Please use a PC Browser to access Register-Tadawul

Saudi Arabia 2026 Outlook: The Ultimate Summary of Institutional Views

ALRAJHI 1120.SA | 106.30 | -1.39% |

SNB 1180.SA | 43.14 | +0.33% |

ALINMA 1150.SA | 27.18 | -0.88% |

SAUDI ARAMCO 2222.SA | 25.26 | -0.24% |

Tadawul All Shares Index TASI.SA | 11270.62 | +0.02% |

Date: January 15, 2026

Topic: Saudi Market Strategy & Outlook

The Saudi capital market is poised for a historic shift in 2026. On January 6, the Capital Market Authority (CMA) announced a game-changing regulatory update: Effective February 1, 2026, the Saudi stock market will open to all foreign investors.

This move eliminates previous restrictions—specifically the Qualified Foreign Investor (QFI) framework and swap agreements—allowing direct access for international investors without the need for complex pre-qualification.

For investors looking to navigate this new landscape, we have compiled a "Smart Money" digest based on the latest institutional reports and analyst commentary.

1. The Liquidity Surge: What to Expect

The immediate impact of this deregulation is expected to be a significant injection of foreign capital.

- The "Big Number": Analysts estimate this reform could unlock between $10 billion and $15 billion in new inflows.

- Saxo Bank (Hamza Dweik, Head of Trading MENA) estimates $9–$10 billion in new inflows, adding to the SAR 519 billion already held by foreigners.

- Riyad Capital projects inflows could reach $10–$15 billion, depending on the extent of the changes.

- Global Weighting: Dweik notes this will likely increase Saudi Arabia’s weighting in global emerging-market indices from approximately 3.2% to 4.7%.

Key Insight: Vijay Valecha (CIO at Century Financial) predicts a "systemic bull trend" in 2026, driven by the removal of these pricing impediments.

2. Sector Watch: Where Are Analysts Bullish?

With the floodgates opening, institutions have identified specific sectors poised for growth. The consensus favors non-oil growth sectors, banks, and tourism.

The Top Picks (Overweight/Positive)

- Banking & Financials

- Why? This sector is the primary beneficiary of foreign inflows due to high liquidity.

- Analyst View: Amol Shitole (Mashreq Capital) and Vijay Valecha (Century Financial) believe demand will initially concentrate on index heavyweights.

- Specific Stocks to Watch: Valecha highlights Al Rajhi Bank(1120.SA), The Saudi National Bank(1180.SA), and Alinma Bank(1150.SA) as key beneficiaries, noting that previous foreign ownership limits had constrained their MSCI weighting.

- Profit Outlook: SNB Capital forecasts a 5% rise in bank profits for 2026.

- Technology & Telecom

- Alignment with Vision 2030’s digital transformation.

- Analyst View: Riyad Capital and SNB Capital both hold a Positive outlook.

- Growth Stat: SNB Capital predicts a massive 20% year-on-year increase in the Information Technology sector earnings.

- Tourism & Real Estate

- Mega-events (Asian Winter Games 2029, Expo 2030, World Cup 2034) are driving infrastructure.

- Tony Hallside (CEO, STP Partners) expects heightened interest in infrastructure and tourism.

- Sentiment Booster: Eric Trump (EVP, Trump Organization) praised the developments in Diriyah and confirmed the launch of Trump-branded projects with Dar Global, stating, "The investment environment gets better and better."

- Growth Stat: SNB Capital forecasts 20% growth in the Tourism sector.

- Healthcare

- Analyst View: Saxo Bank projects healthcare profits to rise by 23% in 2026. SNB Capital forecasts a 16% increase.

The Neutral Zone (Cautious/Hold)

- Energy & Utilities

- Riyad Capital maintains a Neutral outlook on Energy and Utilities.

- However: Century Financial notes that Saudi Arabian Oil Co.(2222.SA) will still benefit significantly from direct foreign buying as a blue-chip staple.

- Petrochemicals (The Turnaround Story)

- Analyst View: While Riyad Capital remains neutral on materials, Saxo Bank offers a contrarian bullish view, projecting petrochemical profits could rebound by 74% in 2026 after a difficult 2025. SNB Capital also forecasts a rebound following one-off losses in 2025.

Hidden Gems?

Beyond the broad consensus, specific analysts have flagged high-potential opportunities in industrial and consumer niches that align with Saudi Arabia's diversification goals:

- Green Energy & Mining:

- Hamza Dweik (Saxo Bank) explicitly highlights Renewable Energy, Green Hydrogen, and Mining & Metals as key sectors that will attract foreign focus due to their alignment with Vision 2030 priorities.

- Logistics & Transportation:

- This is a dual-conviction play. Saxo Bank sees it as a booming sector, while Riyad Capital officially categorizes the Transportation sector outlook as Positive for 2026.

- Consumer Staples (Retail & Food):

- Betting on the Saudi consumer remains a strong strategy. Riyad Capital holds a Positive outlook for both the Retail and Food & Beverages sectors, expecting them to outperform.

- Advanced Manufacturing:

- Tony Hallside (STP Partners) specifically points to Advanced Manufacturing as a sector where foreign capital and expertise are expected to play a catalytic role.

3. TASI Targets & Economic Outlook

What are the numbers saying about the general market direction?

- Price Targets:

- SNB Capital: Sees Tadawul All Shares Index(TASI.SA) trading between 10,000 and 11,700 points in 2026, with a fair value estimate of 12,000 points. They note the market is currently trading at attractive valuations (0.5 standard deviations below the 10-year average).

- Riyad Capital: Believes TASI will recover from 2025 losses, citing a forward P/E currently below the 10-year average of 15.8x.

- GDP & Economy:

- Riyad Capital forecasts 4.3% GDP growth (driven by 4.5% non-oil growth).

- SNB Capital is slightly more optimistic, predicting 4.7% GDP growth.

- Interest Rates: Analysts expect SAIBOR (3-month) to drop to 4.2% by year-end 2026.

4. Market Pulse: The First Wave

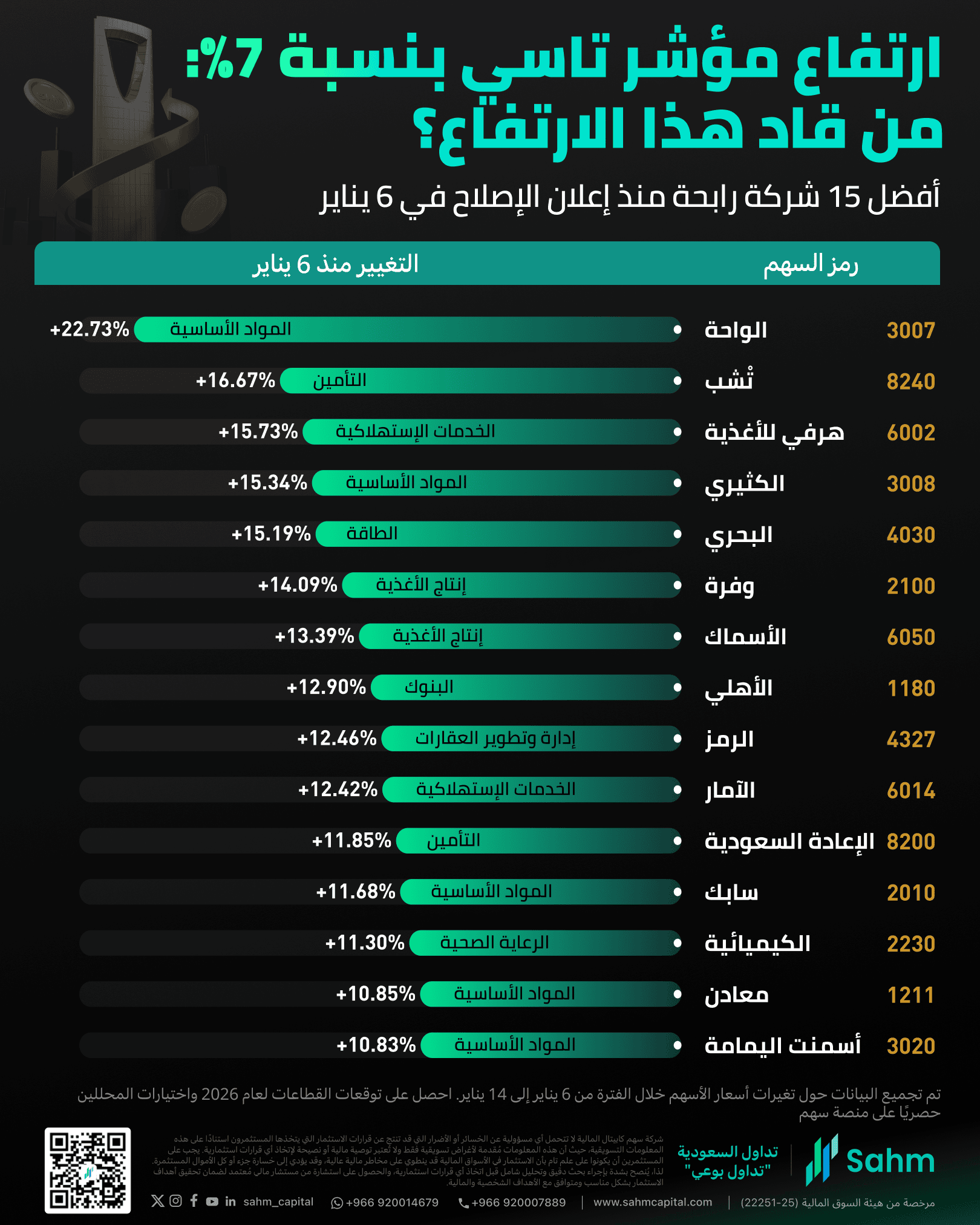

| Company | Change | Sector |

|---|---|---|

| Zahrat Al Waha for Trading Co.(3007.SA) | +22.73% | Materials |

| CHUBB Arabia Cooperative Insurance Co.(8240.SA) | +16.67% | Insurance |

| Herfy Food Services Co.(6002.SA) | +15.73% | Consumer Services |

| Al Kathiri Holding Co.(3008.SA) | +15.34% | Materials |

| National Shipping Company of Saudi Arabia(4030.SA) | +15.19% | Energy |

| Wafrah for Industry and Development Co.(2100.SA) | +14.09% | Food & Beverages |

| Saudi Fisheries Co.(6050.SA) | +13.39% | Food & Beverages |

| The Saudi National Bank(1180.SA) | +12.90% | Banks |

| Alramz Real Estate Co.(4327.SA) | +12.46% | Real Estate |

| Alamar Foods Co.(6014.SA) | +12.42% | Consumer Services |

| Saudi Reinsurance Co.(8200.SA) | +11.85% | Insurance |

| Saudi Basic Industries Corp.(2010.SA) | +11.68% | Materials |

| Saudi Chemical Co.(2230.SA) | +11.30% | Health Care |

| Saudi Arabian Mining Co.(1211.SA) | +10.85% | Materials |

| Yamama Cement Co.(3020.SA) | +10.83% | Materials |

| Data compiled on stock price changes from January 6 to January 14 | ||

Since the announcement, the Tadawul All Shares Index(TASI.SA) index staged a powerful rally, gaining 6.95% and marking a 6-day winning streak.

However, as of today (Jan 15), the market is seeing a pullback (down ~1% intraday).

How to Read Above List:

This list highlights where capital flowed most aggressively during the initial sentiment boost. While global factors (e.g., commodity prices boosting Materials) and specific company news played a role alongside the regulatory reform, these movements offer valuable clues for investors:

- Materials & Energy (SABIC, Maaden, Bahri): Their dominance aligns with the institutional "Turnaround" thesis, though likely amplified by global commodity tailwinds. The current pullback offers a chance to see if this strength holds.

- The "Unsung Heroes" (Insurance & Food): Sectors like Insurance (CHUBB, Saudi Re) and Food (Wafrah, Herfy) outperformed despite less analyst spotlight. This might suggests potential "sector rotation" or specific earnings anticipations that warrant a closer look.

- With the market taking a breather today, this list serves as a potential watchlist. Are these top gainers simply cooling off before the next leg up? Or is it time to look for undervalued peers in these same winning sectors?

5. Risks & Governance

While the mood is bullish, experts advise due diligence.

- Kapil Chadda (Partner, Arthur D. Little) warns that transparency is key. Foreign investors need assurance against "hidden risks such as insider trading" and want to see high governance standards.

- Hamza Dweik (Saxo Bank) reminds investors that despite the opening, they must still navigate the aggregate foreign holding limit (49%) and market volatility linked to oil prices.

Summary: The 2026 Playbook

To help you navigate the opportunities, we have categorized the outlooks into Core Consensus (sectors where multiple firms agree) and Analyst Specifics (high-potential niche picks from individual firms).

| Category | Theme / Sector | Key Beneficiaries | Institutional Source |

|---|---|---|---|

Core Consensus (Broad Agreement) | Direct Inflows (Liquidity) | Banks & Financials (Al Rajhi Bank(1120.SA), The Saudi National Bank(1180.SA), Alinma Bank(1150.SA)) | Century Financial, Mashreq, SNB Capital |

| Vision 2030 Growth | Tourism, Tech & Healthcare | SNB Capital, Saxo Bank, STP Partners | |

| Blue-Chip Staple | Saudi Arabian Oil Co.(2222.SA) | Century Financial | |

Analyst Specifics (Niche & Strategic Picks) | Turnaround Play | Petrochemicals (Proj. +74% profit rise) | Saxo Bank, SNB Capital |

| Consumer Strength | Retail, Food & Beverages | Riyad Capital | |

| Future Industries | Green Energy, Mining, Adv. Manufacturing | Saxo Bank, STP Partners | |

| Infrastructure | Transportation & Logistics | Riyad Capital, Saxo Bank | |

| Macro Drivers | Monetary & Fiscal | Interest Rate Cuts & Debt Instruments | Riyad Capital, Ministry of Investment |

Saudi Arabia’s full market opening is widely viewed as a structural inflection point rather than a short-term catalyst. While near-term inflows may favor large, liquid stocks, most analysts agree that sustained performance in 2026 and beyond will depend on earnings delivery, sector fundamentals, governance standards, and progress under Vision 2030—not access mechanics alone.

The reform, in short, broadens the opportunity set—but leaves investment decisions firmly in the hands of global investors weighing risk, valuation, and long-term growth potential.