Please use a PC Browser to access Register-Tadawul

Royal Gold (RGLD) Valuation Check As Debt Falls And Royalty Portfolio Is Reworked

Royal Gold, Inc. RGLD | 285.54 | +5.06% |

Royal Gold (RGLD) has drawn fresh attention after reporting approximately 64,000 gold equivalent ounces of stream segment sales for Q4 2025, along with a $400 million reduction in borrowings following the Sandstorm transaction.

These updates on stream sales, debt reduction and reshaped royalty exposure appear to sit alongside strong price momentum, with a 30 day share price return of 17.68% and a 1 year total shareholder return of 87.62%. This suggests investors are pricing in both growth potential and changing views on risk.

If this kind of precious metals royalty story has your attention, it may be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Royal Gold trading close to analyst estimates and only a modest intrinsic discount flagged, are you looking at a fair price for quality, or is the market already pricing in most of the future growth story?

Most Popular Narrative: 1% Undervalued

With Royal Gold last closing at US$254.19 against a narrative fair value of about US$256.64, the story here leans toward a modest valuation gap built on detailed earnings and cash flow work.

Several bullish analysts are raising price targets into the US$240 to US$257 range, reflecting updated models that incorporate the Sandstorm Gold and Horizon Copper acquisitions and revised commodity assumptions.

To see what is driving that modest upside, the narrative focuses on brisk revenue growth, firm margins and a future earnings multiple that edges above earlier expectations. Curious which assumptions really carry the weight in that fair value calculation?

Result: Fair Value of $256.64 (UNDERVALUED)

However, that story depends on gold staying supportive and key mines delivering. At the same time, higher leverage from the Sandstorm and Horizon Copper deals could squeeze flexibility if integration disappoints.

Another View: Rich Multiples Signal a Higher Bar

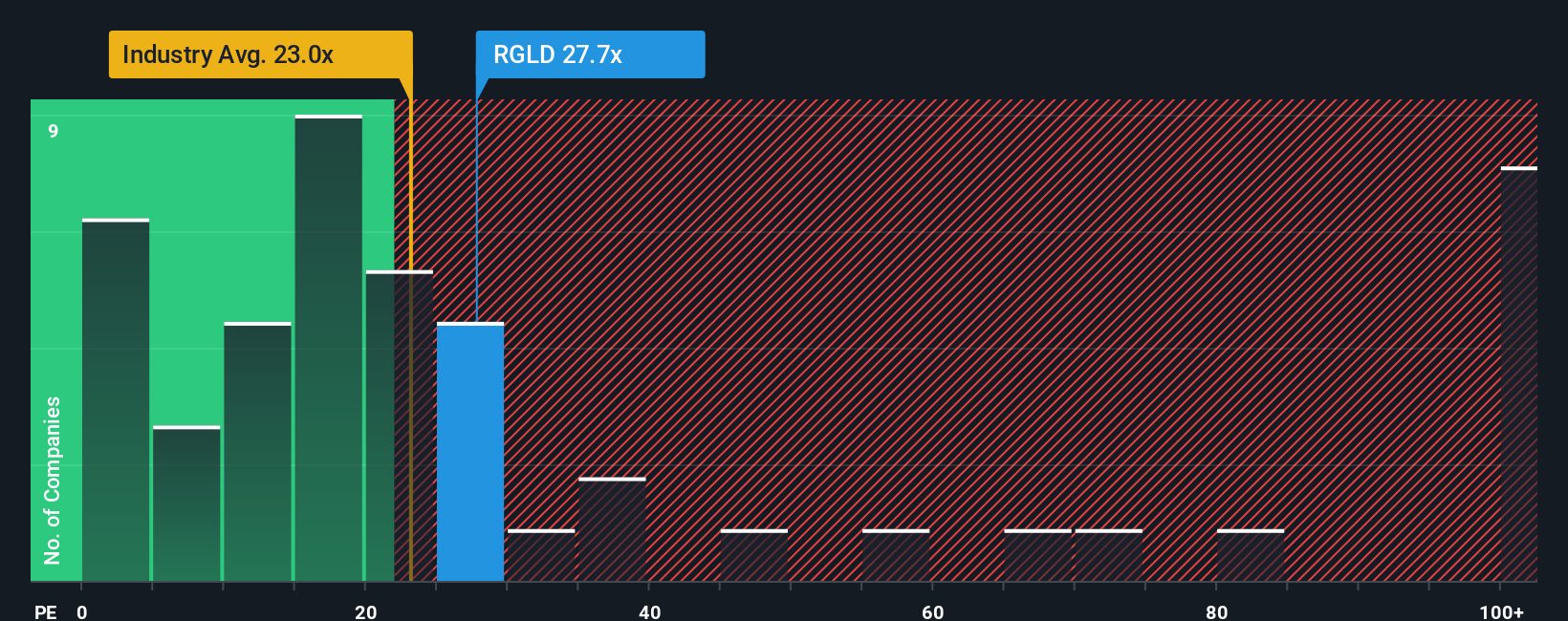

If you step away from fair value models and just look at the price tag, Royal Gold trades on a P/E of 44.7x. That is well above the US Metals and Mining industry at 27.8x, its peer average of 25.9x, and even a fair ratio estimate of 26.2x.

In plain terms, the current price already bakes in strong expectations, so any slip in growth, commodity assumptions or deal outcomes could affect sentiment quickly. Are you comfortable paying this much more than the sector and peers for the profile on offer today?

Build Your Own Royal Gold Narrative

If you see the numbers differently or simply want to test your own assumptions, you can build a personalised Royal Gold story in minutes, starting with Do it your way.

A great starting point for your Royal Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Royal Gold has sharpened your interest, do not stop here. The next step is widening your watchlist with ideas that match your preferred style of opportunity.

- Spot potential value setups by reviewing these 884 undervalued stocks based on cash flows that focus on prices sitting below assessed cash flow strength.

- Tap into the AI trend by checking out these 25 AI penny stocks where companies are building businesses around artificial intelligence themes.

- Strengthen your income watchlist by scanning these 12 dividend stocks with yields > 3% that feature yields above 3% for investors focused on regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.