Please use a PC Browser to access Register-Tadawul

Rubrik (RBRK) Valuation Check As Analysts Trim Targets But Keep The Stock A Top Pick

Rubrik, Inc. Class A RBRK | 50.20 | -7.31% |

Rubrik (RBRK) is back in focus after analysts recalibrated their expectations, trimming price targets while still highlighting the company’s revenue growth, data security focus, and leadership in AI driven cyber resilience.

That enthusiasm has not shown up in recent share price moves, with a 1 day share price return of a 3.31% decline adding to a 30 day share price return of a 17.01% decline and a year to date share price return of a 14.03% decline. The 1 year total shareholder return sits at a 9.08% decline, suggesting momentum has cooled even as Rubrik rolls out offerings like Security Cloud Sovereign and features in high profile industry discussions.

If Rubrik’s recent swings have you thinking about where else growth and cyber themes might show up, it could be a good time to look at high growth tech and AI stocks.

With Rubrik trading at US$64.88 against analyst targets that remain higher on average, yet carrying a recent 1 year total return decline and ongoing losses, you have to ask: is there mispricing here, or is the market already baking in future growth?

Most Popular Narrative: 42% Undervalued

At a last close of US$64.88 versus a narrative fair value of about US$111.95, Rubrik is framed as materially undervalued, with that gap resting on ambitious assumptions for growth, margins and future earnings multiples.

The company's pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM), potentially driving future revenue growth and enhancing their market position in this expanding field.

Curious what kind of revenue ramp, margin shift and future P/E multiple are needed to support that valuation gap? The narrative sets a demanding earnings path, a richer profit profile and a premium multiple usually reserved for established software leaders. Want to see how those moving parts fit together, and which single assumption carries the most weight in the model?

Result: Fair Value of $111.95 (UNDERVALUED)

However, that upbeat story can crack if fierce cyber resilience competition, or slower uptake of newer AI and cloud offerings, holds back the revenue and margin assumptions behind it.

Another Angle On Valuation

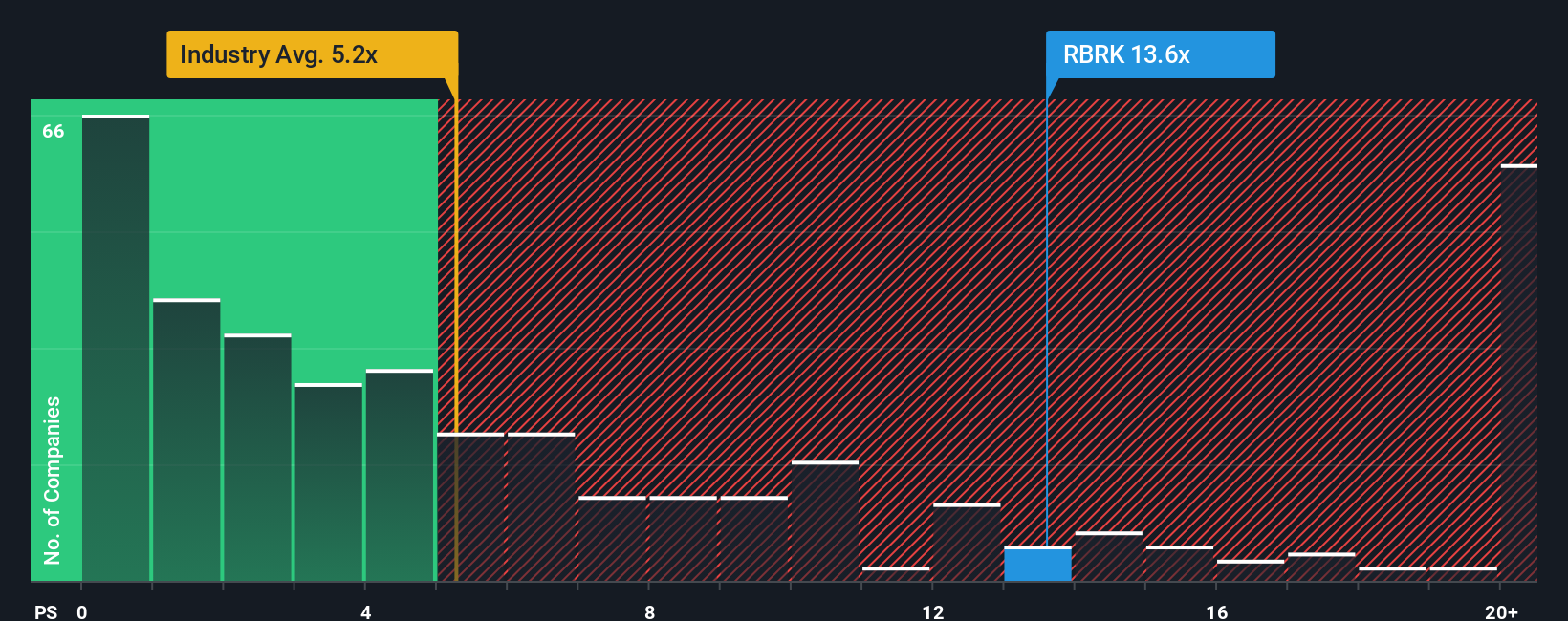

The narrative fair value points to Rubrik looking 42% undervalued, but the price to sales ratio of 10.9x tells a different story. That level sits above the US Software industry at 4.7x, the peer average at 9.9x, and even the 10x fair ratio our model suggests the market could move toward.

In plain terms, you are paying a richer sales multiple than many peers, and even a premium to the fair ratio. At the same time, the story still leans on future execution to close the gap to narrative fair value. Do you see that premium as justified, or as extra valuation risk you want compensated?

Build Your Own Rubrik Narrative

If you look at the numbers and come to a different conclusion, or simply like testing ideas yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Rubrik might be on your radar now, but do not stop there. The screener can help you uncover focused ideas across themes you might otherwise miss.

- Target income-focused opportunities by scanning these 13 dividend stocks with yields > 3% that could add more reliable cash flow to your portfolio mix.

- Spot potential growth stories early with these 3528 penny stocks with strong financials that already show stronger financial foundations than many of their small cap peers.

- Zero in on pricing gaps using these 872 undervalued stocks based on cash flows that the market may not be fully recognising yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.