Please use a PC Browser to access Register-Tadawul

Should You Revisit Boeing After Shares Jump 35% Amid Commercial Plane Order Surge?

Boeing Company BA | 206.71 | +0.59% |

Thinking about what to do with Boeing stock right now? You are not alone. The past year has been a roller coaster, and investors have been watching every twist and turn with keen interest. After a dip earlier in the year, Boeing has rebounded, with shares up nearly 35% year-to-date and notching a 12% gain just in the past three months. That kind of momentum is hard to ignore, especially when you consider that the broader market has dealt with its fair share of turbulence.

So, what is driving these moves? Recent optimism around the aviation industry plays a part, with increasing air travel demand and new aircraft orders helping sentiment. While Boeing still faces some challenges, like working through a hefty backlog and ironing out supply chain issues, the market clearly sees potential for steady growth or at least a reduction in perceived risk. Investors are also keeping a close eye on management’s progress in returning to consistent profitability, as net income growth has surged over the last year.

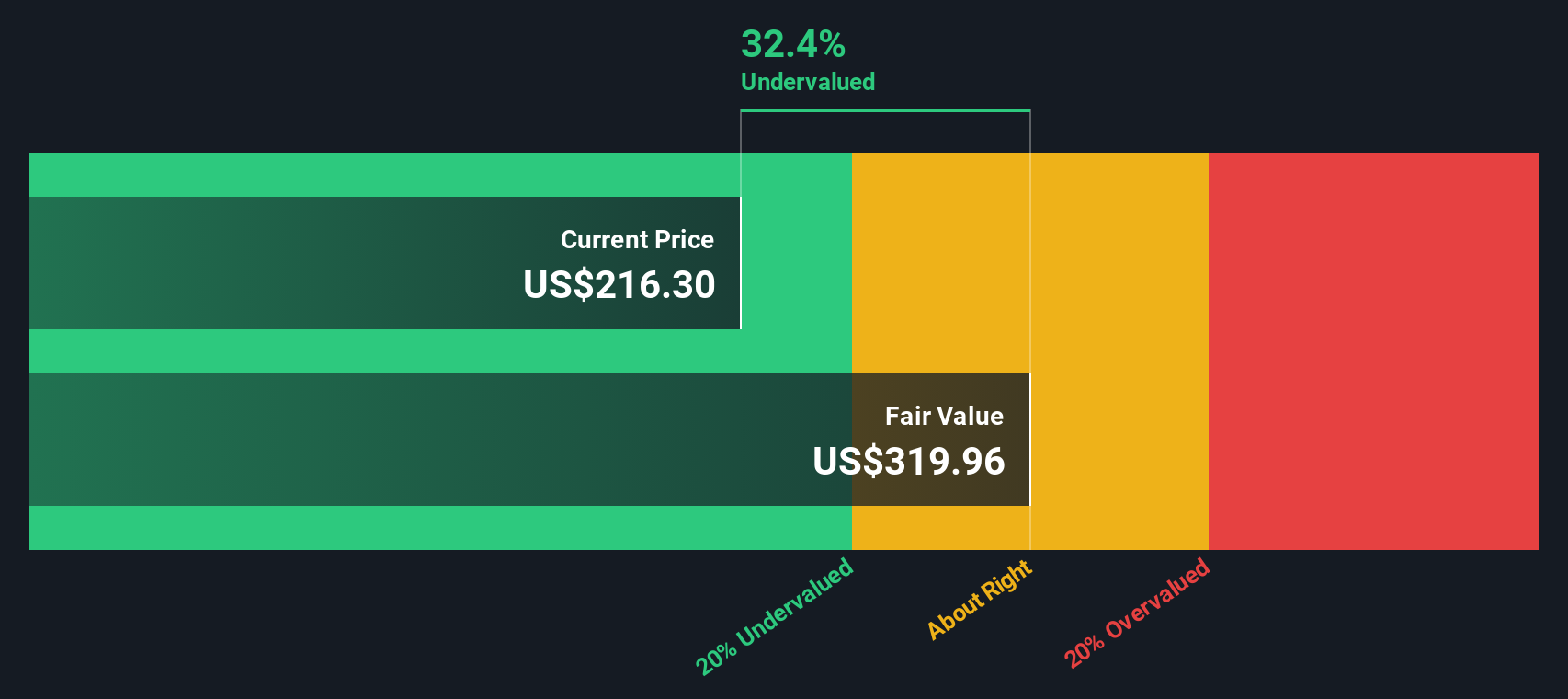

When it comes to valuation, Boeing is a bit of a puzzle. Based on our framework, the company scores a 3 out of 6 on key undervaluation checks, signaling that there may be opportunities, but also areas of caution. The current discount to analyst price targets and intrinsic value estimates adds another layer to the story, with shares trading below where some think they should be.

Let us dig into the main ways investors measure fair value. There may be one perspective that offers a more complete picture, which we will explore at the end of this article.

Boeing delivered 29.4% returns over the last year. See how this stacks up to the rest of the Aerospace & Defense industry.Approach 1: Boeing Cash Flows

The Discounted Cash Flow (DCF) model is a popular way investors measure a company’s worth. This method uses projections of future cash flows and discounts them back to today to estimate intrinsic value. For Boeing, the model begins with the current Free Cash Flow, which is negative $8.1 Billion. This figure reflects ongoing challenges, as well as the potential for recovery.

Analysts forecast strong growth over the coming years. By 2029, Free Cash Flow is projected to reach $12.8 Billion, with annual figures expected to rise steadily throughout the next decade. These forward-looking estimates are incorporated into a two-stage free cash flow model to calculate what Boeing could be worth based on today’s values.

According to this approach, Boeing’s intrinsic value is estimated at $333.25 per share. In comparison to the current share price, this suggests a 30.3% undervaluation, indicating that the stock may offer an attractive margin of safety based on this analysis.

Result: UNDERVALUED

Approach 2: Boeing Price vs Sales

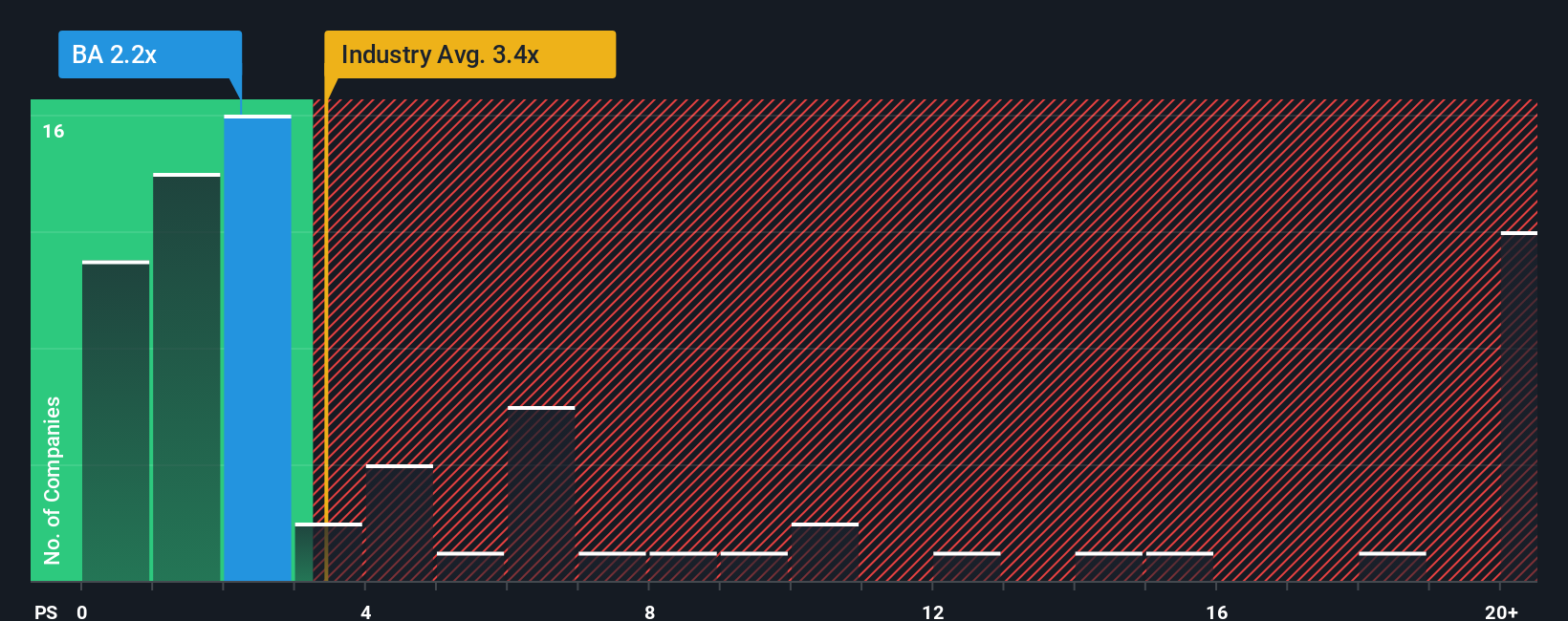

For companies that are not yet consistently profitable, such as Boeing, the Price-to-Sales (P/S) ratio is often a more useful benchmark than earnings-based multiples. The P/S ratio helps investors assess how the market values each dollar of the company’s revenue, which is particularly helpful when cash flows or profits are volatile or negative. In industries with stable growth prospects and moderate risks, companies with higher sales growth or lower risk profiles may justify a higher P/S ratio. Conversely, those with greater risk or weaker revenue outlooks may warrant a lower multiple.

Boeing’s current P/S ratio stands at 2.33x. This compares to an industry average of 3.11x and a peer average of 1.92x, placing Boeing above most peers but below the broader sector. To refine the analysis, a proprietary metric called the “Fair Ratio” is considered. This metric adjusts for Boeing’s earnings growth potential, margin profile, size, and risk, resulting in a Fair Ratio of 1.94x for Boeing.

With its actual P/S ratio just 0.39x above the Fair Ratio, Boeing trades slightly above what would be considered fair but not by a significant margin. This suggests that, at current prices, Boeing stock is valued approximately in line with its fundamentals and risk profile.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Boeing Narrative

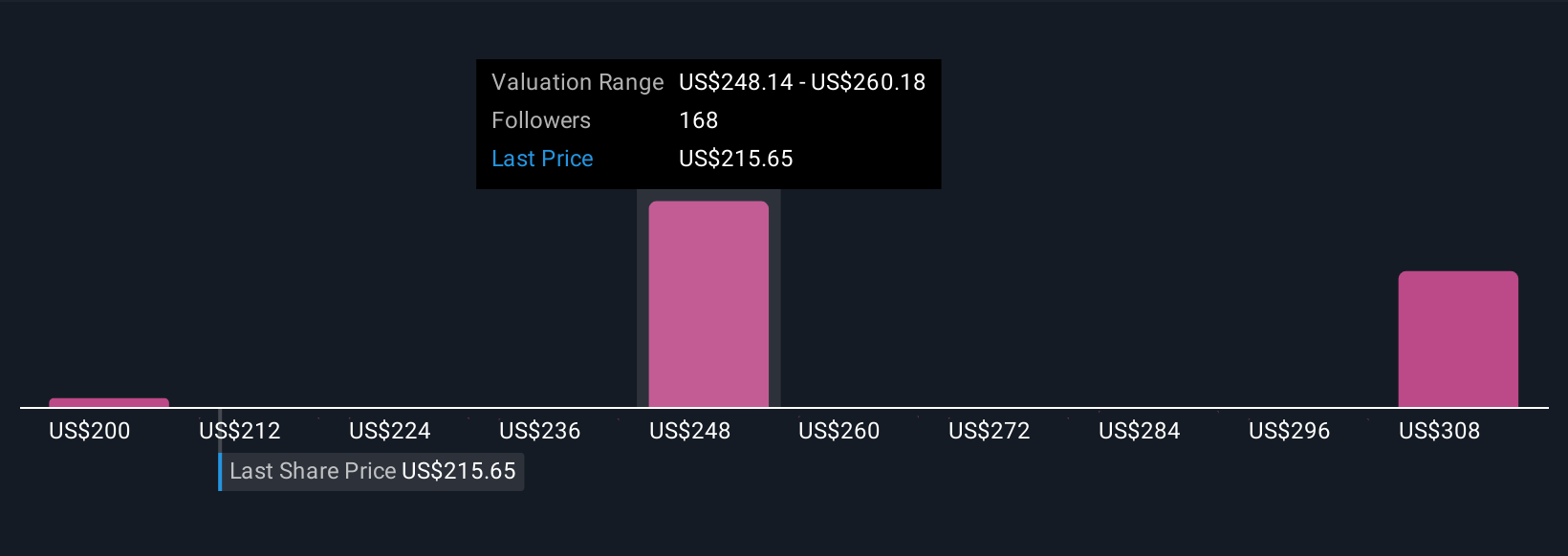

Narratives are simple, dynamic stories investors create about companies, blending their view of business prospects with the hard numbers, like estimates for future revenue, profits, and margins, to calculate a fair value. By tying together what’s happening in the business, a projection of its financial future, and what the stock should be worth, Narratives give you a practical, powerful tool to guide your next move.

Within Simply Wall St’s global investing community, anyone can choose or build a Narrative that matches their outlook. This approach makes it easier to make sense of the market’s noise. Narratives update when new information or news is released, allowing you to see in real time how the story and the numbers change. This means you are always equipped to compare Fair Value with today’s share price and decide if Boeing is a buy, hold, or sell.

For example, one investor might see Boeing poised for global expansion and assign a high fair value of $287 based on strong demand and improving margins. Another, more cautious investor may focus on operational risks and set a lower fair value of $150. With Narratives, you choose the view and strategy that suits you best, making investment decisions smarter and more transparent than ever.

Do you think there's more to the story for Boeing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.