Please use a PC Browser to access Register-Tadawul

Saudi Tadawul Group Holding Company (TADAWUL:1111) Stocks Shoot Up 25% But Its P/E Still Looks Reasonable

TADAWUL GROUP 1111.SA | 155.50 | +1.17% |

Saudi Tadawul Group Holding Company (TADAWUL:1111) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.7% over the last year.

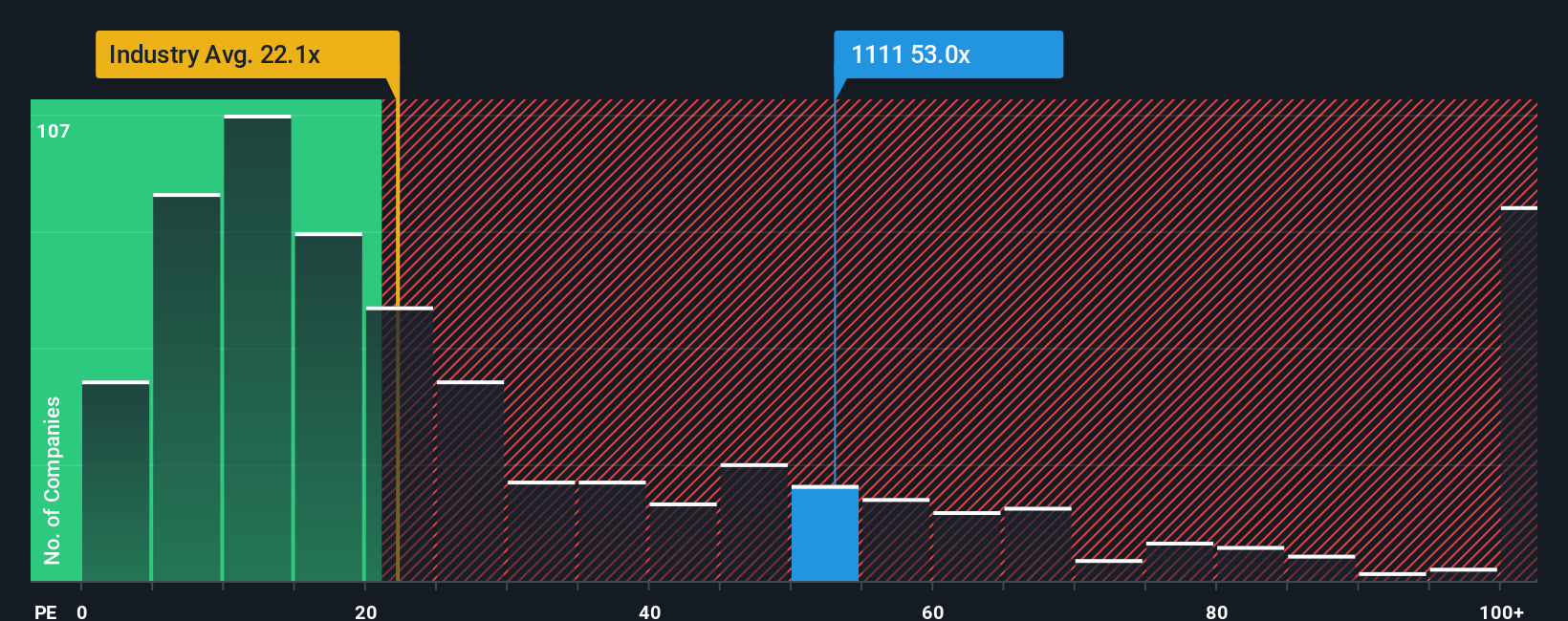

Since its price has surged higher, given close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 21x, you may consider Saudi Tadawul Group Holding as a stock to avoid entirely with its 53x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Saudi Tadawul Group Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Saudi Tadawul Group Holding's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. The last three years don't look nice either as the company has shrunk EPS by 6.1% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 25% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

With this information, we can see why Saudi Tadawul Group Holding is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Saudi Tadawul Group Holding's P/E?

Saudi Tadawul Group Holding's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Saudi Tadawul Group Holding maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Saudi Tadawul Group Holding with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.