Please use a PC Browser to access Register-Tadawul

Should Investors Reassess Evolent Health After 70% Drop and Payment Model News in 2025?

Evolent Health Inc Class A EVH | 4.07 | -1.21% |

Wondering what to do with Evolent Health stock after a wild ride in the market? You are not alone. The stock has turned heads in both directions lately, with a 6.7% dip over the past week and a 3% slip over the past month. If you have held on through the past year, it has been especially challenging, given a staggering 70.3% drop over that period. Even the longer-term returns, down 76.4% for three years and 21.6% over five years, may have shaken the confidence of even the most steadfast investors.

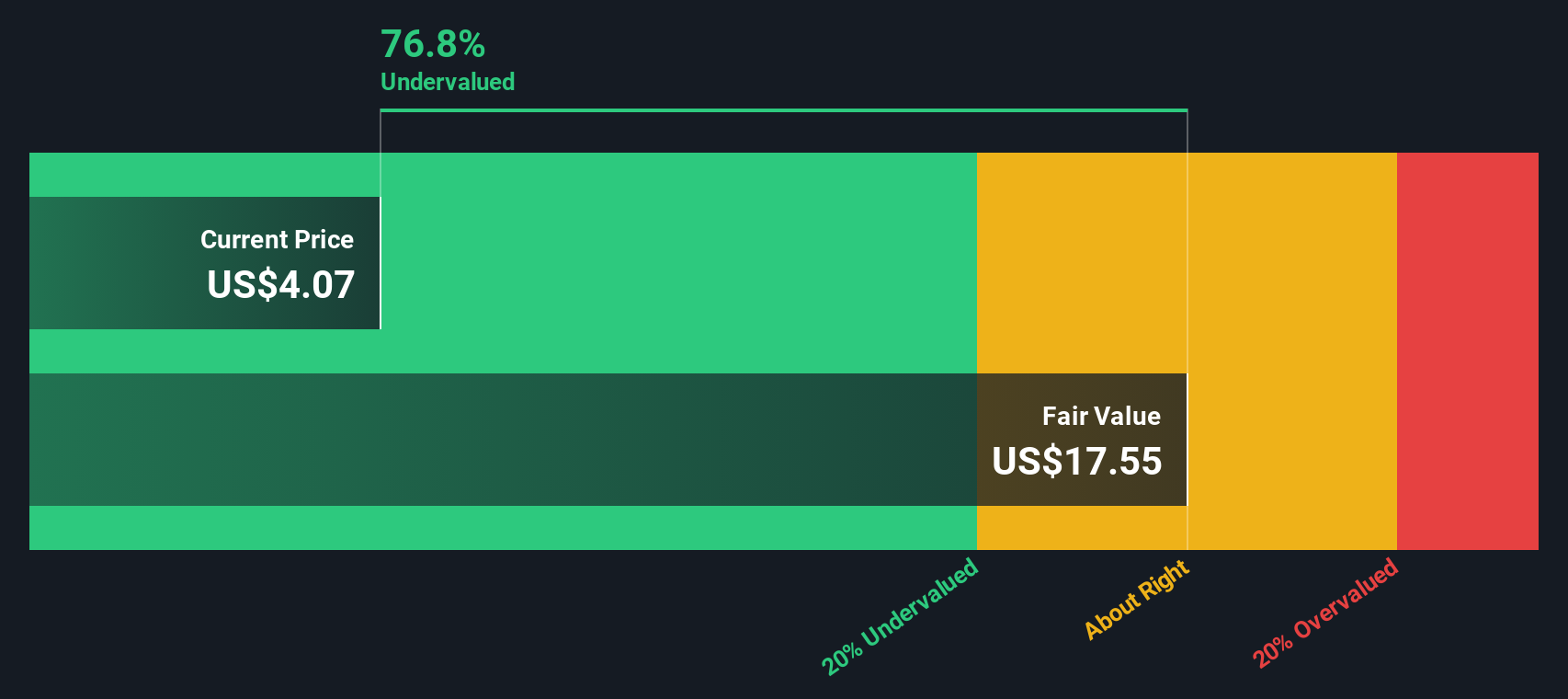

Despite these eye-catching declines, Evolent Health finds itself in an intriguing position. Recent noise in the healthcare sector has introduced new risk perceptions, but some investors are eyeing the current price as an opportunity rather than a warning. The company’s value score stands at 5 out of 6, meaning it passes nearly every major undervaluation check. That is a signal worth paying attention to when the headline numbers look so intimidating.

Is the market finally mispricing Evolent Health, or does the stock deserve its current valuation? In the next section, we will break down the key valuation approaches used to gauge its worth, and tease out what the numbers can and cannot tell us. Stick around, because we will also share a smarter way to think about valuation that could change how you look at stocks like this altogether.

Why Evolent Health is lagging behind its peersApproach 1: Evolent Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates a company's worth by projecting its future cash flows and discounting them back to their present value. This method provides a picture of what a business is truly worth today, based on how much cash it is expected to generate in the years ahead.

For Evolent Health, the latest 12-month Free Cash Flow stands at a negative $92 million. According to analyst estimates and projections, the company is expected to turn this around significantly, with Free Cash Flow forecasted to reach about $247.6 million by the end of 2029. Extensions through 2035, based on further modeling, see continued growth in FCF. However, projections beyond five years should be viewed with added caution as they rely more heavily on estimates and trend extrapolation rather than direct analyst input.

Using this cash flow outlook in the DCF model, Evolent Health’s intrinsic value is assessed at $33.35 per share. The implied discount of 73.0% suggests that, based on these longer-term cash flow forecasts, the stock is trading well below its estimated fair value. This points to a deeply undervalued opportunity, assuming the growth and turnaround materialize as expected.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Evolent Health.

Approach 2: Evolent Health Price vs Sales (P/S)

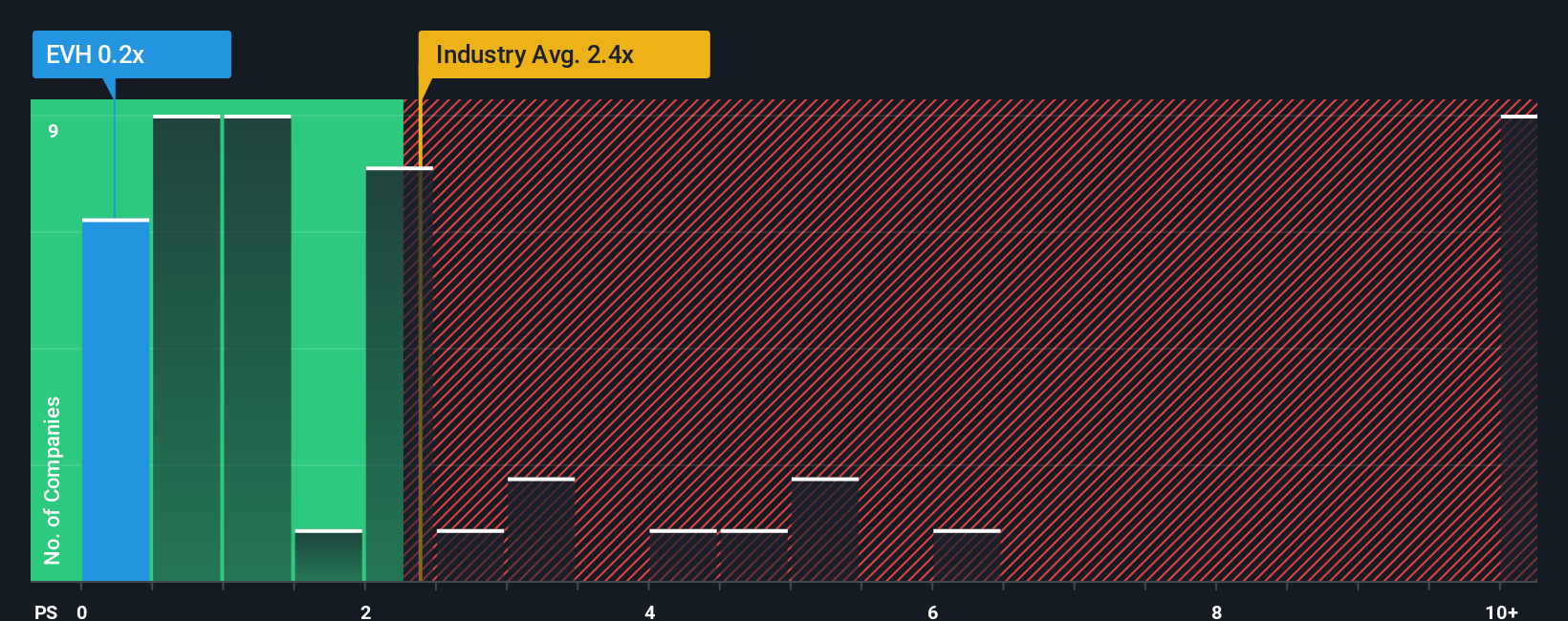

The Price-to-Sales (P/S) multiple is often a preferred valuation metric for companies like Evolent Health, especially when current profitability is limited or negative. This approach allows investors to value the business based on its revenues, which can be a more stable and transparent indicator during periods of fluctuating or negative earnings.

Growth expectations and business risks significantly affect what qualifies as a “normal” P/S ratio. Companies with higher growth prospects or lower perceived risks typically command higher multiples. In contrast, more mature or riskier companies generally trade at discounts to their industries.

At present, Evolent Health is trading at a P/S ratio of 0.48x. This stands in stark contrast to the Healthcare Services industry average of 2.96x and a peer average of 3.10x. This suggests the stock is at a steep discount based on its revenue base alone.

Simply Wall St takes this analysis further by using a proprietary “Fair Ratio,” which weighs important inputs like the company’s growth outlook, profit margins, industry, market capitalization, and risk factors. Unlike simple peer and industry comparisons, the Fair Ratio delivers a more dynamic benchmark tailored to the stock’s unique circumstances. For Evolent, the Fair Ratio sits at 0.75x, suggesting that, given current fundamentals, the stock should trade at a premium to its actual P/S multiple.

Since Evolent’s P/S multiple of 0.48x is noticeably below its Fair Ratio of 0.75x, this indicates the stock appears undervalued by this measure as well.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Evolent Health Narrative

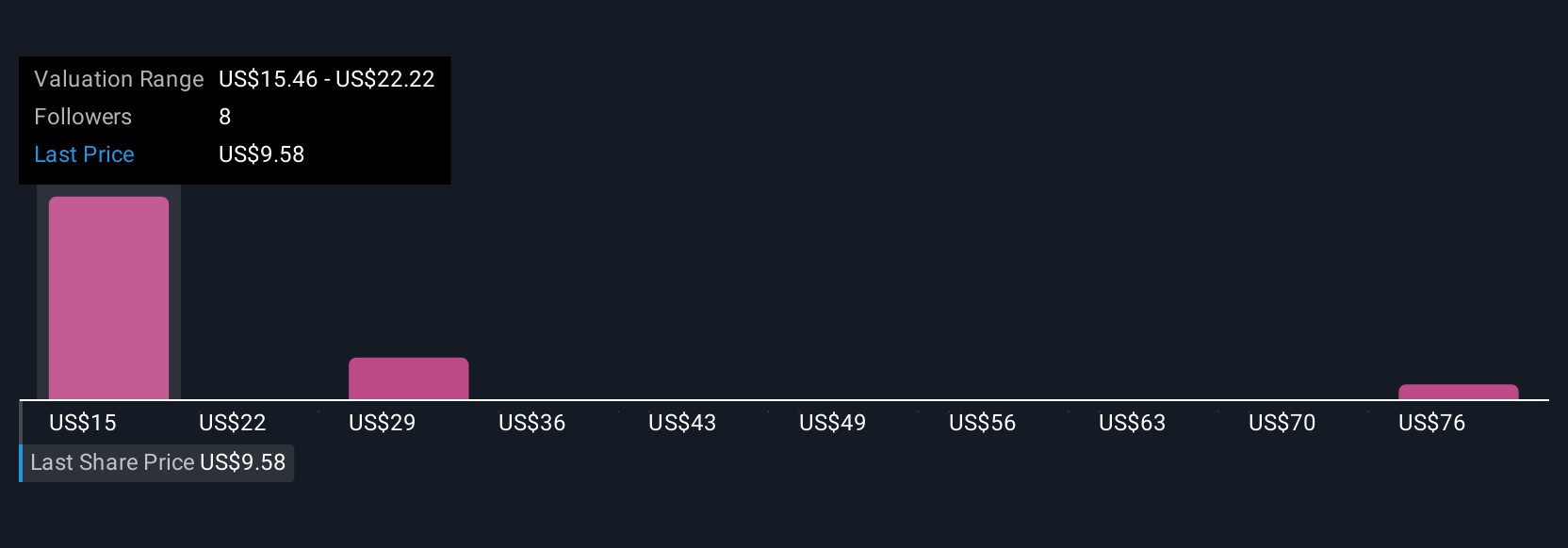

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives put a story behind the numbers, connecting your perspective about a company, such as your assumptions about Evolent Health’s future revenue, profit margins, and risks, to a specific financial forecast and resulting fair value.

Rather than just relying on ratios or analyst estimates, Narratives let you create, save, and share your own investment views in a clear, structured way. They bridge the gap between a company’s story and its valuation, so you can easily see how your outlook translates into a price and quickly compare that “fair value” to the current market price.

Narratives are designed to be easy and accessible, and are already used by millions on Simply Wall St’s Community page. One of their strengths is how they update automatically as new financials, news, or earnings reports come in, ensuring your thesis stays relevant.

For Evolent Health, some investors see value-based care and digital automation driving major long-term growth and assign it a high future target. The most cautious investors focus on risks like client concentration and regulatory change, setting their fair value much lower.

Do you think there's more to the story for Evolent Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.