Please use a PC Browser to access Register-Tadawul

Revenues Not Telling The Story For Ambarella, Inc. (NASDAQ:AMBA) After Shares Rise 32%

Ambarella, Inc. AMBA | 75.28 75.28 | -4.88% 0.00% Pre |

Ambarella, Inc. (NASDAQ:AMBA) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 28%.

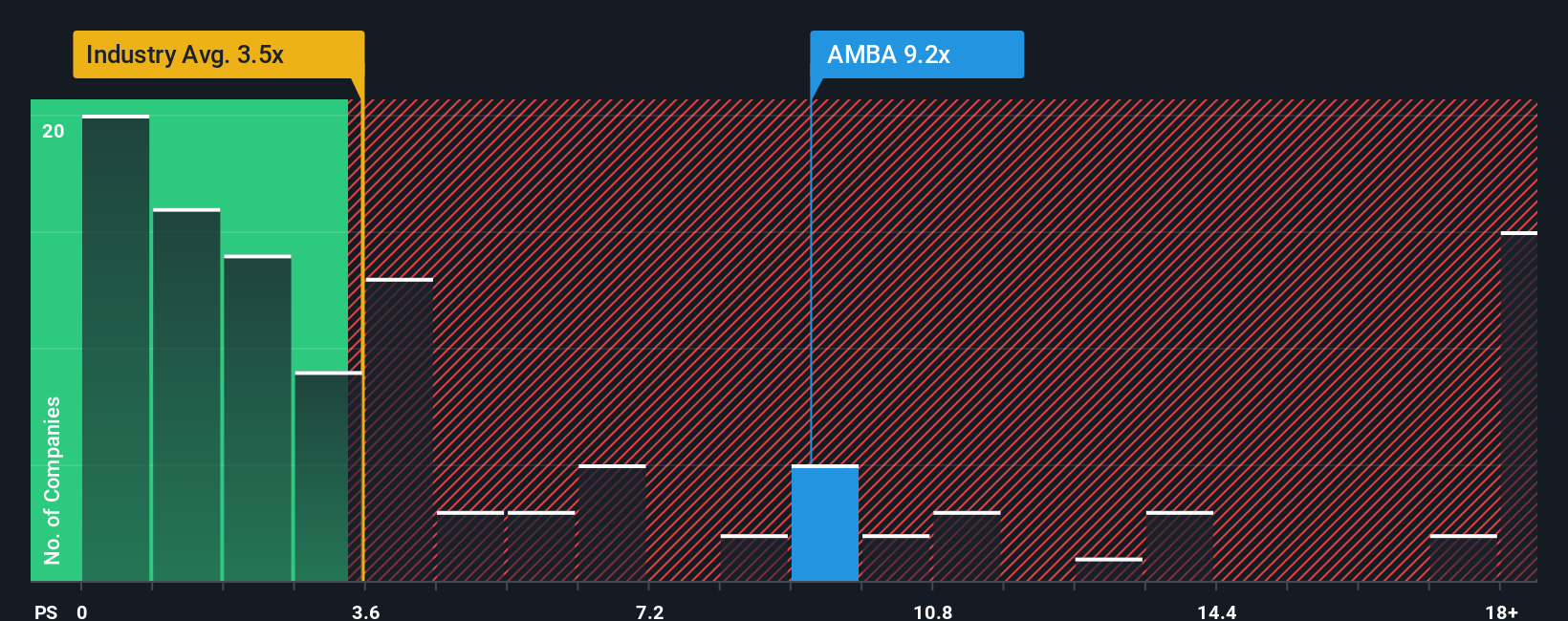

After such a large jump in price, you could be forgiven for thinking Ambarella is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.2x, considering almost half the companies in the United States' Semiconductor industry have P/S ratios below 3.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Ambarella's Recent Performance Look Like?

Recent times haven't been great for Ambarella as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ambarella will help you uncover what's on the horizon.How Is Ambarella's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Ambarella's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 14% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the analysts watching the company. That's shaping up to be materially lower than the 21% each year growth forecast for the broader industry.

In light of this, it's alarming that Ambarella's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Shares in Ambarella have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ambarella, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.