Please use a PC Browser to access Register-Tadawul

Rivian Automotive (RIVN) Valuation Check As R2 SUV And Software Expansion Attract New Attention

Rivian Automotive, Inc. Class A RIVN | 15.27 | -2.05% |

Rivian Automotive (RIVN) has attracted fresh attention as it prepares the R2 mass market SUV, a lower priced model aimed at reigniting deliveries while the company ramps plants, software and subscription based autonomous driving services.

At a share price of US$16.47, Rivian’s 30 day share price return of a 24.28% decline contrasts with a 25.82% gain over 90 days and a 29.79% total shareholder return over one year. This suggests momentum has recently cooled even as interest around the R2 launch, software subscriptions and new leadership appointments builds.

If Rivian’s story has you looking across the EV space, it could be a good moment to scan other auto manufacturers via auto manufacturers for fresh ideas.

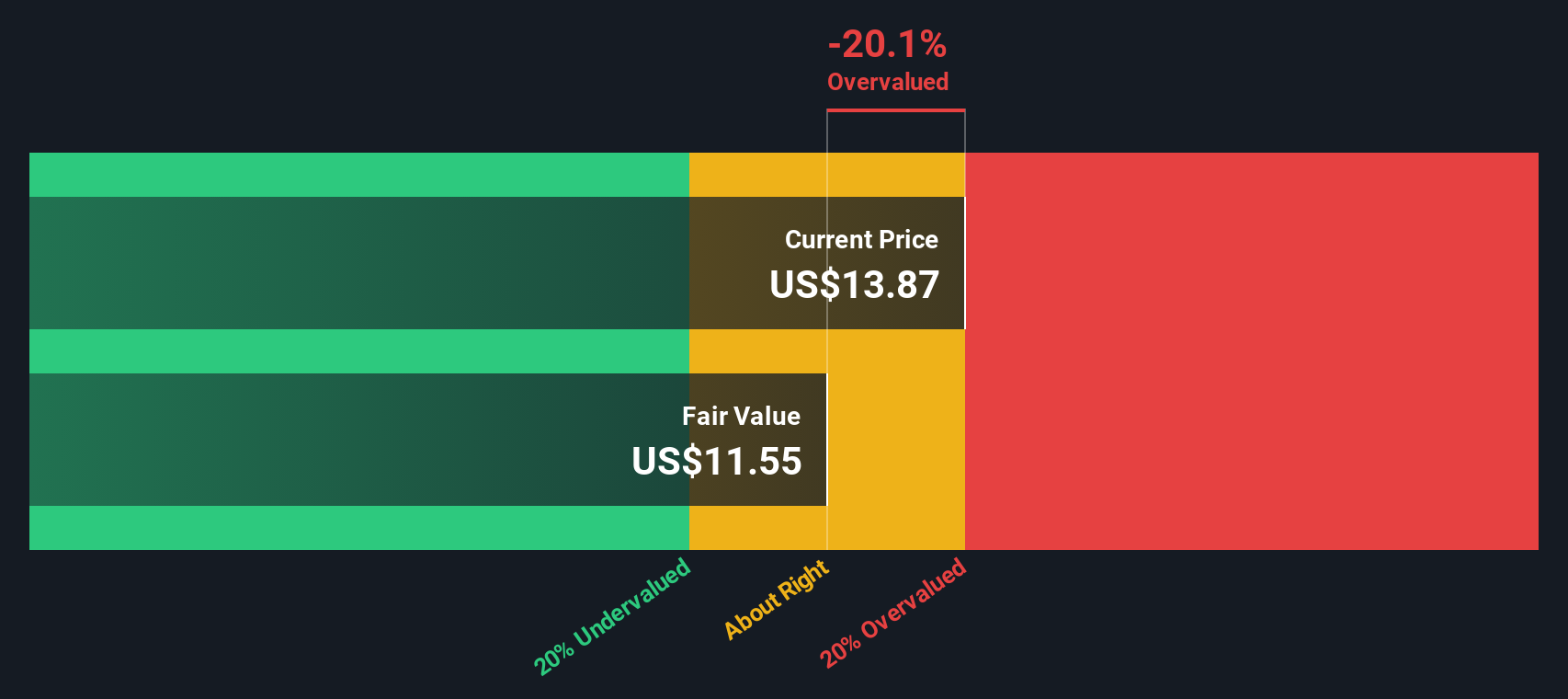

With Rivian trading close to its US$16.96 analyst target and an intrinsic valuation implying a sizeable discount, the key question is simple: are you looking at an underappreciated EV player or a stock where future growth is already baked in?

Price-to-Sales of 3.5x: Is It Justified?

Rivian shares last closed at US$16.47, and at that price the stock trades on a P/S ratio of 3.5x, which is high relative to peers described in the data.

The P/S ratio compares a company’s market value to its revenue, so for a business like Rivian that is still loss making, this metric gives you a sense of how much investors are paying for each dollar of sales rather than profits.

Here, the Statements Data flags that Rivian looks expensive on this yardstick, with its 3.5x P/S ratio above the US Auto industry average of 0.7x and also above the peer average of 1.8x. The fair P/S ratio estimate of 1.1x suggests a level the market could potentially move toward if expectations change.

Put simply, the current 3.5x multiple is 5 times the wider US Auto industry and more than triple the fair P/S ratio estimate, so the market is assigning Rivian a much richer revenue multiple than both sector peers and the regression based fair value signal.

Result: Price-to-Sales of 3.5x (OVERVALUED)

However, the story can break if Rivian’s losses of US$3,579.0m persist longer than investors expect, or if R2 and software subscriptions gain traction more slowly than hoped.

Another View: DCF Points in the Opposite Direction

The SWS DCF model paints a very different picture. At US$16.47, Rivian is trading 61% below an estimated future cash flow value of US$42.25, which screens as undervalued even though the company is forecast to remain unprofitable for at least three years. So is the market too cautious? Or is the model too optimistic about those future cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rivian Automotive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rivian Automotive Narrative

If this view does not quite match your own thinking, or you prefer to stress test the numbers yourself, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Rivian Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Rivian has sharpened your focus, do not stop here. Use targeted stock ideas from our screeners to spot opportunities you might otherwise miss.

- Tap into potential mispricing by scanning these 881 undervalued stocks based on cash flows that currently trade below their estimated cash flow value.

- Ride long term technology shifts by checking out these 23 AI penny stocks that link artificial intelligence themes with listed companies.

- Target high regular income by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.