Please use a PC Browser to access Register-Tadawul

Shopify (SHOP) Margin Durability Questioned As 16.7% Net Margin Meets 86.9x P/E

Shopify, Inc. Class A SHOP | 123.80 123.54 | +1.78% -0.21% Pre |

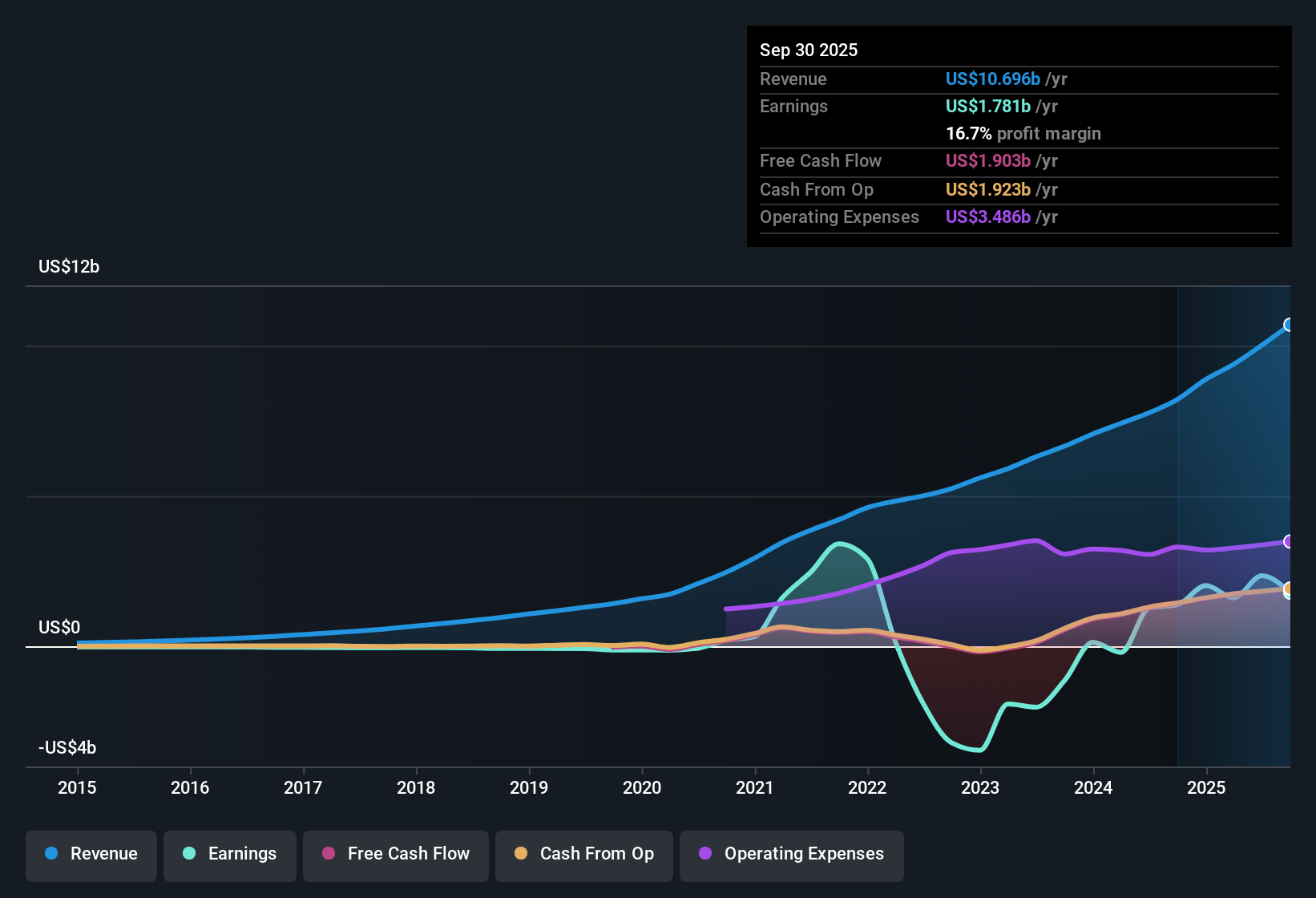

Shopify (SHOP) has reported its FY 2025 third quarter with revenue of US$2.8b, basic EPS of US$0.20 and net income of US$264m, setting the tone for how the rest of the year could look. The company has seen revenue move from US$2.0b in Q2 2024 to US$2.2b in Q3 2024, then to US$2.7b in Q2 2025 and US$2.8b in Q3 2025, while basic EPS has ranged from US$0.13 in Q2 2024 to US$0.64 in Q3 2024, US$0.70 in Q2 2025 and US$0.20 in Q3 2025. This gives investors a detailed read on how the income line is tracking through recent quarters. With trailing net profit margins relatively steady and a one off gain still in the rear view, this set of results puts the spotlight on how durable Shopify’s margin profile really is.

See our full analysis for Shopify.With the headline numbers on the table, the next step is to see how this earnings print lines up with the most widely held narratives about Shopify, and where the data starts to tell a different story.

LTM earnings growth at 28.8% with mixed quarterly EPS

- Over the last twelve months, Shopify generated US$10.7b in revenue and US$1.8b in net income, with TTM earnings up 28.8%, while individual quarters ranged from a loss of US$682m in Q1 2025 (basic EPS loss of US$0.53) to a profit of US$906m in Q2 2025 (basic EPS of US$0.70).

- Bulls point to this 28.8% TTM earnings growth as support for the idea of sustained expansion. However, the swing from a Q1 2025 loss to solid profits later in the year shows a bumpier path than a straight line.

- Supporters of the bullish view also reference multi year earnings growth forecasts of about 22% a year, but the quarterly EPS range from a loss of US$0.53 to a profit of US$1.00 in recent periods shows how results can move around while that bigger picture plays out.

- For a beginner investor, the key tension is that strong TTM growth and bullish forecasts sit alongside some very different profit outcomes from quarter to quarter, which is something to keep in mind when you see big headline growth numbers.

16.7% net margin meets a high 86.9x P/E

- Shopify’s trailing net profit margin sits at 16.7%, almost in line with last year’s 16.8%, while the trailing P/E of 86.9x is far above both the peer average of 36.4x and the US IT industry at 24.5x.

- Bears focus on this combination of steady margins and a rich P/E multiple, arguing that even with 16.7% margins and 28.8% earnings growth, the current US$118.71 share price already prices in a lot of good news.

- Critics also point out that a DCF fair value of US$112.17 sits below the current share price and that a US$514m one off gain affected the last twelve months of reported results, which can make margins and earnings look stronger than the underlying run rate.

- On top of that, the bearish narrative highlights that analyst scenarios rely on high future P/E multiples, so today’s 86.9x P/E plus a DCF fair value under the market price is exactly the kind of setup they cite when they say expectations are already very demanding.

Analyst targets lean on 22.6% revenue growth forecasts

- Consensus data points to revenue growth assumptions of about 22.6% a year and earnings growth of roughly 22% a year, with an analyst price target of US$172.13 compared to the current US$118.71 share price.

- The balanced, consensus style view is that strong recent TTM earnings growth of 28.8% and a 16.7% net margin help support those growth forecasts, but there are also clear watchpoints.

- On the supportive side, consensus highlights international expansion and payments penetration as drivers behind the revenue growth assumptions of about 22.6% a year and revenue of US$18.5b by 2028 in their scenario.

- On the cautious side, that same view flags that margins are expected to move down from 23.4% to 14.6% over the next three years and that the TTM numbers include a US$514m non recurring gain, so investors may want to compare those growth forecasts to the more modest five year earnings CAGR of 6.5% when judging how ambitious the US$172.13 target is.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Shopify on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently and think the story should read another way? Put your view on the record in a few minutes with Do it your way

A great starting point for your Shopify research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Shopify’s high 86.9x P/E, reliance on a US$514m one off gain and expectation of lower future margins all point to demanding valuation risk.

If that leaves you wanting a bit more value support behind the story, take a look at our 51 high quality undervalued stocks that pair stronger pricing with fundamentals that work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.