hidden gems. Expand your investing toolkit with these high-potential ideas you can act on now:

- Tap into untapped value by spotting these 876 undervalued stocks based on cash flows offering strong cash flow potential yet trading below their true worth.

- Seize the future of medicine by checking out these 32 healthcare AI stocks, where innovative healthcare meets AI-powered breakthroughs.

- Maximize your income stream by selecting these 16 dividend stocks with yields > 3% with yields above 3%, built for consistent, reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.