Please use a PC Browser to access Register-Tadawul

Should You Chase Applied Industrial After Recent Share Price Dip in 2025?

Applied Industrial Technologies, Inc. AIT | 261.74 | -0.42% |

Trying to figure out what your next move should be with Applied Industrial Technologies? You are not alone. Whether you are already holding shares or considering an investment, this is a stock that grabs attention for good reason. The last few years have been nothing short of impressive, with the company’s share price soaring 128.0% over three years and a staggering 322.9% over five. Even so, the stock has cooled off lately, dipping 2.8% in the past week and 5.7% over the last month. It remains up by 3.9% year-to-date and 6.5% in the last twelve months. Much of this recent volatility in industrial names like Applied Industrial Technologies can be traced to ongoing shifts in manufacturing sentiment and uncertainty around broader market developments, which have amplified investor focus on value and risk.

With all these price swings, is Applied Industrial Technologies poised for further gains, or is it already priced to perfection? According to our valuation framework, the company scores just 1 out of 6 possible checks for being undervalued. This may indicate that investors are already paying up for its strengths. In the next sections, we will break down what goes into that score, reviewing common ways analysts look at valuation. But stick around, because we will also explore a better way to think about a stock’s true worth that goes beyond the usual metrics.

Applied Industrial Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Applied Industrial Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to present value. For Applied Industrial Technologies, this approach relies on recent Free Cash Flow (FCF) figures and analyst forecasts, then extrapolates possible outcomes into the future.

The company currently generates annual Free Cash Flow of around $466 million. Analyst consensus provides projections for the next five years, with FCF anticipated to reach $480 million by mid-2028. Beyond that, Simply Wall St extends estimates out to 2035, based on assumed growth rates. All of these figures are reflected in US dollars.

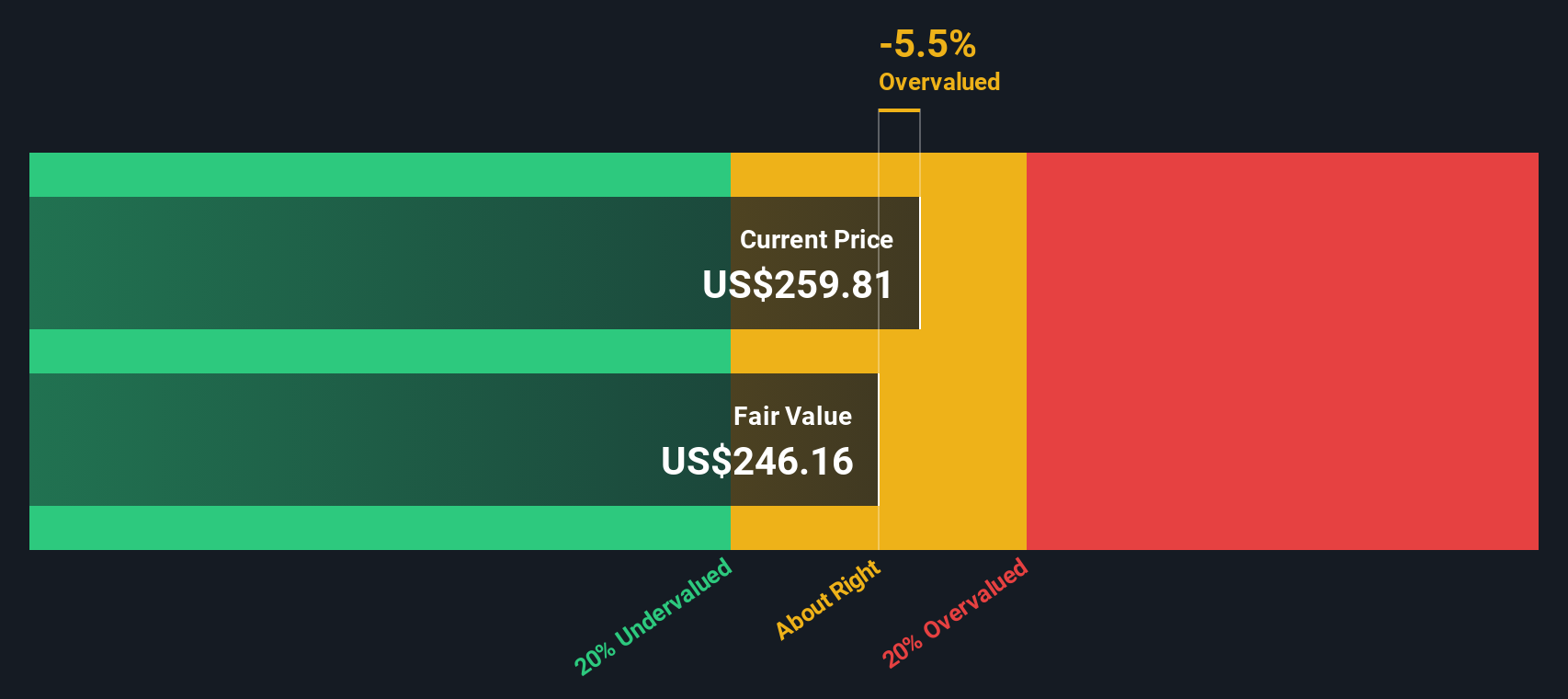

Using these cash flow forecasts, the DCF model arrives at an intrinsic value of $232.38 per share. In comparison to the current market price, this implies the stock is approximately 6.7% overvalued according to this model.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Applied Industrial Technologies's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Applied Industrial Technologies Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Applied Industrial Technologies. It reflects how much investors are willing to pay for each dollar of current earnings. This measure is especially relevant when a business has stable profitability and earnings visibility, offering a straightforward way to compare value across similar firms.

What makes a "normal" or "fair" PE ratio varies based on growth prospects and risk. Faster-growing companies tend to command higher PE multiples, while greater uncertainty or risk typically reduces the ratio investors are willing to pay.

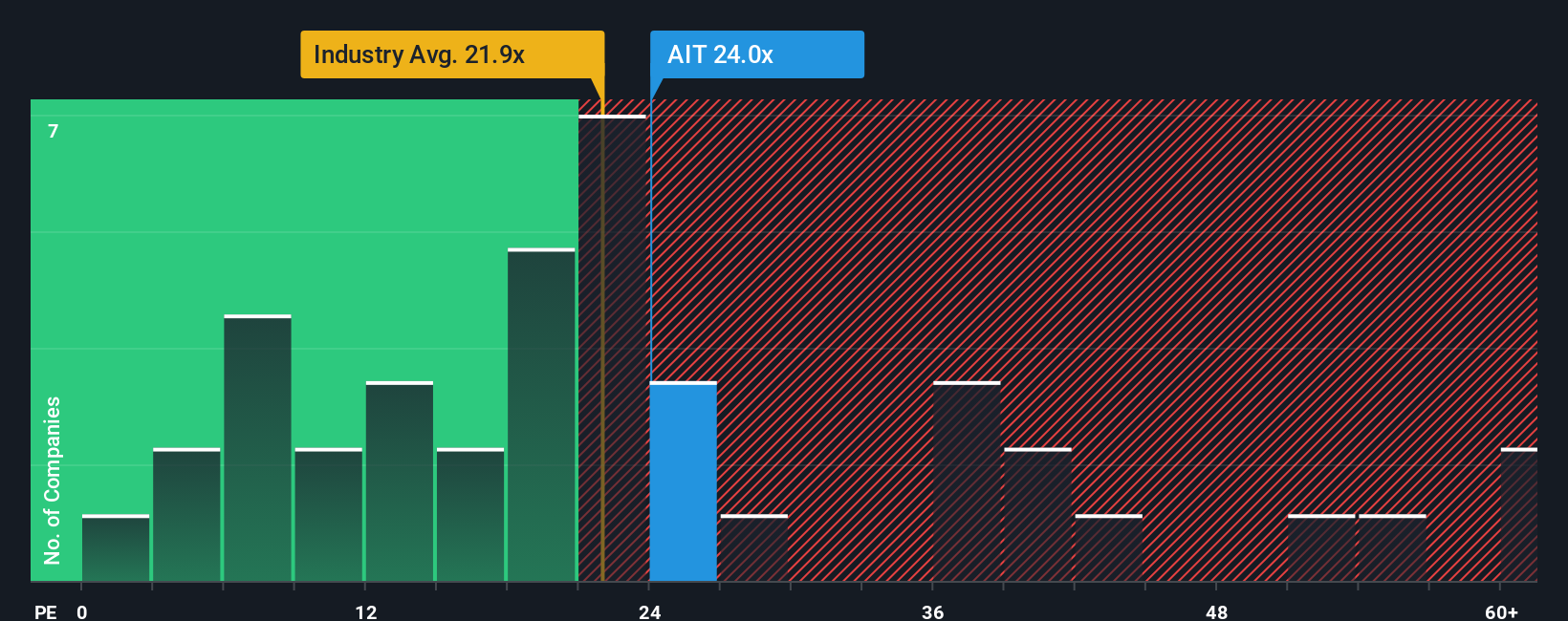

Applied Industrial Technologies currently trades at a PE ratio of 23.8x. This is somewhat higher than the average for its trade distributors industry at 22.1x and above key peers averaging 18.7x. However, Simply Wall St's proprietary Fair Ratio, which factors in not just industry norms but also the company’s unique earnings growth, profit margins, market capitalization, and specific risks, sits at 22.3x.

Relying on the Fair Ratio yields a more tailored valuation benchmark than simply looking at peers or the broader industry. It ensures aspects like stronger growth or lower risk are properly reflected, rather than assuming all companies in the group are created equal.

With the current PE just 1.5x above the Fair Ratio, Applied Industrial Technologies appears fairly valued on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Applied Industrial Technologies Narrative

Earlier, we hinted at a more intuitive and dynamic method to understand valuation, and this is where Narratives come in. A Narrative is a personalized story that connects your perspective on Applied Industrial Technologies—your beliefs about its business trends, future revenues, and profit margins—to a clear financial forecast, ultimately arriving at your own fair value for the stock.

This approach is available on Simply Wall St’s Community page, used by millions of investors, and makes it easy to craft or compare investment stories backed by data. Narratives bridge the gap between numbers and personal insight, helping you decide when to buy or sell by showing whether your assumed fair value is above or below today’s price.

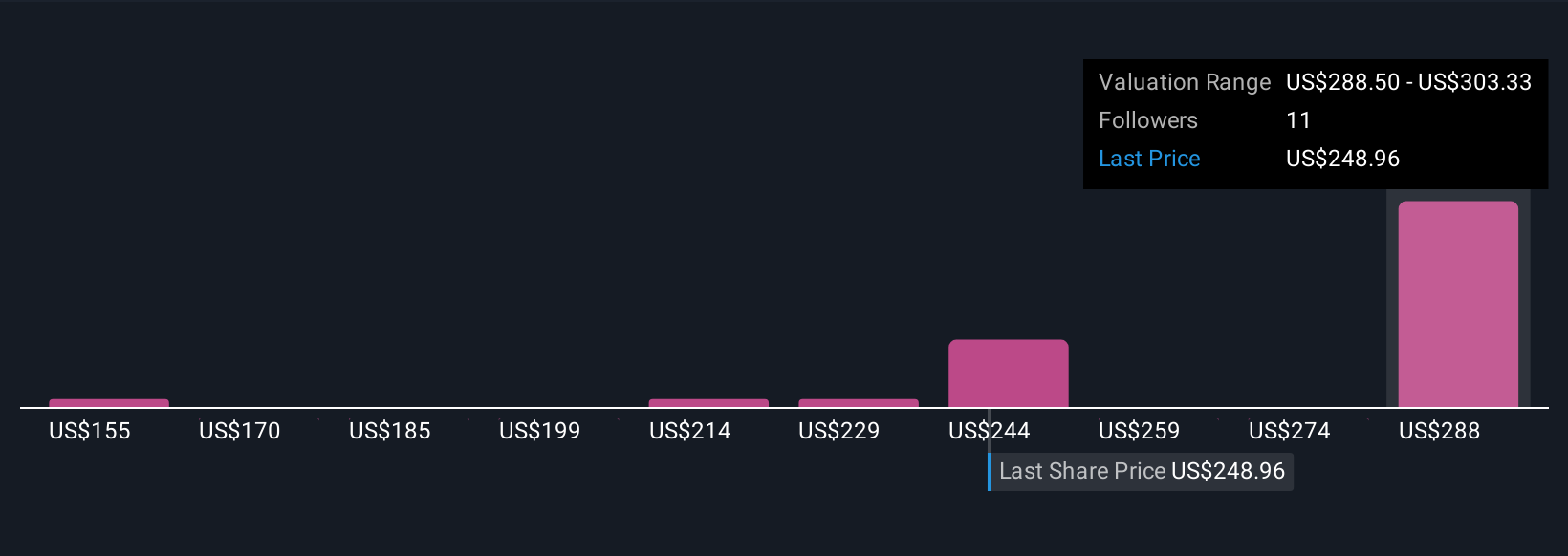

Best of all, Narratives are continually updated in response to new developments, like company news or earnings releases. For example, investors optimistic about automation and manufacturing reshoring might estimate higher future earnings and a fair value of $303 per share. On the other hand, those focused on sector risks and legacy headwinds may place fair value as low as $262, clearly illustrating how different outlooks drive different decisions.

Do you think there's more to the story for Applied Industrial Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.