Please use a PC Browser to access Register-Tadawul

Rivian Automotive (RIVN) Earnings Highlight Persistent US$811 Million Q4 Loss Challenging Bullish Narratives

Rivian Automotive, Inc. Class A RIVN | 15.27 | -2.05% |

Rivian Automotive (RIVN) just closed out FY 2025 with fourth quarter revenue of US$1.3 billion, a basic EPS loss of US$0.66, and net income loss of US$811 million, setting the tone for how investors will read the full year. Over the past six quarters, revenue has moved between US$874 million in Q3 2024 and US$1.7 billion in Q4 2024, while quarterly basic EPS has ranged from a loss of US$0.48 in Q1 2025 to a loss of US$1.08 in Q3 2024. This highlights a business that is scaling the top line while still working through heavy losses, so the market is likely to focus on how quickly margins can tighten from here.

See our full analysis for Rivian Automotive.With the headline numbers on the table, the next step is to see how this latest print lines up against the big stories already priced into Rivian, from growth expectations to concerns about ongoing losses.

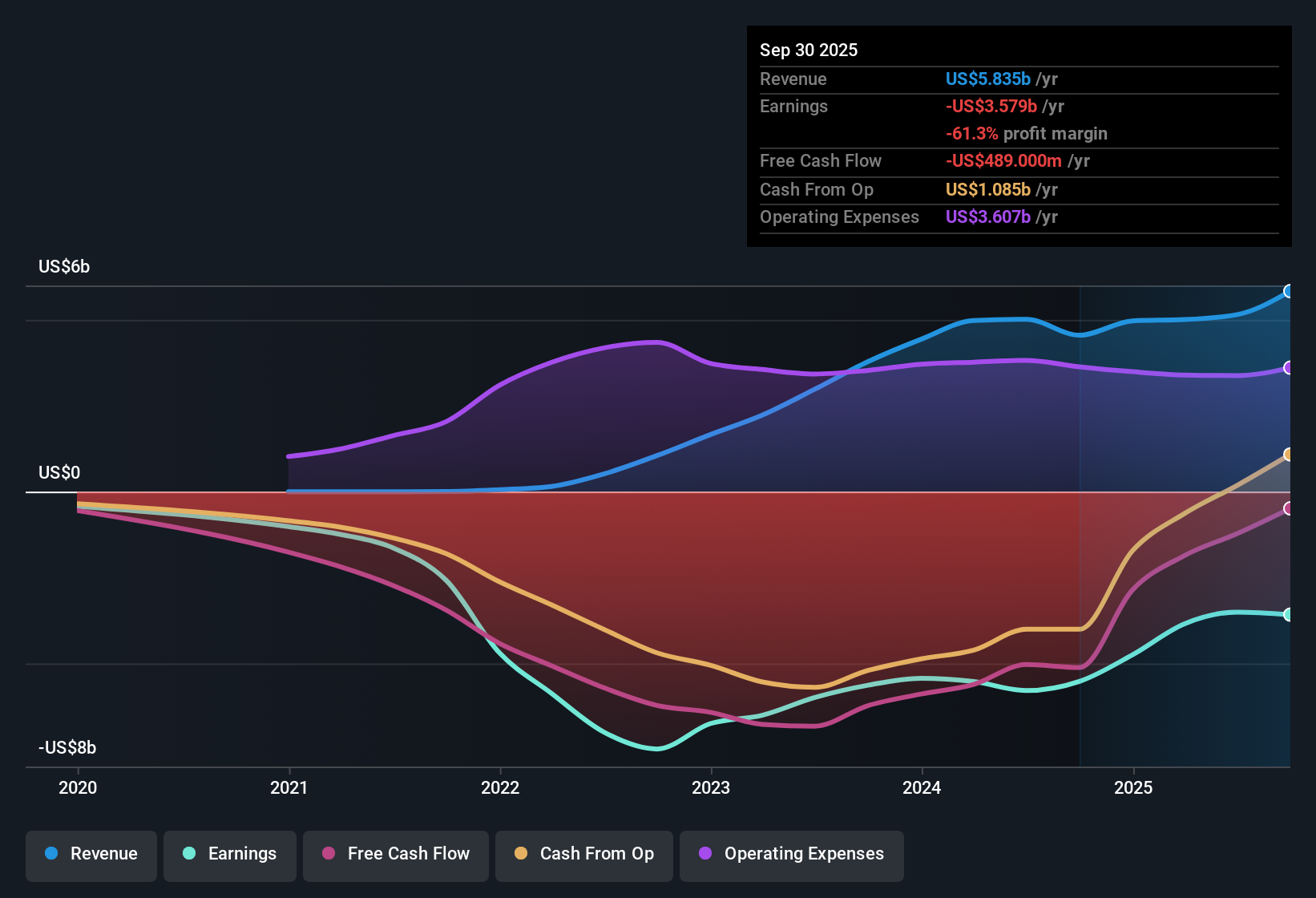

TTM losses of US$3.6b keep profitability distant

- On a trailing twelve month basis to Q4 2025, Rivian generated US$5.4b in revenue and recorded a net loss of US$3.6b, with basic EPS over that period at a loss of US$3.07 per share.

- Bears argue that ongoing heavy spending and widening losses make future funding a key concern, and the current figures give them plenty to point to.

- The TTM loss of US$3.6b compares with US$4.7b a year earlier, while quarterly net losses in FY 2025 stayed between US$545 million and US$1.2b, which still reflects a business far from break even.

- With no profitability forecast in the next three years in the data provided and analysts expecting share count to grow by 7% a year, critics highlight the risk that plugging these losses could mean further dilution or higher financial pressure if external capital is needed.

Revenue growth story vs 31.8% forecast

- Across the last six quarters, revenue ranged from US$874 million in Q3 2024 to US$1.7b in Q4 2024, feeding into TTM revenue of US$5.4b to Q4 2025, while forecasts in the risk and reward data point to about 31.8% annual revenue growth ahead.

- Bullish investors lean on these growth expectations and Rivian’s product roadmap, and the recent revenue scale gives them some support but also some tension to think about.

- The R2 platform and software stack are expected by bullish analysts to support revenue growth of 44.9% to 56.7% a year, yet the forecast quoted in the broader data set is lower at 31.8% a year. This suggests more moderate growth is also being considered.

- Consensus commentary that future revenue could reach around US$15.7b by 2028 sits against a starting point of US$5.4b TTM today. The path from current scale to those figures depends heavily on how quickly new models and software revenues contribute.

P/S of 4.1x and DCF fair value tension

- Rivian trades on a P/S of 4.1x compared with peers at 1.7x and the US auto industry at 0.6x, while the DCF fair value provided is US$42.55 against a current share price of US$17.73, implying the shares trade about 58.3% below that DCF fair value estimate.

- Bulls see that valuation gap as an opportunity, but the numbers also highlight how much needs to go right for the optimistic case to play out.

- The DCF fair value of US$42.55 is more than double the current price, yet the stock already trades at a higher P/S than peers. Investors are therefore being asked to pay a premium on sales today while also believing that long term margins and growth will eventually justify that higher DCF value.

- Analyst work behind the bullish narrative assumes that by around 2028 Rivian could generate hundreds of millions of earnings. With TTM net losses at US$3.6b and no profitability projected in the next three years in the inputs, there is a clear gap between current economics and the earnings power implied by that DCF.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rivian Automotive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the data and shape a clear story around it, then Do it your way.

A great starting point for your Rivian Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Rivian is still posting TTM net losses of US$3.6b, with no profitability projected in the next three years and concerns about future funding needs and dilution.

If those heavy losses and dilution risks make you hesitant, consider companies with stronger financial cushions. You can start by checking out solid balance sheet and fundamentals stocks screener (44 results), which features businesses that are better positioned to weather difficult periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.