Please use a PC Browser to access Register-Tadawul

Samsara Inc.'s (NYSE:IOT) Popularity With Investors Under Threat As Stock Sinks 25%

Samsara, Inc. Class A IOT | 26.79 | -0.04% |

Samsara Inc. (NYSE:IOT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

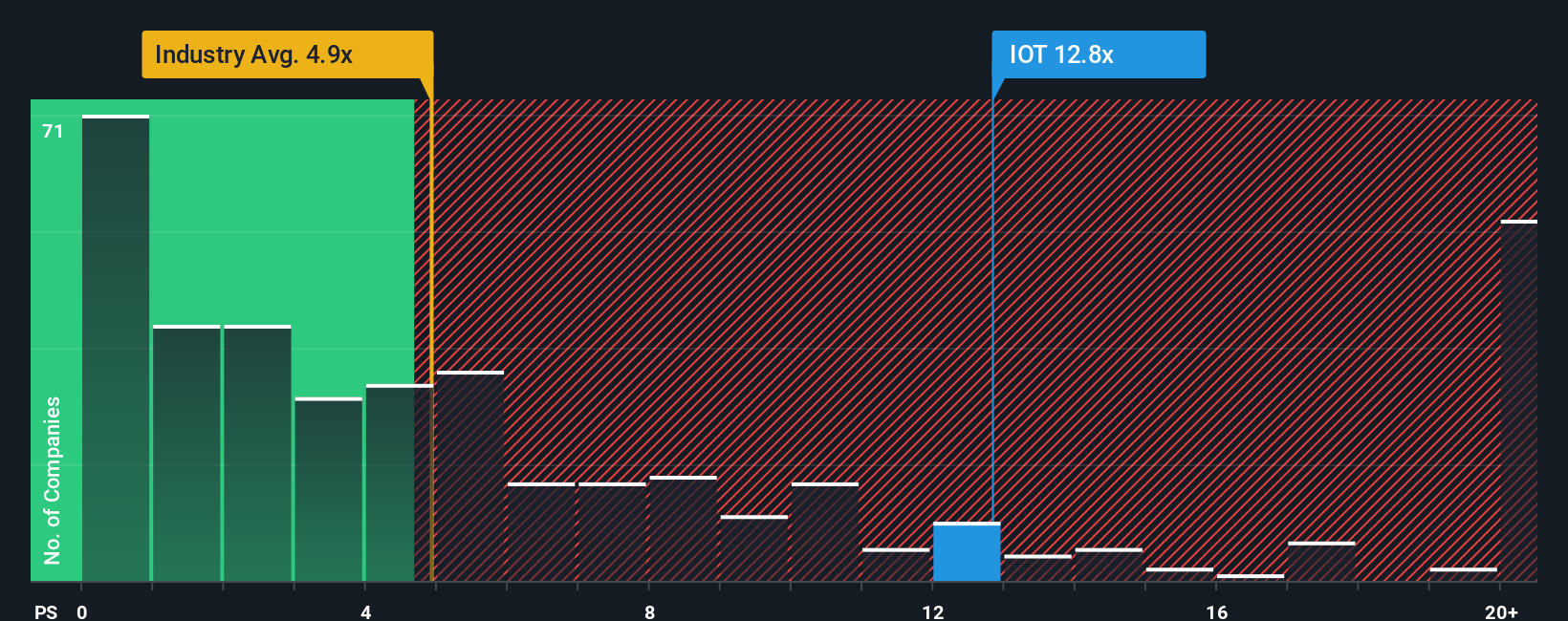

Although its price has dipped substantially, Samsara may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 12.8x, since almost half of all companies in the Software industry in the United States have P/S ratios under 5x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Samsara's P/S Mean For Shareholders?

Samsara certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Samsara.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Samsara's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow revenue by 157% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 32% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Samsara's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Samsara's P/S

Samsara's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Samsara, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

If you're unsure about the strength of Samsara's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.