Please use a PC Browser to access Register-Tadawul

Slammed 25% Opus Genetics, Inc. (NASDAQ:IRD) Screens Well Here But There Might Be A Catch

Opus Genetics Inc. Ordinary Shares IRD | 2.14 2.12 | +0.47% -0.75% Pre |

Unfortunately for some shareholders, the Opus Genetics, Inc. (NASDAQ:IRD) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

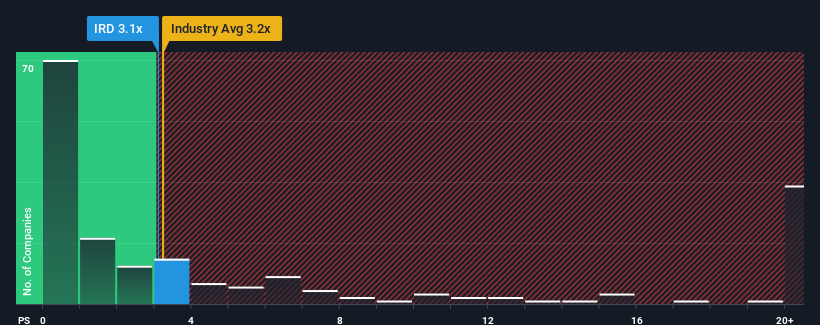

Although its price has dipped substantially, it's still not a stretch to say that Opus Genetics' price-to-sales (or "P/S") ratio of 3.1x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Opus Genetics Performed Recently?

Opus Genetics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Opus Genetics .Is There Some Revenue Growth Forecasted For Opus Genetics?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Opus Genetics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Looking ahead now, revenue is anticipated to climb by 42% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Opus Genetics' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Opus Genetics' P/S?

With its share price dropping off a cliff, the P/S for Opus Genetics looks to be in line with the rest of the Pharmaceuticals industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Opus Genetics currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.