Please use a PC Browser to access Register-Tadawul

Should Investors Reassess Figma After a 53.8% Slide in 2025?

Figma FIG | 21.99 | -0.95% |

Thinking about what to do with Figma stock right now? You are not alone. After a high-flying debut and a stint as a darling of collaborative design, Figma’s share price has come back to earth lately. Over just the past week, the stock dropped 7.7%, and it is down 8.2% for the month. If you had bought at the start of the year, that experience would have felt even bumpier, with shares sliding a steep 53.8% year-to-date. For new and long-term investors alike, these moves may stir up questions, maybe even a sense of opportunity or risk.

A lot of this recent market action can be traced to shifting investor sentiment as competition heats up in Figma’s core workspace and design arenas. News of rivals releasing more integrated toolsets has arguably pushed some investors to rethink growth forecasts, making the stock’s journey rockier and perceptions of risk more volatile. Yet, news of expanding partnerships and continued product innovation still pop up, keeping Figma in the conversation among both experienced analysts and day traders.

So, what does all this mean for the company’s value on paper? By our standard valuation checks, Figma scores a 0 out of 6, signaling that it is not currently undervalued across the board. The media buzz and price swings might catch headlines, but a closer look at the numbers can help put it all into perspective. In the next section, we will dig into exactly how analysts evaluate Figma’s valuation, and hint at an even smarter way to see the full picture by the article’s end.

Figma scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Figma Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company's intrinsic value by forecasting its future cash flows and discounting those amounts back to their present value. In Figma’s case, analysts look at expected Free Cash Flow (FCF), which represents the cash a business can generate after accounting for necessary capital expenditures.

Figma’s last twelve months of Free Cash Flow stands at $294.3 million. Analyst projections, bolstered by Simply Wall St’s extrapolations beyond year five, suggest FCF could grow to $638.7 million by 2035. While official analyst estimates are only available for the next five years, this longer-term view can give investors a sense of both potential and uncertainty.

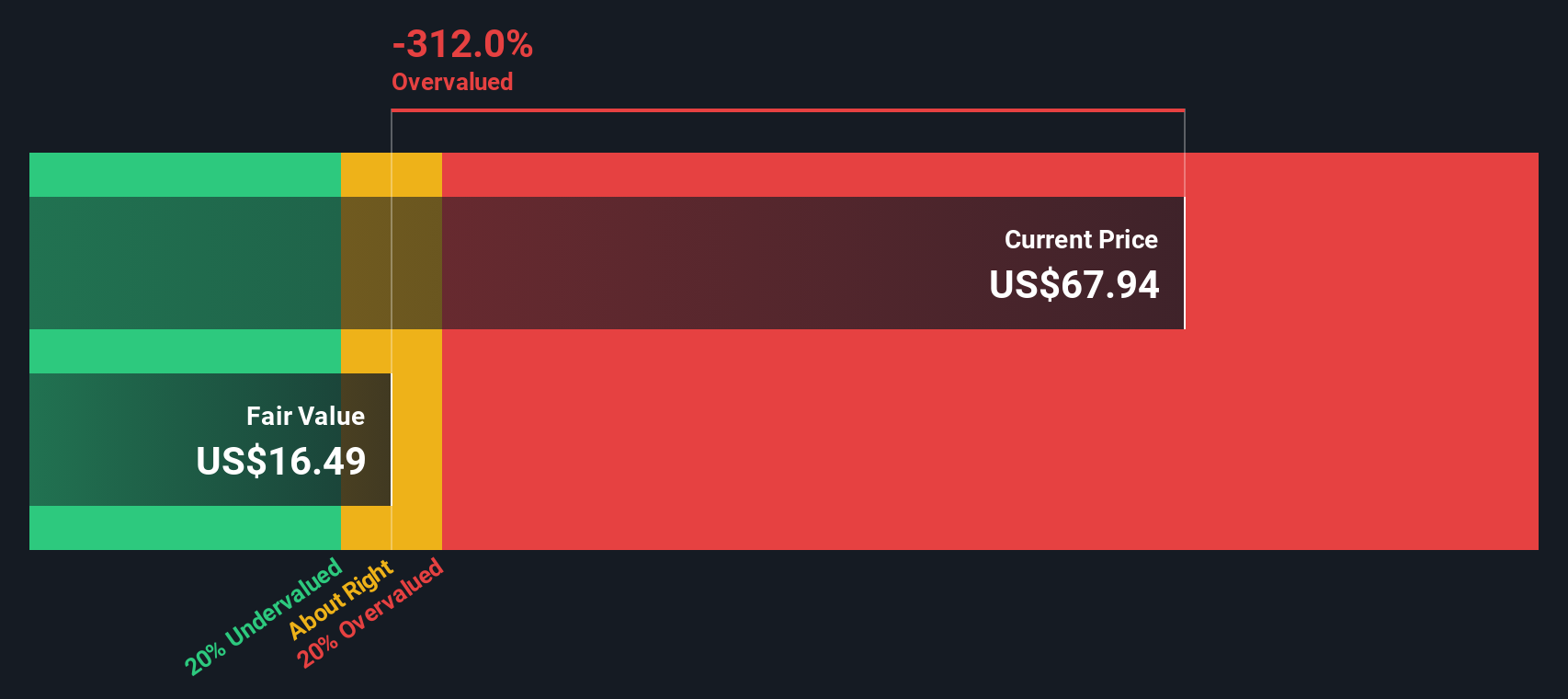

According to this DCF approach, Figma’s fair value is estimated at $16.62 per share. With the current share price sitting more than 220 percent above this intrinsic value, the DCF model signals that Figma stock is significantly overvalued at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Figma may be overvalued by 220.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Figma Price vs Sales

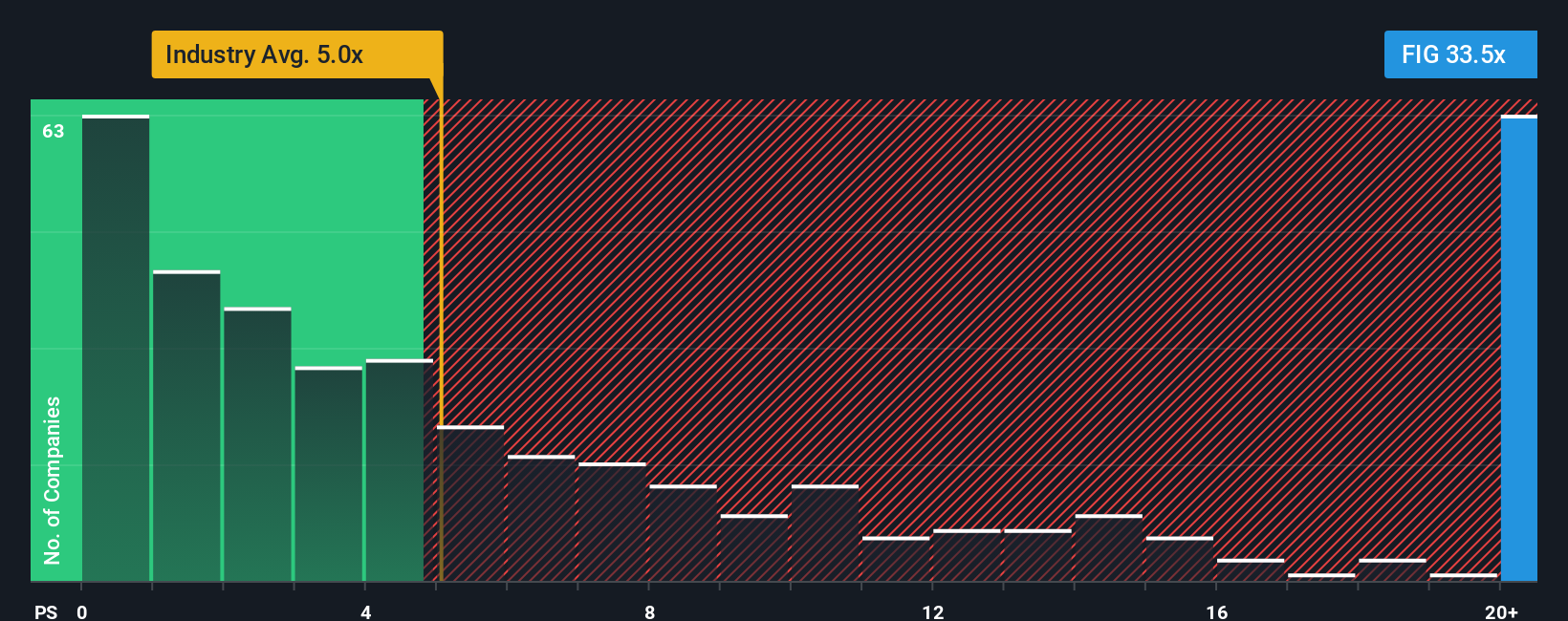

The Price-to-Sales (P/S) ratio is a widely followed valuation metric for software companies, especially those where strong revenue growth is a key driver but profits may be thin or volatile. Since Figma remains highly focused on scaling sales and market share, this measure helps investors gauge how much they are paying for each dollar of the company’s revenue. This is a valuable approach in the fast-moving software sector.

Growth expectations and business risk can have a big impact on what makes for a “normal” P/S ratio. Companies with rapid top-line growth or unique market positions often command higher multiples, while riskier or slower-growing firms generally trade at a discount. For context, Figma’s current P/S ratio sits at 29.25x. This stands out against the software industry average of 5.17x and is also notably above the peer average of 9.53x.

To cut through the noise of headline comparisons, Simply Wall St’s “Fair Ratio” adjusts for factors like Figma’s revenue growth prospects, profit margins, risk profile, industry specifics and market cap. This holistic view offers a more tailored benchmark than just comparing to peers or industry averages, resulting in a more accurate sense of whether investors are overpaying or getting a deal. Based on this perspective, Figma’s actual P/S ratio is well above what would be justified by its fundamentals, making the stock look clearly overvalued on this basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Figma Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers; it brings your view of Figma to life by connecting your financial assumptions, like future revenue growth or profit margins, with your fair value estimate for the company.

Narratives make the link between Figma’s business story, your own forecasted numbers, and what you think the stock is really worth, providing much more context than traditional metrics alone. This tool is available right inside Simply Wall St’s Community page, meaning millions of investors can easily build, save, and update their Narratives as conditions change.

What makes Narratives powerful is that they help you decide when Figma is a Buy, Hold, or Sell, by clearly showing how your fair value stacks up against the latest market price. They also automatically adjust with new earnings, news, or trends, so your view always stays relevant.

For example, some Figma Narratives in the community put fair value as high as $85 per share while more cautious views point to just $16, showing how different investor perspectives can be, all based on the same set of public data but unique stories and forecasts.

Do you think there's more to the story for Figma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.