Please use a PC Browser to access Register-Tadawul

Revisiting Select Medical (SEM) Valuation After Its Recent Short-Term Share Price Rebound

Select Medical Holdings Corporation SEM | 15.01 | -6.65% |

Select Medical Holdings (SEM) has quietly outperformed the broader market over the past 3 months, with the stock up around 15% and roughly 12% over the past month, despite weaker year to date returns.

That recent 30 day share price return of nearly 12% looks more like a rebound than a blip. This is especially true when set against a year to date share price decline of around 21% and a one year total shareholder return of roughly minus 24%. This suggests sentiment is improving off a low base, while longer term three year total shareholder returns near 20% show the story has not been all bad for patient holders.

If Select Medical’s move has you rethinking where healthcare fits in your portfolio, it could be a good moment to explore other opportunities across healthcare stocks for fresh ideas.

With earnings growing faster than revenue, a value score suggesting only middling appeal, and the share price still below analyst targets, is Select Medical a contrarian buy today, or is the market already pricing in its recovery?

Most Popular Narrative: 16.4% Undervalued

With Select Medical shares last closing at $14.91 versus a narrative fair value near $18.33, the current price sits well below projected fundamentals.

Policy and payer shifts toward value based and cost effective care settings favor Select Medical's post-acute and rehab offerings, potentially boosting occupancy rates and reducing earnings volatility as payers and hospitals increasingly steer patients to these lower-cost, high-quality care environments.

Curious how modest revenue growth, rising margins, and a leaner share count can still justify a richer future earnings multiple than today? The full narrative explains the cash flow math, the discount rate, and the earnings bridge that turn today’s price gap into that upside target.

Result: Fair Value of $18.33 (UNDERVALUED)

However, persistent Medicare reimbursement pressure and the company’s sizable debt load could constrain margins and free cash flow, which may challenge the upside narrative.

Another Lens on Valuation

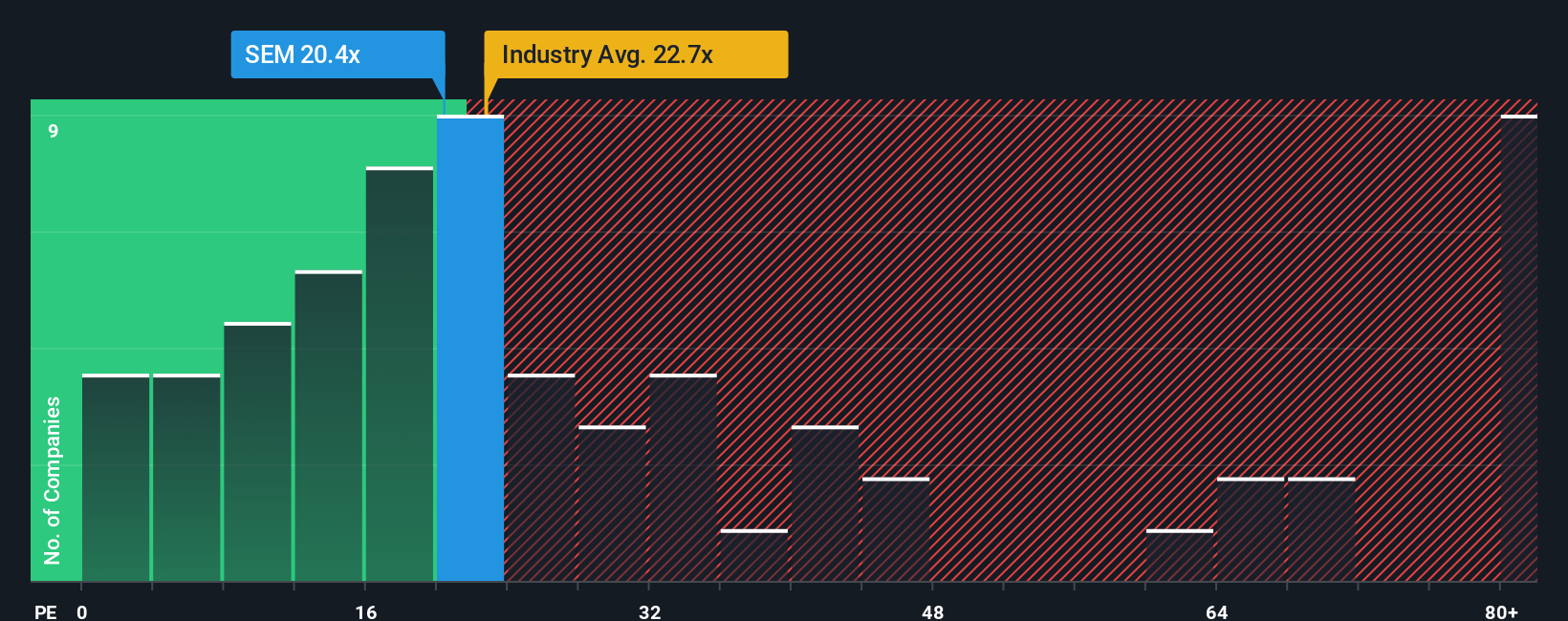

On earnings based metrics, Select Medical looks less obviously cheap. Its P E ratio of 19.6 times sits below the wider US Healthcare sector at 22.2 times, but well above its peer group average of 13.6 times and a fair ratio nearer 28.5 times. This leaves a mixed picture on risk and opportunity.

Build Your Own Select Medical Holdings Narrative

If you see the numbers differently, or simply want to dig into the assumptions yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

If you stop at Select Medical, you could miss companies with stronger tailwinds, clearer growth runways, and better risk rewards already flagged by the Simply Wall St screener.

- Capture potential multi-baggers early by tracking these 3595 penny stocks with strong financials that already show resilient balance sheets and encouraging fundamentals, before the crowd catches on.

- Position your portfolio at the heart of the next productivity wave by targeting these 27 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Lock in quality at a discount by focusing on these 904 undervalued stocks based on cash flows where strong cash flows support compelling long term return potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.