Please use a PC Browser to access Register-Tadawul

Shopify (SHOP) Valuation Check After Recent Share Weakness And Strong 1 Year Momentum

Shopify, Inc. Class A SHOP | 138.54 | -4.12% |

Why Shopify is on investor watch now

Shopify (SHOP) has been drawing attention after recent share moves, with a 1 day return of about a 0.3% decline and a 7 day return of about a 0.6% decline, focusing investors on current valuation and fundamentals.

While the latest 1 day and 7 day share price returns are slightly negative, Shopify’s 90 day share price return of 7.19% and 1 year total shareholder return of 64.79% indicate momentum that has been building over a longer stretch. Recent moves likely reflect shifting views on its growth profile and risk.

If Shopify’s recent run has you rethinking your watchlist, it could be a good moment to look at other tech names as well, including high growth tech and AI stocks.

So with a 1 year return near 65%, solid double digit revenue and net income growth, and the share price only about 7% below the average analyst target, is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 4.6% Undervalued

With Shopify last closing at about US$167.44 and the narrative fair value sitting near US$175.43, the story leans slightly in favor of upside driven by long term growth and margin assumptions.

The analysts have a consensus price target of $161.109 for Shopify based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $114.0.

Curious what earnings path needs to play out to back this premium? Revenue, margins and a punchy future P/E all sit at the core of this narrative. Want to see the exact mix that gets to that fair value?

Result: Fair Value of $175.43 (UNDERVALUED)

However, this depends on Shopify maintaining its position against large e commerce rivals and managing higher compliance and data privacy costs that could pressure growth and margins.

Another View: Rich Valuation On Earnings

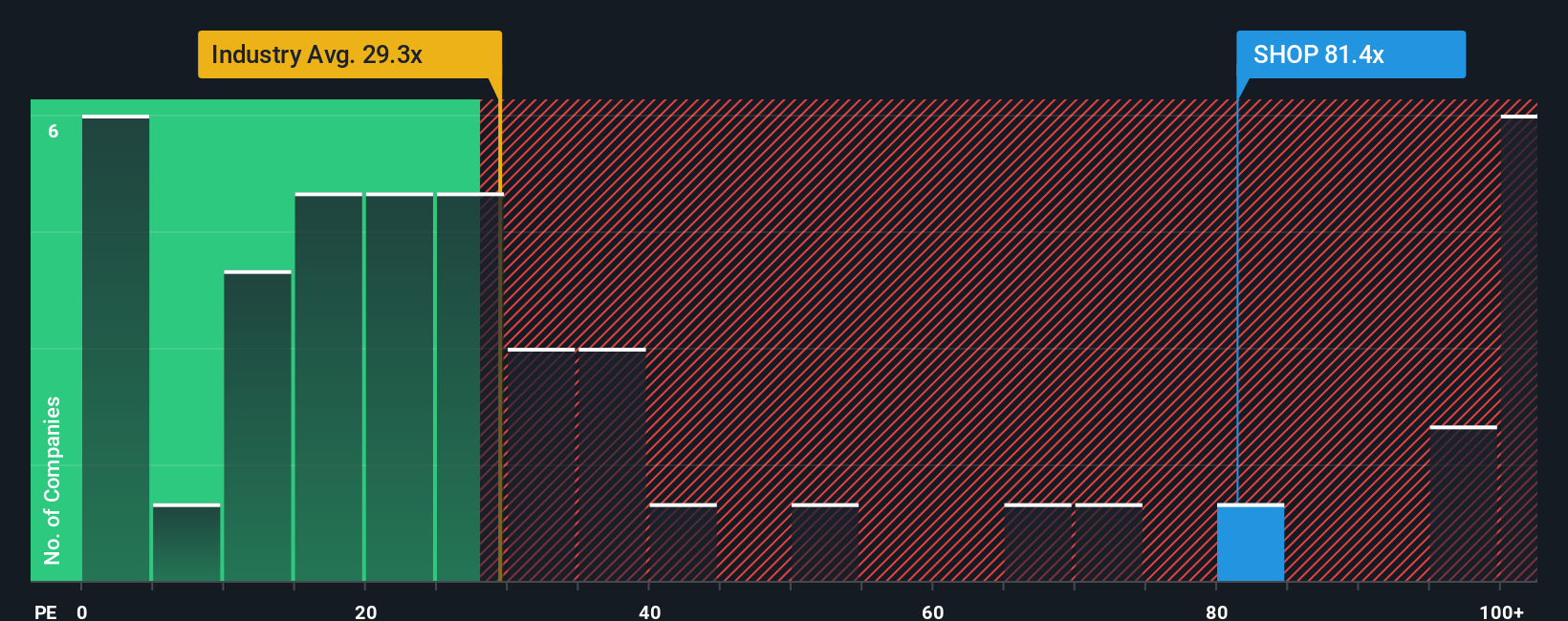

The narrative suggests about 4.6% upside to a fair value near US$175, but the current P/E of roughly 122.8x tells a different story. That is far above the US IT industry at 29.7x, peers at 39.4x, and even our fair ratio of 49.2x. This points to meaningful valuation risk if sentiment cools.

Build Your Own Shopify Narrative

If you see the numbers differently, or just want to test your own assumptions against the data, you can quickly build a custom Shopify story and Do it your way

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Shopify is already on your radar, do not stop there. The Simply Wall St screener can quickly surface more focused ideas that match how you like to invest.

- Spot potential value opportunities by checking out these 883 undervalued stocks based on cash flows that line up with your views on price and cash flows.

- Zero in on cutting edge opportunities with these 25 AI penny stocks that fit your view on where artificial intelligence could matter most.

- Boost your income focus by scanning these 12 dividend stocks with yields > 3% that might suit a yield minded approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.