Please use a PC Browser to access Register-Tadawul

Should You Be Adding Badger Meter (NYSE:BMI) To Your Watchlist Today?

Badger Meter, Inc. BMI | 184.80 | +1.33% |

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Badger Meter (NYSE:BMI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Badger Meter

How Fast Is Badger Meter Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Badger Meter's EPS has grown 20% each year, compound, over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

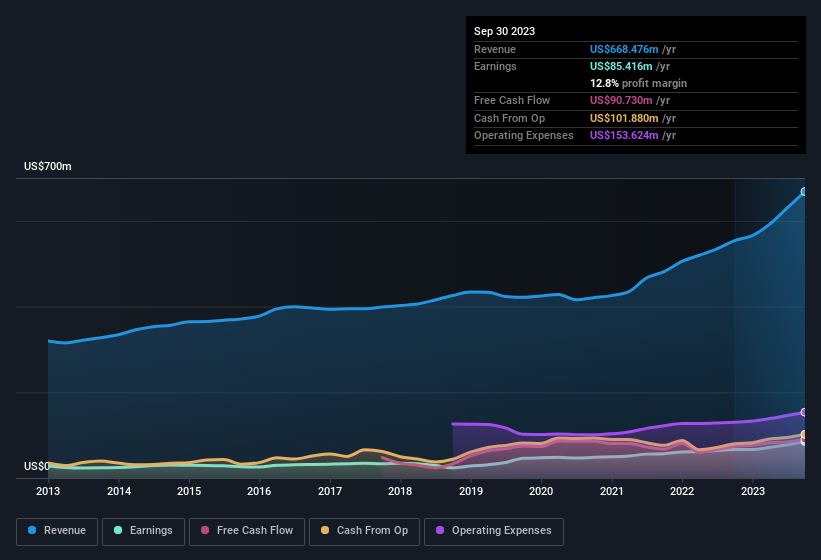

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Badger Meter maintained stable EBIT margins over the last year, all while growing revenue 21% to US$668m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Badger Meter.

Are Badger Meter Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Badger Meter insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at US$28m. This considerable investment should help drive long-term value in the business. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Badger Meter, with market caps between US$2.0b and US$6.4b, is around US$6.6m.

Badger Meter offered total compensation worth US$3.9m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Badger Meter Worth Keeping An Eye On?

You can't deny that Badger Meter has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. This may only be a fast rundown, but the key takeaway is that Badger Meter is worth keeping an eye on. Of course, profit growth is one thing but it's even better if Badger Meter is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Badger Meter certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.