Please use a PC Browser to access Register-Tadawul

Risks Still Elevated At These Prices As Alkami Technology, Inc. (NASDAQ:ALKT) Shares Dive 27%

Alkami Technology Inc ALKT | 17.03 | +2.16% |

Alkami Technology, Inc. (NASDAQ:ALKT) shares have had a horrible month, losing 27% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

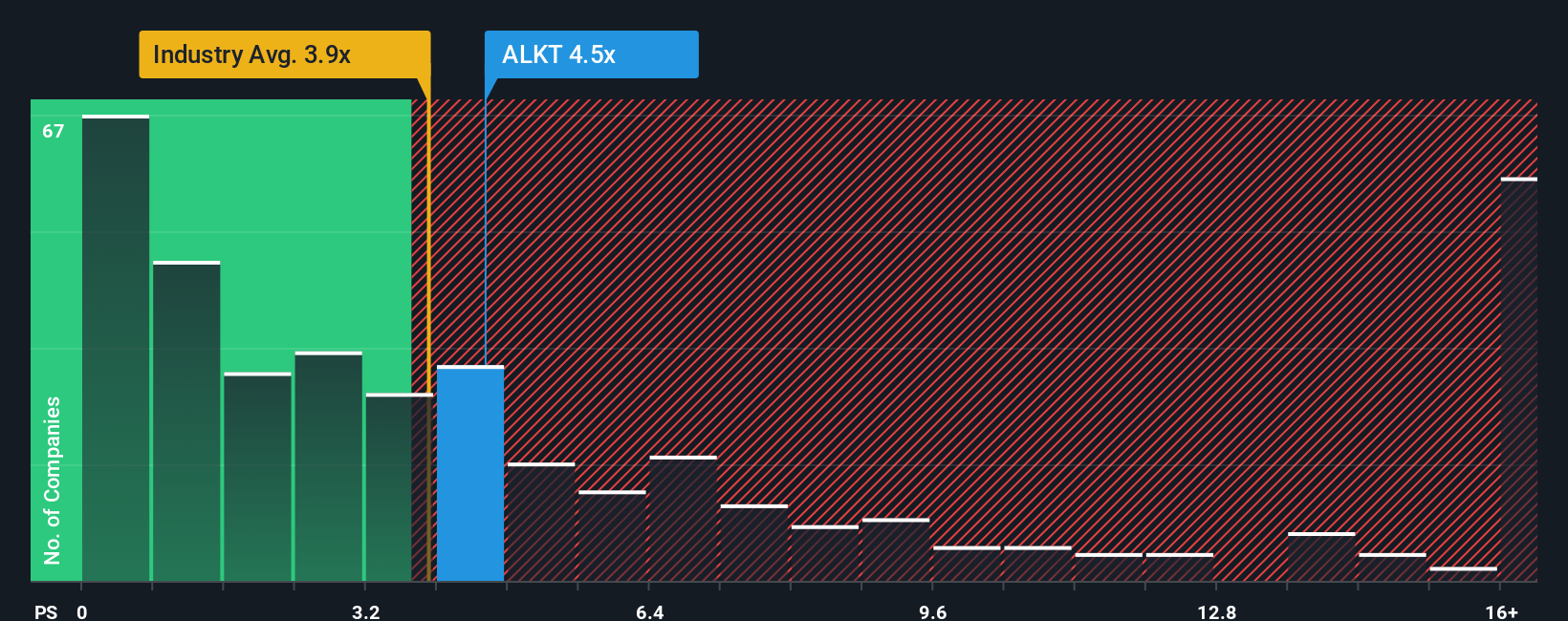

Even after such a large drop in price, there still wouldn't be many who think Alkami Technology's price-to-sales (or "P/S") ratio of 4.3x is worth a mention when the median P/S in the United States' Software industry is similar at about 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Alkami Technology Has Been Performing

Alkami Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Alkami Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Alkami Technology's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The strong recent performance means it was also able to grow revenue by 116% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 32%, which is noticeably more attractive.

In light of this, it's curious that Alkami Technology's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Alkami Technology's P/S?

Alkami Technology's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Alkami Technology's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.