Please use a PC Browser to access Register-Tadawul

Saudi Market's Next Big Thing? SMC IPO (SAR 25/share) Opens Today & Closes Tomorrow. Institutions 64x Oversubscribed

Tadawul IPO Index TIPOC.SA | 4346.49 | -1.85% |

Tadawul All Shares Index TASI.SA | 10452.91 | -1.30% |

SMC HEALTHCARE 4019.SA | 19.70 | -2.52% |

Health Care Equipment & Svc THEI.SA | 9716.25 | -0.82% |

Riyadh, Saudi Arabia – June 15, 2025

Attention investors: The retail subscription period for the Initial Public Offering (IPO) of Specialized Medical Company (SMC) commences today, June 15, 2025.

This follows the successful completion of the institutional book-building process, which demonstrated exceptional investor demand and resulted in the setting of the Final Offer Price at the top end of the range.

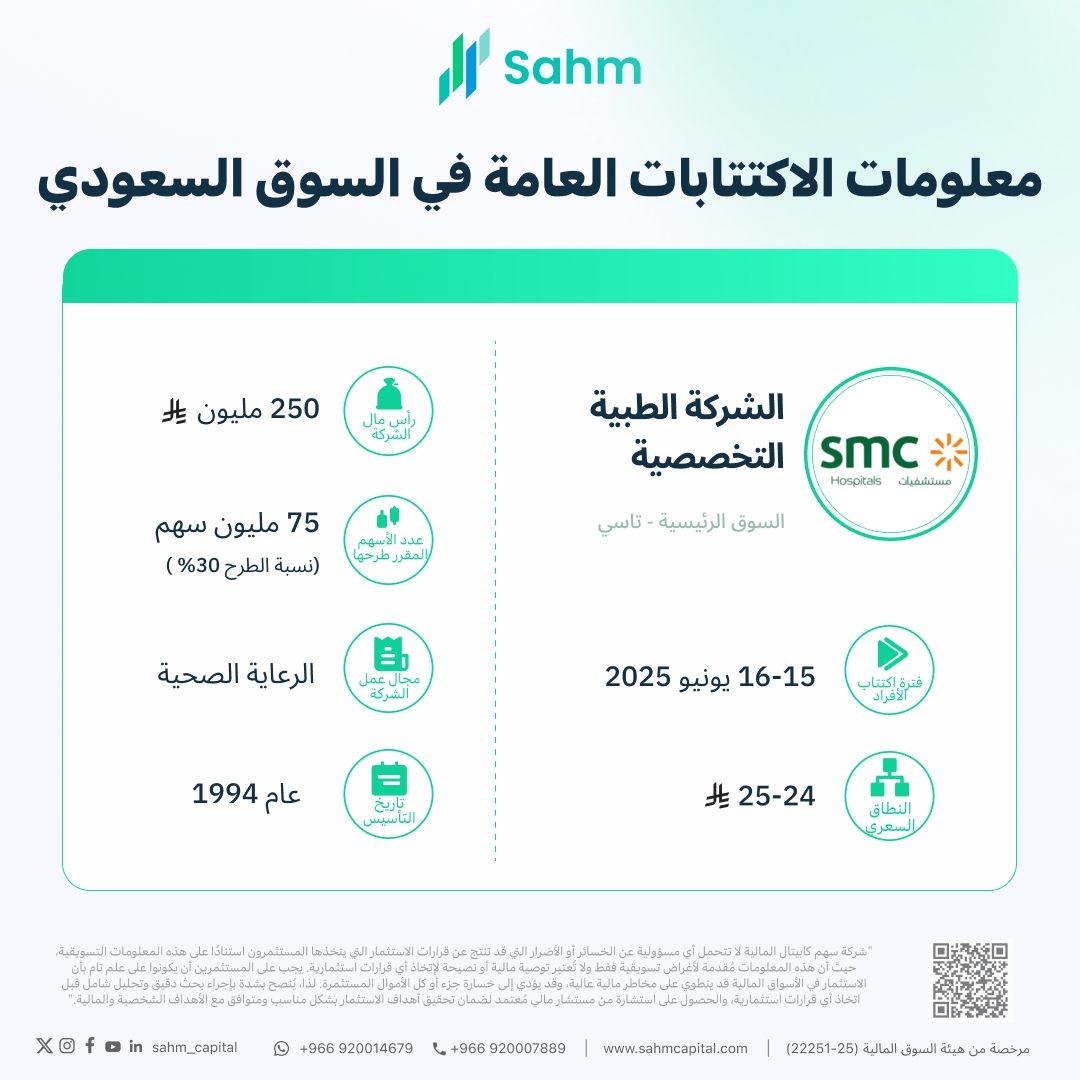

Key IPO Information:

- Retail Subscription Opens: Today, June 15, 2025, closing at 2:00 PM (KSA time) on Monday, June 16, 2025

- Final Offer Price: SAR 25.00 per share (Set at the upper limit of the initial price range)

- Total Shares Offered: 75 million ordinary shares (representing 30% of the company's issued share capital)

- Implied Market Capitalization: SAR 6.25 billion (approximately USD 1.67 billion) upon listing

- Institutional Book-Building: Oversubscribed, with orders totaling approximately SAR 121.3 billion (USD 32.4 billion), representing coverage of 64.7 times

Introducing the new IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

IPO Summary

| Category | Details |

|---|---|

| Company Name | Specialized Medical Co. (SMC) |

| Market | Main Market (TASI) |

| Core Activities | Healthcare |

| Capital | SAR 250 million |

| Total Shares | 250 million |

| Par Value | SAR 1 per share |

| Issue Percentage | 30% |

| Number of Offered Shares | 75 million |

| Qualified Subscribers | Participating institutions & Retail investors |

| Total Number of Shares Offered to Retail Investors | 15 million shares (20% of the offering size) |

| Minimum Number of Offer Shares to be Applied for by Individual Investors | 10 shares |

| Maximum Number of Offer Shares to be Applied for by Individual Investors | 1,000,000 shares |

| Minimum Number of Offer Shares to be Applied for by Institutional Investors | 100,000 shares |

| Maximum Number of Offer Shares to be Applied for by Institutional Investors | 12.5 million shares |

Overview of SMC:

Founded in 1999, SMC operates two state-of-the-art hospitals in Riyadh with a combined capacity of 578 inpatient beds and 266 outpatient clinics. The company employs a skilled medical team of 443 doctors, 960 nurses, and 494 ancillary staff delivering specialized care across multiple disciplines:

- Cardiology: Over 2,000 interventional procedures annually

- Surgery: More than 24,000 general surgeries yearly, including 400+ complex spine procedures

- Oncology: Supporting 15,000+ outpatient visits annually with 4,000 active patients

- Nephrology: Delivering 11,000+ dialysis sessions yearly

- Ophthalmology: Conducting 5,000+ eye surgeries and approximately 50 corneal transplants annually

- Fertility: Performing approximately 2,000 specialized IVF procedures per year

- Laboratory Services: Conducting over 1.6 million tests annually

SMC has achieved numerous accreditations from leading healthcare bodies, including CBAHI, CAP, AABB, and HIMSS, underscoring its commitment to quality and excellence.

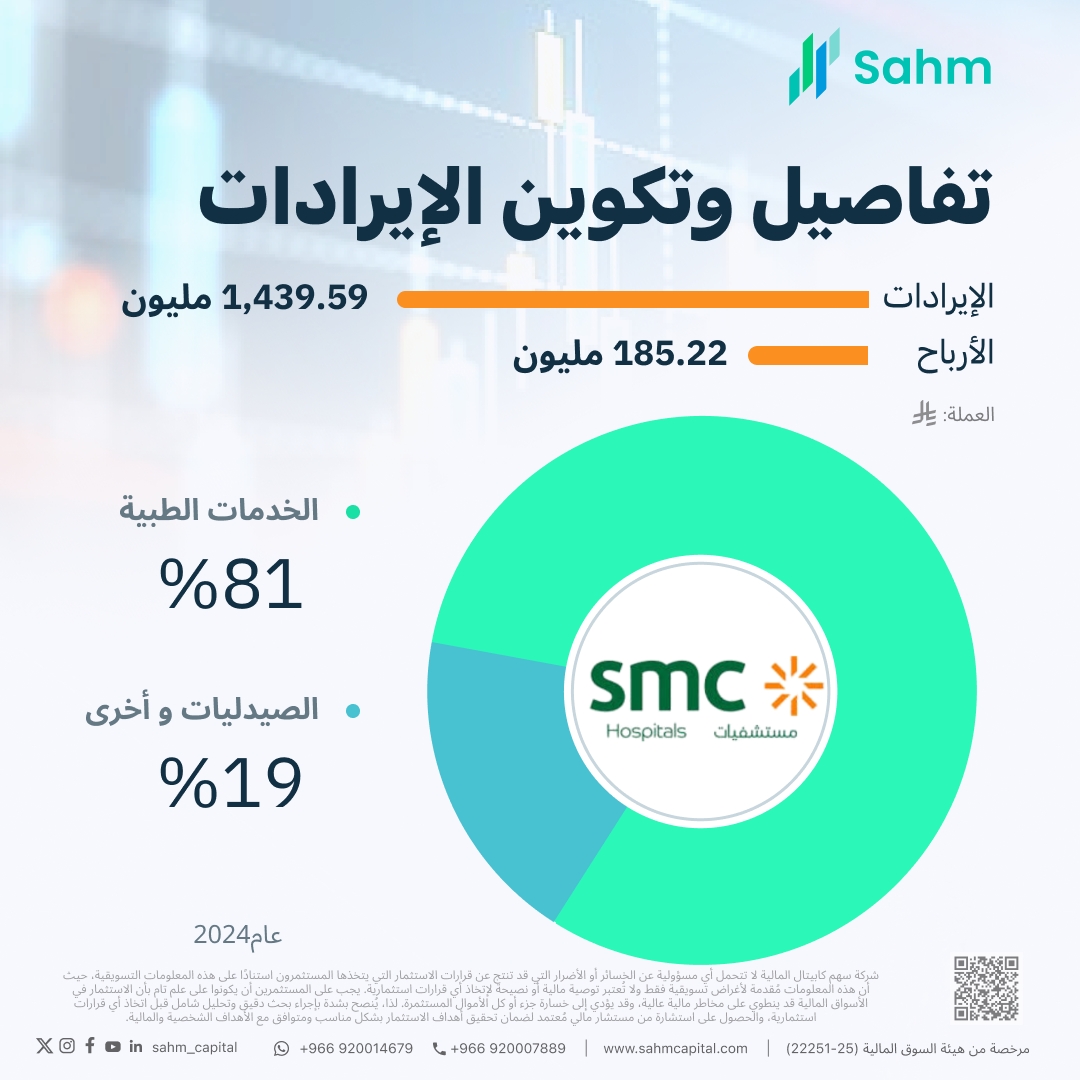

Strong Financial Performance

SMC has demonstrated robust financial growth:

- Net revenue increased from SAR 1,053 million in 2021 to SAR 1,368 million in 2023 (14% CAGR)

- Net profit rose from SAR 56.0 million to SAR 168.7 million over the same period (73.6% CAGR)

- EBITDA margins expanded from 17.2% in 2021 to 24.2% in the first nine months of 2024

Strategic Expansion Plans

SMC is executing an ambitious expansion strategy into Northern Riyadh, where rapid urban development is creating strong demand for healthcare services:

| Hospital | Location | Beds | Outpatient Clinics | Est. Cost (SAR M) | Expected Opening |

|---|---|---|---|---|---|

| SMC 3 | Northern Ring Road | 296 | 200 | 1,300 | Q4 2027 |

| SMC 4 | Khuzam District | 201 | 120 | 925 | Q4 2028 |

| SMC 5 | Al Malqa | 201 | 120 | 950 | Q4 2029 |

Once operational, these facilities will more than double SMC’s current capacity to approximately 1,276 beds and 770 outpatient clinics, positioning the company to capture over 25% of private hospital capacity in Northern Riyadh.

Investment Highlights

- Favorable Market Dynamics: Saudi Arabia’s healthcare sector is growing at a projected 4.6% CAGR through 2035, supported by Vision 2030 initiatives and population growth.

- Strategic Position in Riyadh: The city’s population is expected to grow from 7.3 million to 9.4 million by 2035, with Northern Riyadh emerging as a key growth corridor.

- Comprehensive Healthcare Services: SMC delivers full-spectrum care across the healthcare value chain, serving over one million patients annually.

- Technological Leadership: The company’s proprietary mobile app accounts for 62% of all bookings, with AI integration supporting diagnostics and laboratory operations.

- Expanding Margins: SMC’s focus on outpatient services and higher-margin specialties has driven significant profitability improvements.

- Experienced Leadership: The company is led by a management team with over 50 years of combined healthcare experience, supported by a distinguished board of directors.

Investor Groups

- Tranche (A): Participating Parties

- Eligible participants include investment funds, qualified foreign companies and institutions, GCC corporate investors, and other foreign investors under swap agreements

- Provisionally allocated 75,000,000 Offer Shares, representing 100% of the total Offer Shares

- Final allocation will be determined after the individual subscription period ends

- If Individual Subscribers show sufficient demand, the Financial Advisors may reduce allocation to a minimum of 60,000,000 ordinary shares (80% of Offer Shares)

- The exact number and percentage of Offer Shares allocated will be determined by the Financial Advisors in coordination with the Company

- Tranche (B): Individual Subscribers

- Eligible participants include Saudi natural persons, non-Saudi natural persons resident in the Kingdom, and GCC nationals with a bank account at a Receiving Agent and an investment account with a Capital Market Institution

- Maximum allocation of 15,000,000 Offer Shares, representing 20% of the total Offer Shares

- If Individual Subscribers do not fully subscribe to their allocation, the Lead Manager may reduce their allocation proportionate to their subscription level

Substantial Shareholders of the Company Pre- and Post Offering

| Substantial Shareholders | Pre-Offering | Post-Offering | ||||||

|---|---|---|---|---|---|---|---|---|

| Number of Shares | Total Nominal Value (SAR) | Direct Ownership (%) | Indirect Ownership (%) | Number of Shares | Total Nominal Value (SAR) | Direct Ownership (%) | Indirect Ownership (%) | |

| Abdul Rahman Saad AlRashid and Sons | 100,985,250 | 100,985,250 | 40.3941% | - | 70,689,675 | 70,689,675 | 28.27587% | - |

| Abdullah Saad AlRashid and Sons Co. | 51,602,500 | 51,602,500 | 20.6410% | - | 36,121,750 | 36,121,750 | 14.4487% | - |

| Al-Thomad Trading Company | 50,492,750 | 50,492,750 | 20.1971% | - | 35,344,925 | 35,344,925 | 14.13797% | - |

| Rashid Saad AlRashid and Sons Co. | 32,552,000 | 32,552,000 | 13.0208% | - | 22,786,400 | 22,786,400 | 9.11456% | - |

| Total | 235,632,500 | 235,632,500 | 94.2530% | - | 164,942,750 | 164,942,750 | 65.9771% | - |

Source: The Company.

Expected Offering Timetable

| Event | Date (Hijri) | Date | Additional Details |

|---|---|---|---|

| Subscription period for Individual Subscribers | 19/12/1446H - 20/12/1446H | 15/06/2025G - 16/06/2025G | Ends at 2:00 PM KSA time on 20/12/1446H (16/06/2025G). |

| Deadline for submission of Participating Parties’ Subscription Application Forms | 16/12/1446H | 12/06/2025G | Based on provisionally allocated Offer Shares. |

| Deadline for submission of Subscription Application Forms and payment by Individual Subscribers | 20/12/1446H | 16/06/2025G | - |

| Deadline for payment of subscription monies by Participating Parties | 20/12/1446H | 16/06/2025G | Based on provisionally allocated Offer Shares. |

| Announcement of Final Allocation of Offer Shares | 28/12/1446H | 24/06/2025G | No later than this date. |

| Refund of excess subscription monies (if any) | 28/12/1446H | 24/06/2025G | No later than this date. |

| Expected Date for Commencement of Trading on the Exchange | - | - | After fulfilling requirements; announced on Tadawul (www.tadawul.com.sa). |

Read the full Prospectus on Company Website

Introducing the new IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

Further updates regarding this IPO will be provided as more information becomes available.

- Reporting by Zaid, Sahm News team