Please use a PC Browser to access Register-Tadawul

Roku, Inc.'s (NASDAQ:ROKU) Popularity With Investors Under Threat As Stock Sinks 32%

Roku, Inc ROKU | 107.47 | +1.10% |

Roku, Inc. (NASDAQ:ROKU) shares have had a horrible month, losing 32% after a relatively good period beforehand. Indeed, the recent drop has reduced its annual gain to a relatively sedate 5.9% over the last twelve months.

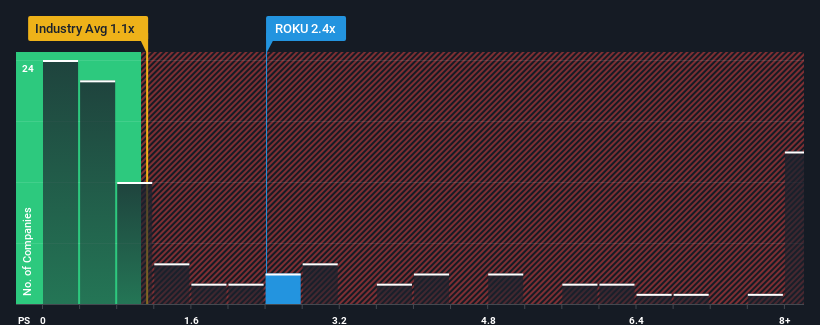

Although its price has dipped substantially, given close to half the companies operating in the United States' Entertainment industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Roku as a stock to potentially avoid with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Roku's P/S Mean For Shareholders?

Recent times haven't been great for Roku as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Roku.Is There Enough Revenue Growth Forecasted For Roku?

Roku's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 49% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 12% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's curious that Roku's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Roku's P/S Mean For Investors?

Roku's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Roku's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Roku with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.