Please use a PC Browser to access Register-Tadawul

Roku (ROKU) Valuation in Focus After Return to Profitability and Raised Outlook

Roku, Inc. Class A ROKU | 90.06 | +8.60% |

Roku (ROKU) delivered a significant earnings report, posting its first profitable quarter since 2021 thanks to robust platform revenue growth, increased ad sales, and a stronger operating margin. Management also raised its full-year outlook, fueling a wave of market enthusiasm.

After its quarterly profit surprise and raised outlook, Roku’s share price jumped nearly 10% in a week and now sits at $108.63, reflecting solid positive momentum. Over the past year, shareholders have enjoyed a 61.7% total return. However, long-term holders are still under water given the 51% loss over five years. With upbeat guidance and buybacks in play, the market appears bullish on Roku’s growth story for now.

If Roku’s rebound has you searching for more, you might enjoy discovering fast growing stocks with high insider ownership.

With strong results, rising guidance, and a multi-year high for shares, should investors see Roku’s latest rally as the start of a long-term comeback, or has the market already factored in all of the good news?

Most Popular Narrative: 3% Overvalued

Roku’s most followed consensus suggests the stock may be pricing in a bit more optimism than the numbers warrant, given a fair value of $105.32 compared to Friday’s $108.63 close. This invites debate over whether recent revenue acceleration and new initiatives can truly support premium pricing in an increasingly crowded streaming market.

*Ongoing investments in proprietary content (such as The Roku Channel), self-service ad solutions, and performance marketing are boosting user engagement and attracting new cohorts of advertisers (especially SMBs). This is adding incremental high-margin advertising revenue and broadening usage, which support margin and earnings growth.*

Want to know which optimistic assumptions are fueling this lofty narrative? The story centers on bold profit growth forecasts and ambitious future margins. What future numbers support these valuations? Click to see the projections that shape this consensus fair value.

Result: Fair Value of $105.32 (OVERVALUED)

However, intensifying competition in connected TV and the possibility of slower platform growth could challenge expectations and disrupt Roku’s bullish momentum.

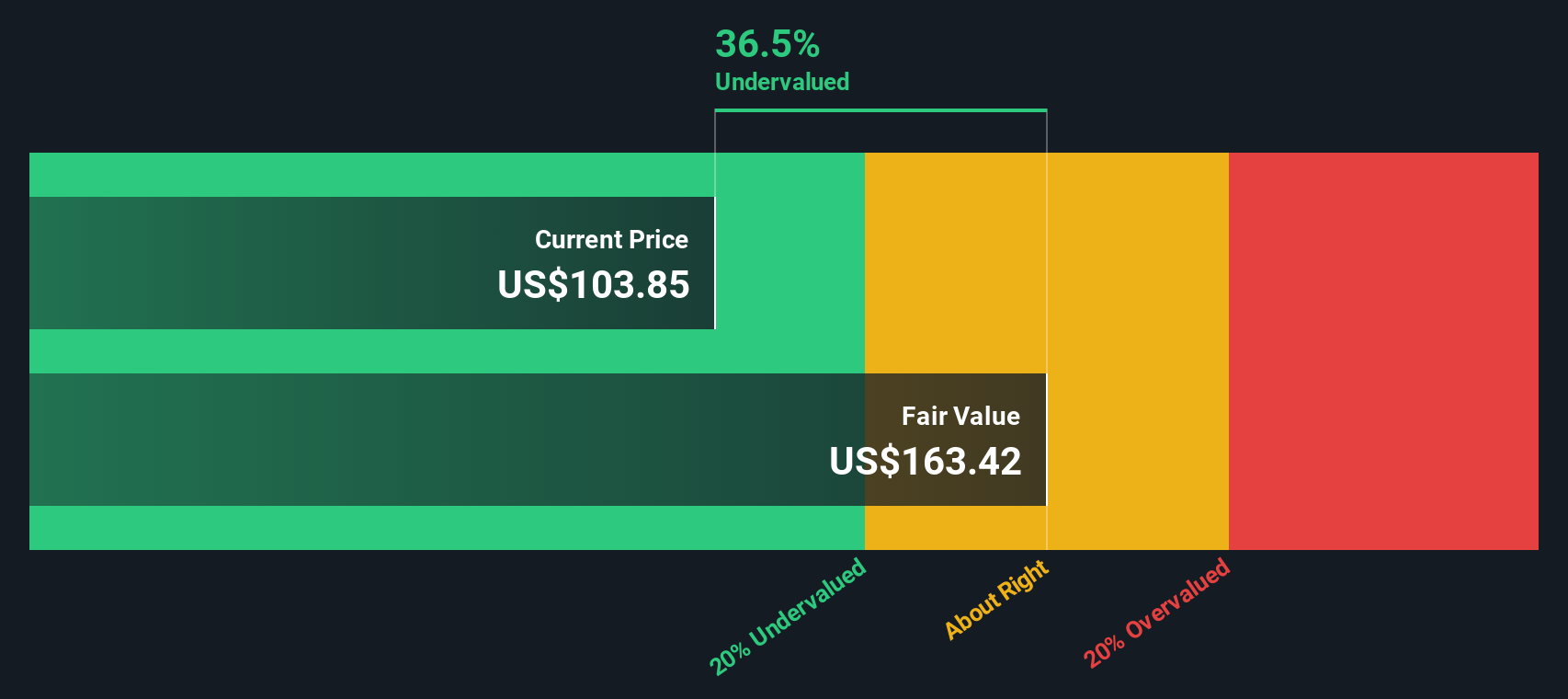

Another View: DCF Model Shows Upside

A different lens comes from our DCF model, which puts Roku’s fair value at $157.05. This is about 44% higher than the current price. This suggests analysts’ consensus may be underestimating Roku’s long-term cash flow potential. Could the real opportunity be hiding in the company’s free cash flow growth story?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Roku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Roku Narrative

If you have a different perspective or want to put the story together your own way, you can quickly craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Roku.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock. Expand your opportunities and position yourself for what’s next with these powerful ideas built on our data-driven approach:

- Tap into early-stage potential by checking out these 3598 penny stocks with strong financials with robust financials and promising growth trajectories.

- Boost your portfolio with income streams by exploring these 18 dividend stocks with yields > 3% offering yields above 3% for steady returns.

- Seize the momentum in health-tech innovation. See these 33 healthcare AI stocks leading the charge in AI-powered breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.