Please use a PC Browser to access Register-Tadawul

Should You Revisit Arlo Technologies Stock After 55% Jump and Smart Home Sector Momentum?

ARLO TECHNOLOGIES, INC. ARLO | 14.07 | -2.49% |

Trying to figure out what to do with Arlo Technologies stock? You are definitely not alone. With the company’s recent moves, there is plenty to weigh before making your next decision. At its latest closing price of $17.25, Arlo might look like just another player in tech hardware, but the numbers under the surface tell a more interesting story. In the past seven days, the shares drifted up just 0.6%, but step back and you will see that over the past year, Arlo has soared 54.8%, with its returns since the start of the year even stronger at 57.2%. Long-term holders have fared even better, up 201% in five years and a staggering 280% over three years.

Behind these moves, general enthusiasm for the smart home sector and evolving consumer security needs have been pushing more eyes and capital toward Arlo. Investors are recalibrating what they are willing to pay, and there is growing confidence that the company has legs, not just hype. But is the stock still undervalued or have you missed the boat? Based on a set of six valuation checks, Arlo scores a 4 out of 6, suggesting the shares pass most of the key affordability tests and could still offer room to run compared to their fundamentals.

If you are trying to gauge whether Arlo belongs in your portfolio or your watchlist, let us walk through the valuation landscape. We will cover traditional methods, their results, and a smarter way to truly judge what Arlo is worth, coming up at the end.

Approach 1: Arlo Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by taking projections of its future cash flows and discounting them back to how much they are worth today. This method is often used by investors to see whether a stock’s price is justified based on actual cash the business can generate in the future.

For Arlo Technologies, the latest reported Free Cash Flow (FCF) stands at $60.4 Million. Analysts typically forecast cash flows for the next five years. Further out, projections are extrapolated to complete a 10-year view. According to these estimates, Arlo’s FCF could reach as high as $186.9 Million in 2035, with annual growth gradually moderating from 31.4% in 2026 to about 4.2% in 2035. All figures are in US dollars, and each amount represents the company’s potential to produce value for shareholders.

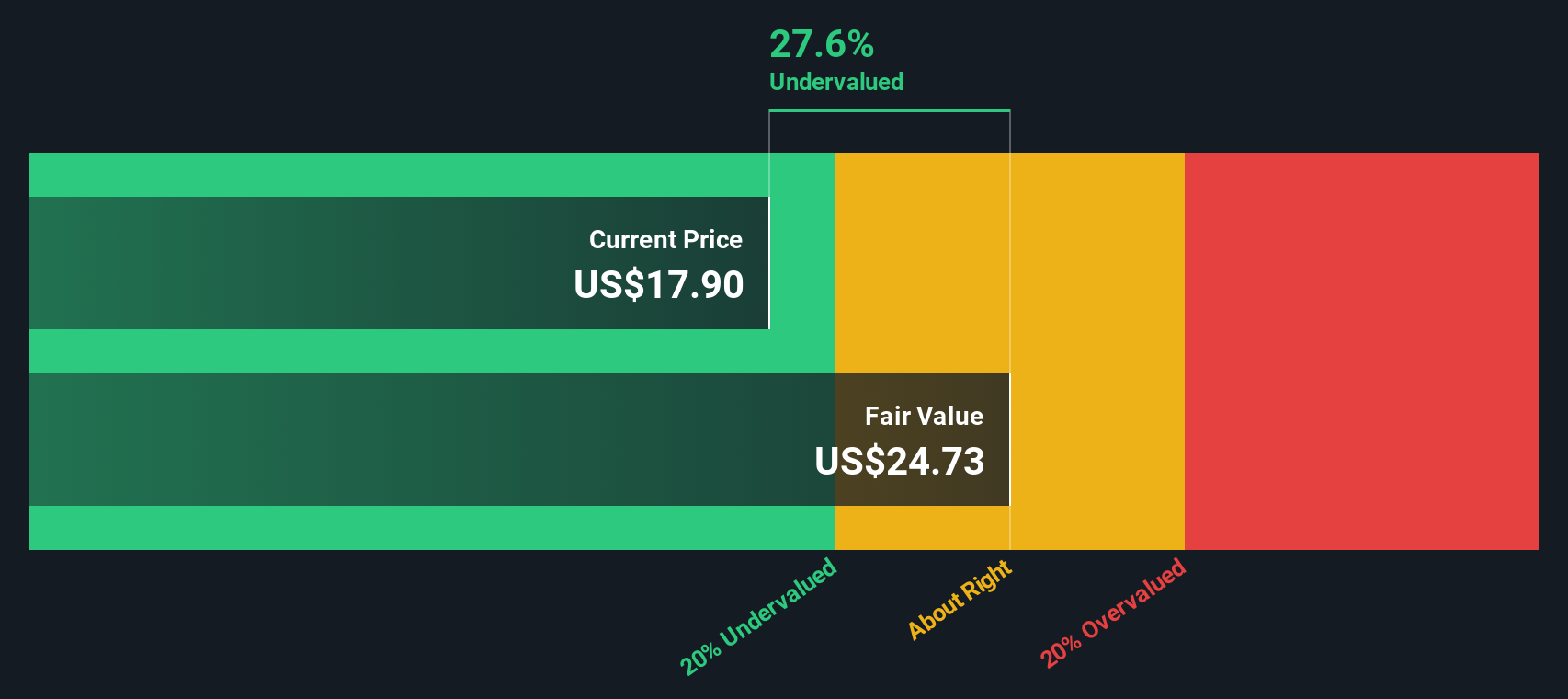

Bringing all of these projections together, the DCF analysis arrives at an intrinsic fair value of $24.73 per share for Arlo. With the current share price at $17.25, the DCF model suggests the stock is trading at a 30.3% discount to its estimated fair value, signaling a solid margin for buyers.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arlo Technologies is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Arlo Technologies Price vs Sales

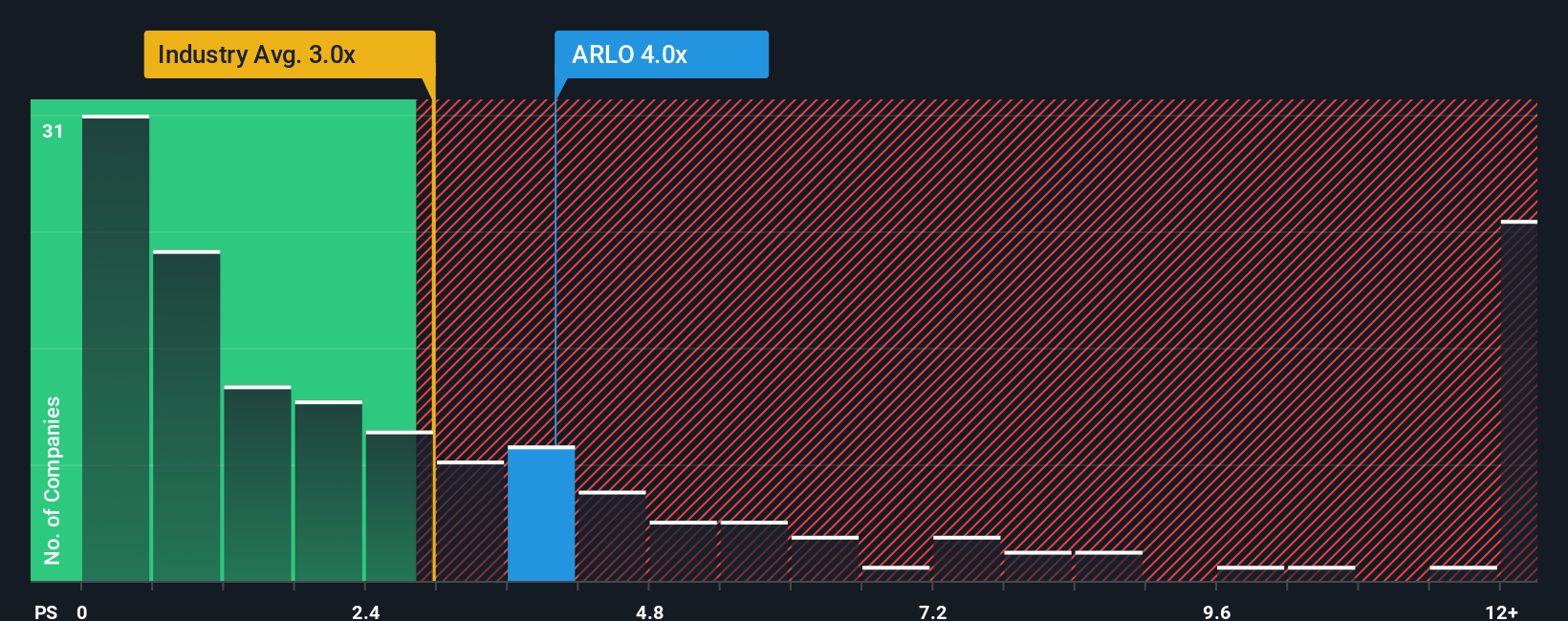

The Price-to-Sales (PS) ratio is commonly used to value companies like Arlo Technologies because it helps investors assess how much the market is willing to pay for each dollar of revenue. For profitable and fast-growing tech firms, the PS ratio is often a preferred metric since earnings can be volatile or negative as companies reinvest in their growth.

Growth expectations and perceived risk both play a big role in determining what is considered a “normal” PS multiple for a company. Firms with higher growth and lower risk profiles generally command higher PS ratios, while slower-growing or riskier firms tend to trade at lower multiples.

Currently, Arlo trades at a PS ratio of 3.55x. This is below the peer average of 4.81x, but above the electronic industry average of 2.48x. Rather than just looking at these broad comparisons, Simply Wall St calculates a proprietary “Fair Ratio” for Arlo, currently set at 1.93x. This custom metric factors in not just industry benchmarks but also Arlo’s own earnings growth, margins, company size, and unique risks.

The Fair Ratio approach is considered a more reliable standard than simply comparing Arlo to its peers or the industry average because it tailors expectations to the company’s specific strengths and risk factors. When comparing Arlo’s actual PS ratio of 3.55x to its Fair Ratio of 1.93x, the current valuation appears stretched and suggests the stock is trading above its fundamental value based on these custom factors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arlo Technologies Narrative

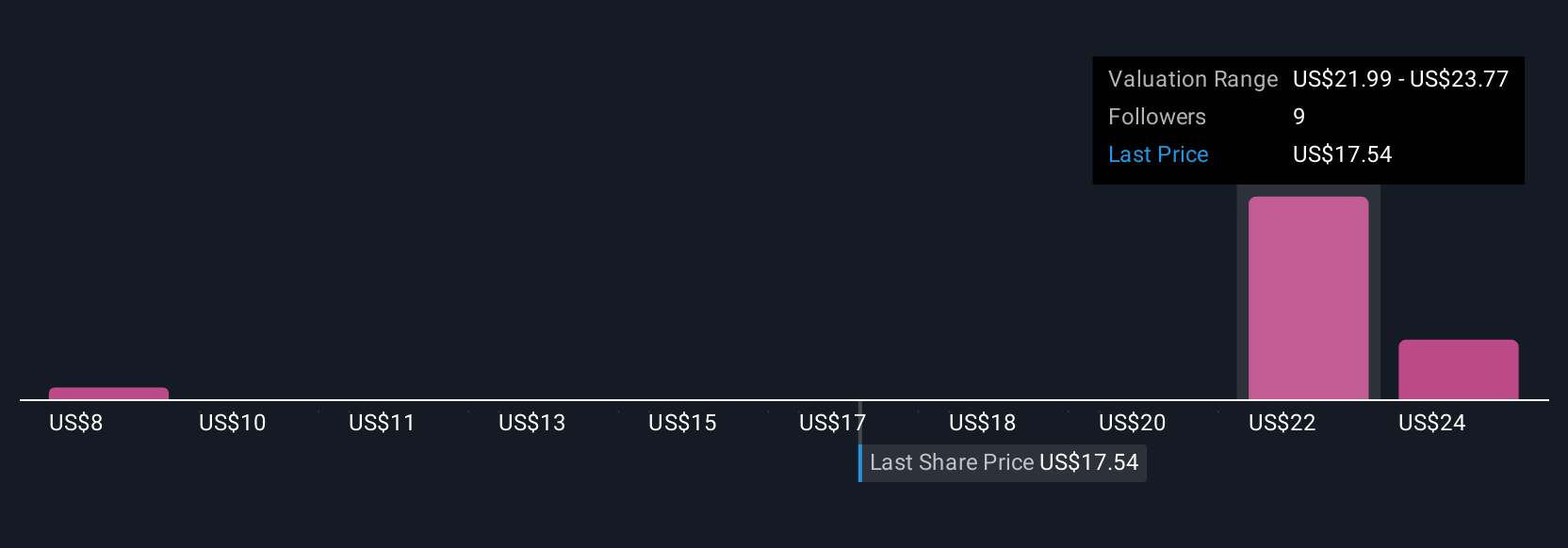

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple yet powerful approach that connects your view of a company’s story—how you think its products, partnerships, or strategy will shape its future—to a detailed financial forecast and a calculated fair value. Narratives let investors set their own expectations for things like future revenue, margins, and growth, helping you make sense of where a company might be headed beyond today’s numbers.

Available to everyone on Simply Wall St’s Community page and already used by millions, Narratives make it easy to visualize if a stock is worth buying or selling by seeing how your chosen fair value compares with the latest share price. What makes Narratives truly dynamic is that they update automatically as new information such as news or earnings comes in, so your analysis always reflects the latest developments.

For example, one investor’s Narrative for Arlo might be optimistic about robust subscriber growth, new product launches, and a major ADT partnership, leading them to a high fair value around $26.00 per share. Meanwhile, a more cautious Narrative could focus on risks like dependency on service revenue, increasing competition, or pricing pressures, resulting in a more conservative fair value near $22.00. By making your own Narrative, you can anchor your decisions with both your outlook and the numbers that matter most to you.

Do you think there's more to the story for Arlo Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.