Some Grove Collaborative Holdings, Inc. (NYSE:GROV) Shareholders Look For Exit As Shares Take 30% Pounding

Grove Collaborative Holdings Inc Ordinary Shares - Class A GROV | 0.00 |

The Grove Collaborative Holdings, Inc. (NYSE:GROV) share price has fared very poorly over the last month, falling by a substantial 30%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

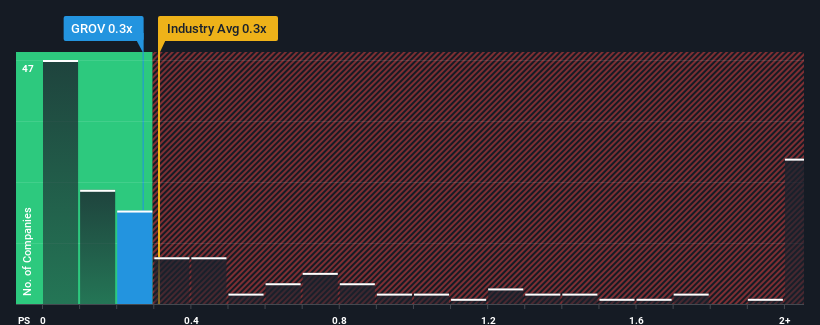

Even after such a large drop in price, it's still not a stretch to say that Grove Collaborative Holdings' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Grove Collaborative Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Grove Collaborative Holdings' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Grove Collaborative Holdings' future stacks up against the industry? In that case, our free report is a great place to start .Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Grove Collaborative Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 5.1% during the coming year according to the two analysts following the company. That's not great when the rest of the industry is expected to grow by 4.6%.

With this information, we find it concerning that Grove Collaborative Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Grove Collaborative Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Grove Collaborative Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Don't forget that there may be other risks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 19/11 13:53

NetEase Earnings Preview

Benzinga News 19/11 14:00P/E Ratio Insights for Genuine Parts

Benzinga News 19/11 14:00Price Over Earnings Overview: Colgate-Palmolive

Benzinga News 19/11 18:00Colgate-Palmolive (CL): Is the Current Valuation a Compelling Opportunity for Investors?

Simply Wall St 19/11 18:27'Unilever could sell vintage brands Bovril, Colman's and Marmite'- The Times

Benzinga News 20/11 19:01Procter & Gamble (PG): Exploring Valuation After Surge in Unusual Options Activity and Upbeat Analyst Sentiment

Simply Wall St 20/11 23:45A Look at Church & Dwight (CHD) Valuation Following Recent Share Price Decline

Simply Wall St 18m